The week began on a subdued note with the broader crypto market trading in the red. Recession worries, the downturn in Indian and global equities, and the US Fed’s resolve to implement aggressive interest rate hikes weighed on the market, driving it down by 0.74% at the time of writing.

Significant developments

Here are the key market-specific findings to keep tabs on:

- The overall crypto market cap is at $927.08 billion— lower than it was over the weekend.

- Bitcoin market dominance continues to hold above 39%— 39.03% to be precise.

- Bitcoin (BTC) is trading at $18,877 at publishing time, with a 1% increase in the 24-hour trading volume.

- ETH manages to hold onto the key support level of $1,302, despite a 1.36% dip day-on-day.

- The onshore crypto index (CRE8) is down by 0.48%, dragged down by a weaker rupee and bearish market sentiment.

Key coins

Top cryptos such as BTC and ETH are trading flat at the moment, gaining over half a percent each over the past hour or so. Most weekly losses have been erased, and it would be interesting to see what these stalwarts have in store for the investors as the day wears on.

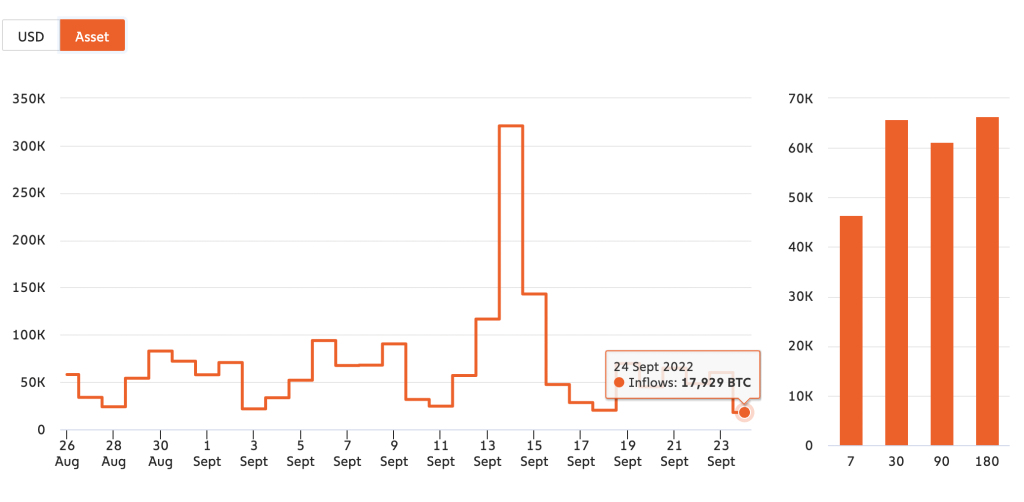

It is important to note that BTC volume moving into the exchanges is at a 112-day low, as of 24 September. Fewer cryptos moving into the exchanges means less selling pressure. Still, keep your fingers crossed.

Source: Chainalysis

Most other top 10 cryptos were more or less steady, barring Solana (SOL), which is down by 2.64% at release. XRP appears to be holding onto its last week’s gains, with a 2.82% uptick, day-on-day.

Coming to the top gainers, ApeCoin is making some heads turn, up by 5.16%, as of now. Following APE is Cosmos (ATOM), which has a 3.93% uptick against its name.

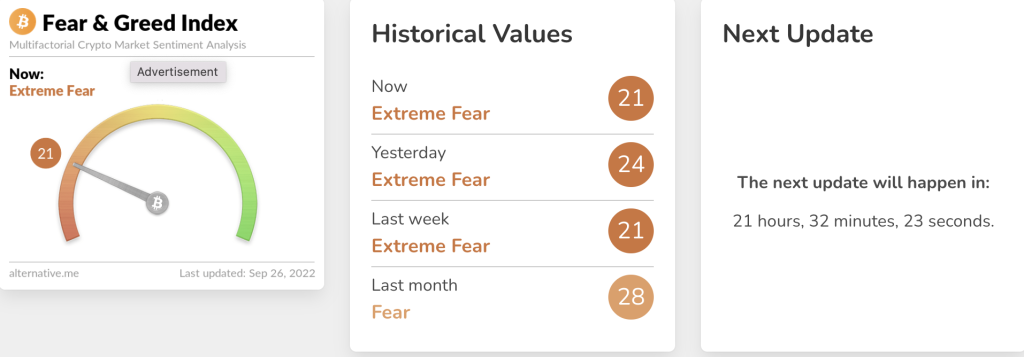

Crypto Fear and Greed Index (CFGI)

The Crypto Fear and Greed Index, currently at 21, continues to be in the fearful territory. This level shows that the market sentiment is still bearish and it would take some really strong buying pressure and a relief rally to entice the buyers.

As the CFGI takes market volatility, social media sentiment, dominance, and market momentum into account, fresh buying inflow might only be seen if the index touches 30 or thereabouts and is sustained.

For now, waiting on the sidelines and sitting on cash might be the best possible strategies. And yes, while you wait, you might consider putting together a viable DYOR strategy to navigate market uncertainty.