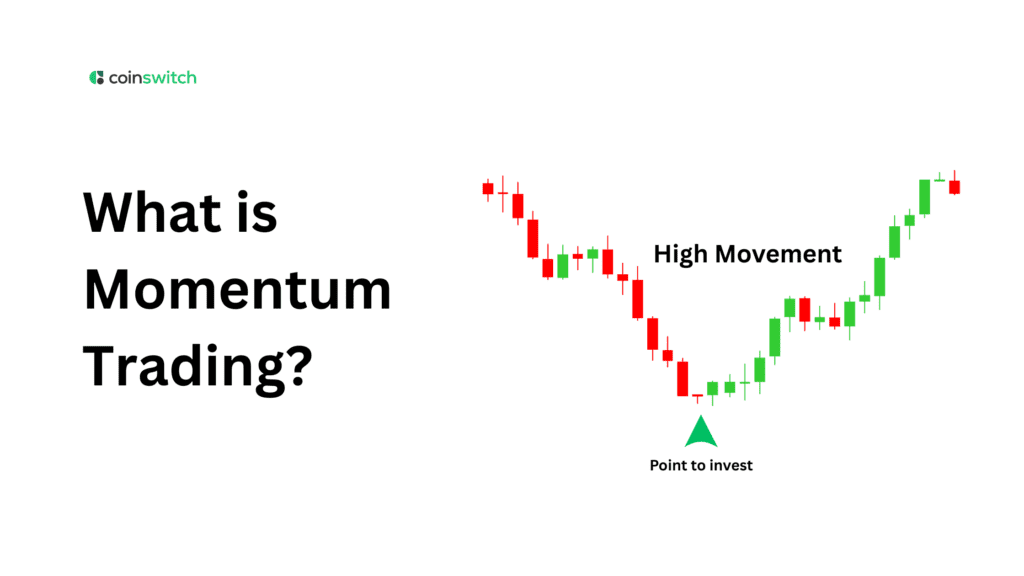

Momentum trading is a method where traders buy assets that are increasing in price and sell assets that are decreasing in price, as they expect the trend to continue. It is all about speed and riding on the momentum. Understanding momentum trading, its key elements, strategies, and benefits, will help you maintain profits during sudden market movements.

How Does Momentum Trading Work?

In momentum trading, traders identify strong price movements early and capitalize on them. Besides recognizing momentum shifts, traders often use technical indicators, volume spikes, and news events to identify each early momentum entry.

Also, momentum stocks become popular very quickly, which requires active traders to act quickly to jump in on the momentum. When momentum is present, traders enter with strength and exit before the momentum weakens or reverses.

Elements of Momentum Investing

Understanding what is a momentum stock sounds incomplete without understanding the key elements involved in it. Traders don’t just jump into the market; they follow a process with established rules of liquidity, timing, and control. Let us examine the key aspects of conducting momentum investing.

Liquid Securities

Liquidity is the most basic but most essential element of momentum trading. Traders need to select liquid stocks that can be entered and exited easily without market distortion. A liquid stock in momentum will provide smooth entry and exits, even within a volatile or fast-moving trend.

Risk Management During Opening and Closing Trades

Intelligent traders will establish a stop-loss position and a take-profit level before entering or exiting a trade. Momentum trading moves fast; therefore, by managing the risk side of trading, you can still avoid large losses and be out of a trend before it knocks you down.

Early Entry

When you catch a trend early, you increase your chances for upside profit potential. The technical tools traders use today, such as volume spikes and RSI, help identify an early entry point when some momentum is already established and getting ready to flood into the market.

Contemplating a Holding period

Once on board with a momentum stock, you will need to decide when to exit based on the strength of the trend. Longer trends require more patience, and shorter ones burst faster. If you know how long the stock has been trending, you will also see when the time is right to exit.

Timely Exit Period

If you are going to make money in the stock market using momentum, you’d better time the exit, or your gains can vanish in short order. Good momentum traders know when to exit: they will exit with technical signals or just scale back on their size trades using trailing stops.

Read More: Swing Trading & Techniques: A Complete Guide

Momentum Trading Strategy

Momentum trading has several strategies to help traders make decisions about entries and exits. Although the variations are vast, most are based on three key elements: patterns, price levels, and indicators. Here are four strategies that you can deploy while trading.

1) Breakout Strategy

Breakouts occur when the price of a stock breaches above a defined resistance level or goes below the support. When momentum stocks break out with large volume, they tend to keep moving, and traders take a position immediately after the breakout and ride the move.

Suppose a stock has been trading between $50–$55 for the previous three weeks and then jumps to $58 with a breakout volume. Traders then recognize the breakout and buy quickly, expecting further upside while using the strategy to put the stop-loss orders just below the old resistance level. This helps them trade with speed and confidence.

2) Trend Following Strategy

This classic strategy is based on identifying upward trends in stocks to go long and downward trends in stocks to go short. Traders use price charts and determine higher highs and higher lows to determine that they are now in a new trend, and they will participate.

