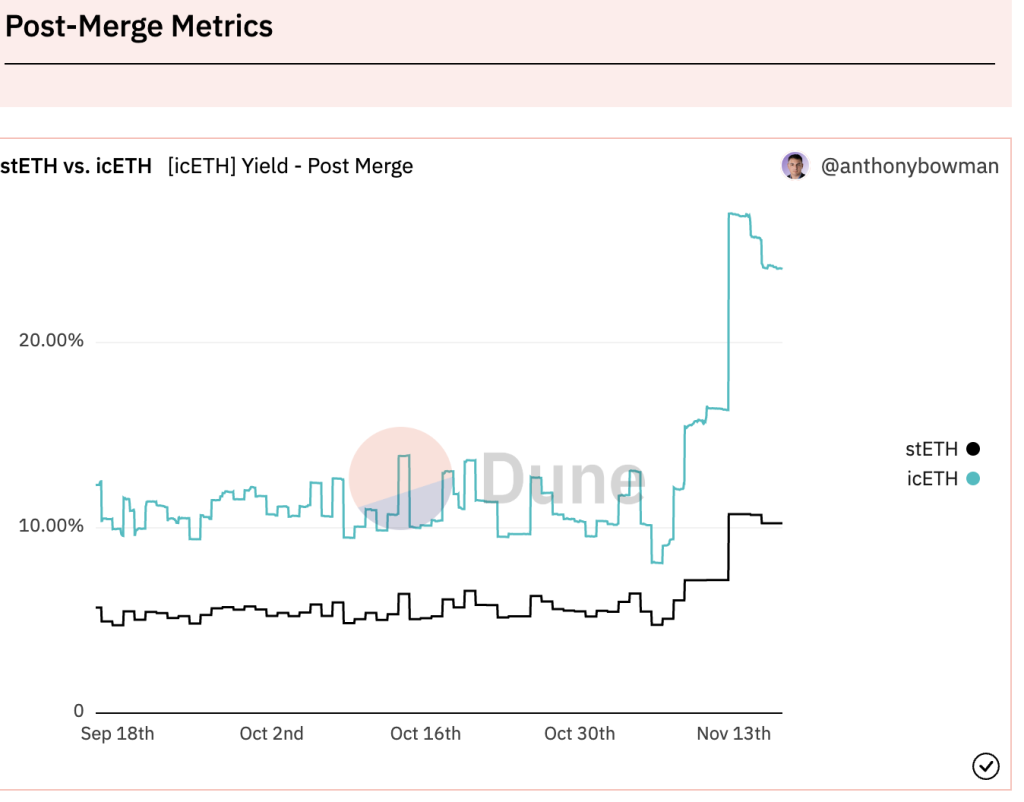

While the broader market reels from the effects of crypto contagion, vanilla ETH staking seems to be the way to go for many, thanks to the high yields. The APR for yields on ETH staking is now above 10%, according to the data released by Dune Analytics, an on-chain data analytics platform.

The surge in the APR aligns with the piece that we did earlier today where we discussed that despite being down month-on-month in terms of DeFi TVL, protocols like Lido and AAVE have started showing some weekly gains. With passive earning in sight, people are making use of staking services by Lido, where the APR surge was as high as 10.7%. This kind of APR concerns standard stETH stakers—people who have already staked their ETH for stETH and are now using that stETH to earn higher yields.

But that’s not even the fun part here. The higher staking rewards aren’t just synonymous with standalone staking yields. Instead, it also concerns a new product that is currently being floated in the DeFi space and termed the icETH. icETH is a recursive staking product or rather an index launched by Index Coop. And with the ETH staking yields moving at a clip, icETH is generating yields at 25.5%, according to Dune Analytics.

How does icETH work?

While people staking their Ether can get hold of stETH on platforms like Lido, Index Coop’s icETH index allows them to make better use of the idle stETH.

Here is more about icETH:

📢 Introducing $icETH 🧊

The Interest Compounding ETH Index pic.twitter.com/68ktJPrn2H

— Index Coop 🦉 (@indexcoop) April 5, 2022

This automated strategy urges a user to use the stETH as collateral on AAVE’s money market, only to get hold of a token called WETH or Wrapped Ether. This WETH is then used by the icETH index to purchase additional stETH and multiply returns for the user. This product also has its own token—the icETH token.

The collateral a user supplies to AAVE is leveraged here. Currently, $21 million worth of icETH tokens is in circulation.

However, recursive staking options like these come with their share of risks. Like any other smart contract product, icETH investors should also be aware of liquidation risks. Furthermore, as the icETH token borrows more stETH from AAVE, the interest rate should also be taken into account as nobody would want it to be higher than the staking return.