Introduction

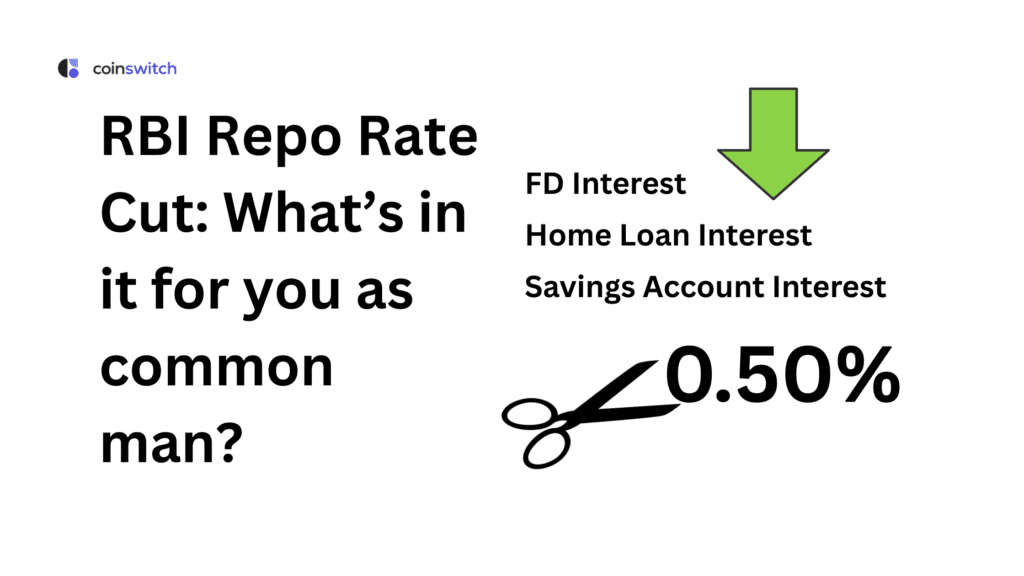

The Reserve Bank of India (RBI) cut the repo rate (RBI Repo Rate Cut) by a larger-than-expected 50 basis points to 5.5% from 6% on June 6th, marking the third consecutive rate cut since February 2025. With the latest rate cut, the central bank has cut interest rates thrice this year, with the second reduction happening in April. Along with this, the RBI also cut the cash reserve ratio (CRR) for banks to make more money available for lending. This blog post will discuss what the rate cut means for consumers, as it is expected to reduce home loan EMIs for borrowers as well as returns on popular products such as fixed deposits (FDs).

Bank Interest Rates for Savings Account and FD Rates (As of 10th Jun 2025)

| Bank | Savings Account Rate | Fixed Deposit Rate Range |

| State Bank of India (SBI) | ~2.70% (floor rate) | Cut by 30–70 bps across tenures |

| HDFC Bank | 2.75% (uniform balances) | 2.75%–6.60% (general); 3.25%–7.10% (senior citizens) |

| ICICI Bank | ~2.70–2.75% | 3.00%–6.60% (general); 3.50%–7.10% (senior citizens) |

| Axis Bank | Around 2.70% (aligned) | Reduced FD rates in line with peers |

| Kotak Mahindra Bank | Around 2.70% (aligned) | Cut FD rates across various tenures |

| Canara Bank | Around 2.70% (aligned) | Adjusted FD rates following repo cut |

| Suryoday SFB (Small Finance) | N/A | Up to 9.10% (senior citizens before cut); now reduced |

| Other SFBs (e.g., Ujjivan) | N/A | Still offering ~8–9% FDs for seniors |

Bank Interest Rates for Home Loans (As of 10th Jun 2025)

| Bank | Current Interest Rate |

| State Bank of India (SBI) | 8.00% – 9.20% p.a. |

| HDFC Bank | From 8.45% p.a. |

| ICICI Bank | From 8.75% p.a. |

| Axis Bank | From 8.75% p.a. |

| Kotak Mahindra Bank | From 8.65% p.a. |

| Bank of Baroda (BoB) | From 8.00% p.a. |

| Punjab National Bank (PNB) | From 8.05% p.a. |

| Canara Bank | From 7.90% p.a. |

RBI Repo Rate Explained

The term repo rate is best explained by an analogy. For instance, if you take a loan from a bank, you need to pay interest on the borrowed amount. Likewise, banks also need to pay interest on the money they borrow from the Reserve Bank of India. Put simply, the rate at which commercial banks borrow from the RBI is known as the repo rate. In other words, the repo rate is the rate at which the RBI lends money to commercial banks in exchange for government securities.

