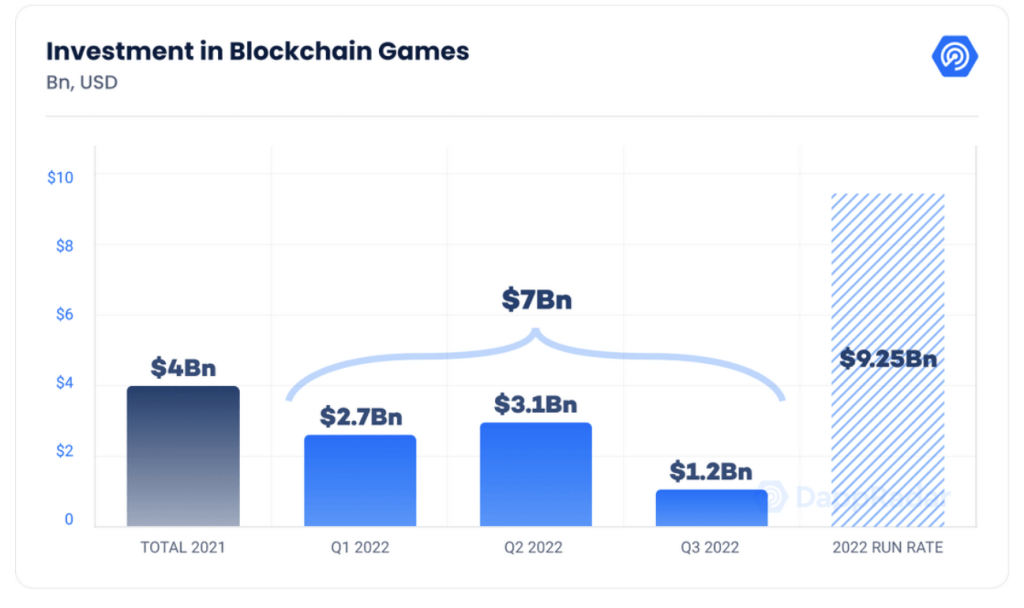

Harsh market conditions may have kept retail investors away, but venture capitalists are doubling down on their investments in the crypto space. Venture capitalists have poured in $1.3 billion into the blockchain gaming space, a recent Blockchain Game Alliance report by DappRadar reveals. While that is 48% lesser than the previous quarter, it is almost double the number from last year.

“The amount of investments demonstrates that despite the challenging and uncertain conditions in the digital asset markets, major investment entities remain bullish on the blockchain gaming industry,” the report reads.

The report also mentions that projects focused on building Web 3.0 metaverse infrastructure accounted for almost 36% of quarterly investments.

The report findings come at a time when the market has been having a dry run. The fact that blockchain gaming and metaverse are helping boost crypto adoption could spell hope for retail investors.

Blockchain gaming: A bright spot on the crypto horizon

The burgeoning interest is not entirely surprising. After all, according to the report, Web 3.0 games account for almost half of the blockchain activity across 50 blockchain networks.

Additionally, in September 2022, the blockchain gaming industry witnessed an 8% rise in the average number of daily Unique Active Wallets (dUAWs). The 912K dUAWs recorded account for almost 48% of blockchain activity.

While other top blockchain platforms witnessed a slight decline in the number of UAW, Solana’s UAW increased by 269% or 45K compared to the previous quarter. And gaming is only 4.82% of the network activity for Solana.

Top blockchain games in Q3

Alien Worlds (TLM) retained the top spot this quarter as far as the most played blockchain games are concerned. With average dUAW of 190,770, it saw an increase of 14% compared to the previous quarter. Splinterlands comes in second. Farmers World is the third-most played blockchain game.

The most used dApp this September is Gameta, with a 109% dUAW increase. The dUAWs reached 69K after rising by 253% since the previous quarter.

The blockchain gaming segment expects to close the year with $9.25 billion in funding.