The broader crypto market continues to hold on to the 1 trillion market cap ($1.02 trillion) this Wednesday morning. The current 0.13% uptick might not look much, but it extends the market’s winning streak by another day.

Things may change later in the day as crypto investors brace themselves for a potential Fed-led 75 bps rate hike.

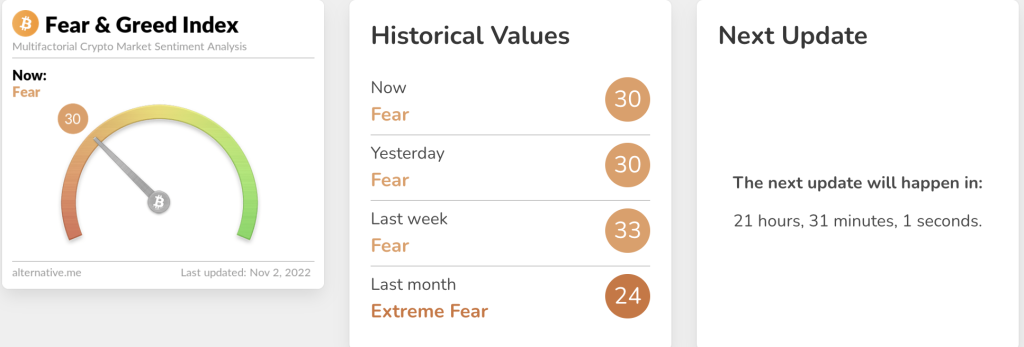

Crypto Fear and Greed Index

The Crypto Fear and Greed Index (CFGI)—one of the biggest indicators of market sentiment around—is holding on to the 30 level.

Screenshot of the Fear and Greed Index

It is good news that the CFGI is in the “fear” quadrant instead of the “extreme fear” territory that it found itself in last month. However, the index would have to cross the 35 mark and stay above it for a while for the market to experience higher buyer inflow.

Key coins

Coming to the topic of key crypto assets, let’s begin with a rundown of some of the top 10 cryptos by market cap. Bitcoin (BTC) and Ether (ETH) are trading a little flat. They are up by only 0.02% and 0.51%, respectively, at press time. Dogecoin (DOGE) is continuing to lead market gains. It is up by 9.64% over the past 24 hours.

Binance Coin (BNB) and Cardano (ADA) are trading in red. They have shed 1.37% and 1.97% gains, respectively over the past 24 hours.

Other market movers

Top gainers, according to CoinSwitch data, at the time of writing are:

- Polymesh (POLYX): +14.99%

- Theta Fuel (TFUEL): +5.45%

- Uniswap (UNI): +3.27%

- Shiba Inu (SHIB): +3.22%

- Theta Network (THETA): +3.10%

The cryptos that registered the largest corrections today are:

- GAS (GAS): -5.72%

- Fantom (FTM): -5.24%

- Gala (GALA): -4.78%

- ApeCoin (APE): -4.77%

- Avalanche (AVAX): -4.68%

Developments to keep an eye on

Some believe that the great crypto decoupling has started. While it is true that Nasdaq corrected by 1% over 24 hours on 26 October 2021 and BTC gained 2%, it may make sense to rein in the optimism for a while. Because, for starters, the FED hikes coming in today might put the decoupling narrative to test.

You may also want to keep in mind that Bitcoin’s hashrate (which indicates network strength) increased to 317 EH/s (exahashes per second), according to Ycharts data. Because there often is a loose correlation between Bitcoin’s prices and hashrate.

Additionally, post-Merge, Ethereum’s top 10 non-exchange investors added to the cumulative portfolio by 6.7%, according to the following Santiment tweet. That could impact the fate of the second largest crypto as well as the broader market.

🐳 #Ethereum's top 10 largest non-exchange addresses have been accumulating assets after their big drop-off leading up to September's merge. They have added 6.7% more $ETH. Meanwhile, the top 10 exchanges are standing pat with just an 0.2% rise. https://t.co/h5CxDwOphX pic.twitter.com/msrrzvhB4P

— Santiment (@santimentfeed) November 1, 2022

Overall, the crypto market looks steady for now, all thanks to the Dogecoin-led relief rally we saw in the last week of October. However, as we wait to see how things pan out in November, doing more of your own research will help you safely navigate the volatility around.