Since the RBI is mandated to manage the supply of money in the economy, the repo rate is an important tool in its arsenal to control inflation. For instance, if inflation in the economy is high, the central bank would increase the repo rate to control the flow of money in the economy by making money more expensive. On the other hand, if inflation is low and the supply of money is less, the RBI would reduce the repo rate to increase the money supply.

Who will benefit from the RBI repo rate cut?

Owning a home is a dream come true for most of us. Since house prices are expensive, most home buyers depend on housing loans to make the bulk payment to purchase the house. Once they avail a home loan, they start paying back the amount borrowed with interest in equated monthly installments (EMIs) to the bank over the tenure of the loan. So, what happens to your housing loan interest rate when the RBI cuts the repo rate? Let’s find out.

Typically, banks react immediately to changes in repo rates and pass on the benefit to consumers. Close on the heels of the RBI repo rate cut on June 6th, the Bank of Baroda (BoB) said it reduced its benchmark lending rate linked to the repo rate by 50 basis points. Thus, BoB borrowers whose loans are linked to this benchmark will benefit.

Likewise, private sector lender HDFC Bank cut its MCLR (Marginal Cost of Funds-based Lending Rates) by 10 basis points, benefiting borrowers whose loans are linked to this benchmark, such as home loans. To be sure, the MCLR is a benchmark used by banks to calculate interest rates on floating-rate loans such as home loans, auto loans, and personal loans. By extension, a cut in MCLR would mean a reduced loan EMI or a shorter loan tenure.

Read More: What is Repo Rate?

Monthly home loan EMI likely to come down

The reduction in the RBI repo rate is widely watched for its impact on home loan interest rates. Some banks directly pass on the benefit of the repo rate cut to their home loan borrowers, reducing their home loan EMIs. Some borrowers would benefit from shorter loan tenures. By one estimate, if a borrower has availed a home loan of Rs. 50 lakh for a 20-year tenure, the loan EMI would be lower by about Rs. 2,000.

Read More: Understanding repo rate and its significance in monetary policy

RBI repo rate cut expected to boost growth

The RBI repo rate cut would support industrial, agricultural, and economic growth by increasing the money supply and making credit cheaper.

Stock market gets a boost

Along with the RBI repo rate cut, the central bank also changed its monetary policy stance from “accommodative” to “neutral.” It is widely believed that the fall in the inflation rate from 4% to 3.2% prompted the RBI to change its stance to neutral. The effect was almost immediately visible in the stock market as it gained momentum, guided by banking and financial stocks as the RBI cut cash reserve ratio by 100 basis points to 3% from 4%.

Repo Rate Changes Over the Years

| Effective Date | Repo Rate |

| 6th June 2025 | 5.50% |

| 9th April 2025 | 6.00% |

| 7th February 2025 | 6.25% |

| 7th June 2024 | 6.50% |

| 8th February 2024 | 6.50% |

| 8th December 2023 | 6.50% |

| 6th October 2023 | 6.50% |

| 10th August 2023 | 6.50% |

| 8th June 2023 | 6.50% |

| 8th February 2023 | 5.50% |

| 7th December 2022 | 6.50% |

| 30th September 2022 | 5.90% |

| 8th June 2022 | 4.90% |

| 13th May 2022 | 4.40% |

| 4th December 2020 | 4% |

Cut in RBI repo rate would hurt bank FD returns

While the RBI repo rate cut is widely seen as a morale booster for the economy and borrowers in general, it would hurt investors in bank fixed deposits, especially senior citizens who depend on FD interest to meet their expenses. FD investors would do well to book their bank FDs now before banks pass on the impact of the repo rate cut to their customers.

Conclusion

Money supply in the economy is crucial to maintain economic stability. The lever used by the central bank to maintain this balance is the RBI repo rate. A repo rate cut will make money cheaper, easing the availability of credit and boosting economic activity.

FAQs

1. What is repo rate?

Repo rate is the rate at which the Reserve Bank of India (RBI) lends money to commercial banks or financial institutions in India against government securities.

2. What is the current repo rate?

The current repo rate in 2025 stands at 5.50%. Changes in the repo rate affect the flow of money in the market.

3. What is the difference between the bank rate and repo rate?

The repo rate is the rate at which the RBI lends to commercial banks by buying securities. The bank rate is the lending rate at which commercial banks borrow from the RBI without securities.

4. How is the repo rate availed by banks, practically speaking?

Repo rate is the rate of interest at which commercial banks in India borrow money from the Reserve Bank of India. Commercial banks are required to deposit securities such as government bonds or treasury bills as collateral to avail these loans from the central bank of India.

5. Define SLR and CRR

Cash Reserve Ratio (CRR) is the percentage of money that a bank has to keep with the RBI in the form of cash. Statutory Liquidity Ratio or SLR is the minimum percentage of deposits that a commercial bank has to maintain in the form of liquid cash, gold, or other securities.