It was a mixed session for the crypto market on Thursday. The total crypto market cap hovered just above the $1 trillion level, showing a bit of resilience amid tumultuous market conditions.

BNB has been continuing its upward movement. It is up by 3.8%. MATIC coin is up by 13.54% after JPMorgan and Instagram chose the blockchain for DeFi and NFT-related transactions. The gains have had something to do with the surge in trading volumes.

Meanwhile, DOGE is witnessing a bit of selling pressure from the top, joining the league of losers. It is down by over 10%. BTC and ETH were mostly sideways during yesterday’s session. They are currently close to their key support levels of $20,200 and $1,500 respectively.

The fact that US economic indicators have fallen short of expectations has left its impact. In October, for instance, the ISM Non-Manufacturing PMI fell from 56.7 to 54.4, and the ISM Non-Manufacturing Employment Index fell from 53.0 to 49.1. The prices index rose from 68.7 to 70.7. All of this has resulted in a volatile session in the US stock market.

Nasdaq closed the day with a 1.73% loss to its register. This impacts buyer appetites negatively.

As we enter the weekend, a slowdown in trading activity may keep the crypto market sideways, in a very tight range.

Crypto Fear and Greed Index

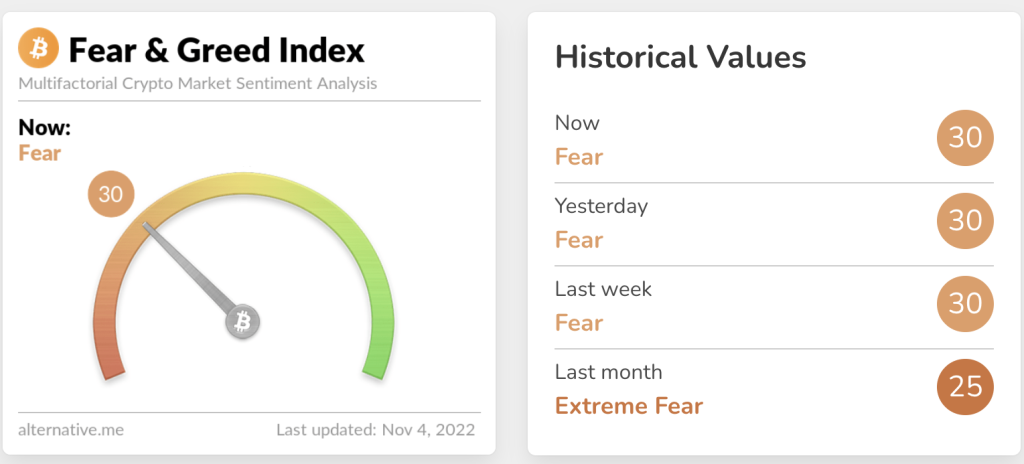

The Crypto Fear and Greed Index, which measures the overall market sentiment, remained flat for the third consecutive sessions, indicating the prevalence of fear.

However, the index did manage to hold on to the 30/100 level despite Nasdaq sliding for the fourth consecutive session. So that seems to be easing some of the fear amongst investors.

Top gainers and losers

Some of the top gainers, according to CoinSwitch data, as of 4 November 2022 are:

- Band Protocol (BAND): +121.16%

- NKN (NKN): +40.93%

- Fantom (FTM): +14.83%

- DIA (DIA): +14.31%

- Polygon (MATIC): +14.10%

The coins with the highest losses at publishing time are:

- Gala (GALA): -15.93%

- Dogecoin (DOGE): -9.96%

- Chiliz (CHZ): -6.26%

- Uniswap (UNI): -5.57%

- Storj (STORJ): -5.47%