The momentum trade involves keeping track of when the trend goes stale and then reevaluating your position. This strategy tends to be less about predictability and more about participation. Trend-following strategies usually allow for longer holding periods and avoid frequently active trading.

3) Moving Average Crossover

In this strategy, you will use two or more moving averages to maximize your trading opportunities, follow trends, and trend reversals. Here, out of the two averages, one indicates short-term fluctuations, while the other indicates long-term aspects. Using this, you can auto-generate buy signals whenever the short-term indicator crosses above the long-term.

This strategy prevents traders from making a trading decision based on noise or impulses. Many momentum stocks identified by a moving average crossover tend to be successful. However, you need to be cautious, especially in the sideways market, as the indicators may generate false signals. This is typically remediated by also using a volume or RSI indicator.

4) Relative Strategy

The relative strength strategy evaluates stock price performance relative to a market benchmark or stocks. Traders will pick stocks that are categorized as “strong” instead of bots that are lagging behind. The idea behind this strategy is simple: if a stock is strong, it will stay strong.

The trader will buy stocks that show a magnitude of strength and will avoid stocks that are lagging. This style of momentum trading involves rotating the trader through various stocks. It is a data-driven style of trading that depends on ranking tools. By scouting out only the winners, they aim simply to enhance their returns promptly.

Read More: Day Trading: The Basics and How to Get Started

Momentum Trading Examples

To clear your concept of what is a momentum stock, let’s understand momentum trading in practice. Let’s walk through a hypothetical example with Stock X and Stock Y. To begin with, say you have $8,000 to invest in each stock. Stock X is exhibiting strong upward momentum. In month one, its value climbs from $40 to $48.

Next month, it climbs to $58. In month three, it climbs to $68. By month four, it climbs to $73, by month five $78, and by month six $85. This means that your investment of $8,000 in Stock X has doubled to $16,000, a 100% return based simply upon upward momentum.

Conversely, Stock Y is exhibiting downward momentum. At the beginning of month one, its value is $40. By the end of month one, it’s at $36. Month two, it is at $32. Continued downward momentum sees it at $28 by month four, $25 by month five, and lastly $22 in month six. Your investment in Stock Y goes from $8,000 to $4,400, or a loss of 45%.

In this scenario, Stock X would bring in traders anticipating that the upward trend would continue. They would likely buy stock X, seeing its upward trend, and possibly short stock Y as its value decreased.

Benefits and Drawbacks of Momentum Trading

Momentum trading offers the opportunity for profitable trades very quickly. However, it comes with risks. A trader must weigh both risks and rewards to figure out this style of trading. Below, let’s outline some significant pros and cons of momentum trading to help you figure out whether it is appropriate for your style.

Pros

· Simple Style of Trading: Momentum strategies tend to use simple rules based on technical indicators. This makes it simpler and easier to get started without having a deep understanding of finance.

· Versatile and Flexible Timeframes: You can utilize momentum trading strategies using short (the day), medium, or long (the month) timeframes. Both day traders and swing traders can participate in momentum trading because of its versatility.

· Follow the Trend: Traders follow the market, instead of fighting the market. When you are trading with a significant trend, the odds are more in your favour of success.

· Reduces market noise: Because momentum trading incorporates taking out the noise of small price movements, it solely focuses on larger trends that matter.

Cons

· False Signals: Sometimes, a stock may give off strong early signals of momentum to quickly reverse direction and generate losses.

· Level Indicator: The momentum indicator (s) are a lagging indicator, meaning they confirm trend direction after the trend has started. Part of the price movement may already be gone when the trend is confirmed.

· Only Limited to the Trending Market: Momentum trading does not work well in sideways or choppy markets. In those cases, the momentum signal is often false, limiting its effectiveness.

Conclusion

Momentum trading is rewarding if you understand the speed and personal discipline involved in it. The gains come in if you follow the correct strategy, recognizing strong price moves, and yet stay vigilant about the drawbacks. For traders seeking fast-paced action and quick gains, momentum trading is a highly effective trading strategy.

FAQs

1. What does momentum trading mean?

Momentum trading refers to purchasing securities that have been following strong upward trends. This also indicates selling securities that have shown downward trends, with the expectation that the price will continue to drop.

2. What is momentum in crypto?

Momentum in crypto refers to trading a digital asset that has a price that is moving very fast and is often propelled by news, FOMO, market hype, or volume. Momentum traders seek to capitalize on rapid price movements and ride the trend until it slows down or reverses.

3. How long is momentum trading?

Momentum trading can last anywhere from a few seconds to several days or even longer, depending on how long the trend persists. As a momentum trader, you need to be able to determine when the momentum stops, and that’s when you exit your position, not based on a timeframe.

4. What is the difference between day trading and momentum trading?

Day trading is buying and selling a stock within the same day, regardless of the stock’s previous trend. Momentum trading involves taking a position based on a strong recent price movement, either upward or downward, expecting the trend to continue.