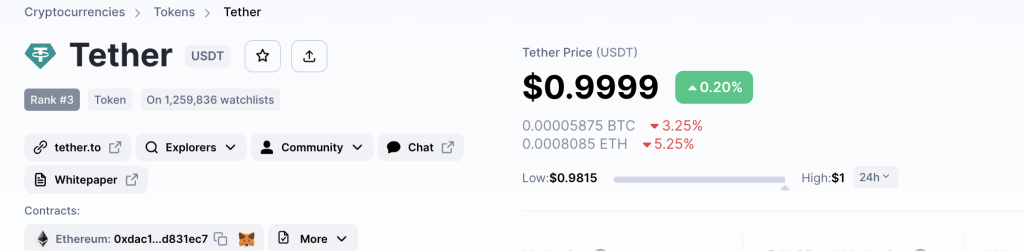

Tether (USDT), the largest stablecoin by market cap, lost its dollar peg last night, albeit briefly. The stablecoin dropped as low as 93 cents on certain exchanges when it is mandated to maintain the $1 peg. However, it was a short-lived scare as Tether quickly came back to parity with the US dollar. At press time, USDT is trading at $0.99, with the peg status intact.

With TerraUSD (UST)-triggered market crash in May still remaining fresh in investors’ minds, it is quite natural that even a short depegging instance becomes the talking point of the crypto world. And it wasn’t just USDT that depegged. Decentralized USD or USDD—an overcollateralized and algorithmic stablecoin—couldn’t maintain its peg on 10 November 2022 and dropped to a low of $0.96—amid the FTX-Alameda crisis.

What triggered the depegging of stablecoins?

It is speculated that Alameda Research started borrowing USDT on the DeFi protocol AAVE, using USDC as collateral. Eventually, they started dumping or aggressively selling the borrowed USDT on the Curve DEX. This approach created FUD (Fear, Uncertainty, and Doubt) in the market and eventually lowered the liquidity associated with the 3Pool—the largest LP (Liquidity Pool) related to the Curve DEX.

The FUD started spreading, and people started dumping their USDT, a usual panic response of the crypto community. All of that increased the concentration of USDT in the 3Pool, which went up to 86%. And with USDT or Tether taking up such a portion of a liquidity pool, liquidity for other assets dropped. The stablecoins list for the Curve 3Pool comprises USDT, USDC, and DAI.

The sudden increase in the supply of Tether—people swapping it for other tokens like USDC—caused the peg to dwindle for a while. Data from Coinmarketcap shows the lowest price for Tether in the past 24 hours was $0.9815.

Even while the prices were close to the depeg region, Paolo Ardoino, CTO at Tether, mentioned yesterday that the firm had already processed about $700 million in USDT redemptions without facing any issue.

#tether processed ~700M redemptions in last 24h.

No issues.

We keep going.— Paolo Ardoino 🍐 (@paoloardoino) November 10, 2022

More direct reasons were behind USDD’s brief depeg. It is believed that Alameda dumped USDD in droves to stay afloat. Here is a tweet by Justin Sun — Founder of Tron, which talks about the same:

I think probably Alemeda just sold their USDD to cover the liquidity of ftx exchange. The pool currently is back with a healthy rate. 😎 pic.twitter.com/oSIzUNqE0Z

— H.E. Justin Sun🌞🇬🇩🇩🇲🔥 (@justinsuntron) November 9, 2022

USDD may not be out of the woods yet

USDD is a Tron-based hybrid stablecoin that is currently trading at $0.978, down 0.08% from its peg. This hybrid/ algorithmic stablecoin on the stablecoins list went as low as $0.9669 in the last 24 hours, giving off some serious scares.

However, USDD doesn’t seem to be out of the woods just now. Here is why:

While USDD is no more just an algorithmic stablecoin and is sufficiently backed by reserves in TRX, Bitcoin, and USDC—a majority of the collateral is earning staking rewards at the moment. Besides, almost 99% of the Tron token (TRX) collateral is illiquid, courtesy of a governance contract. When it comes to readily usable collateral, Tron DAO only has $236 million worth of BTC and $600 million in USDC to show for.