Some trading tactics require diligence, while others need quick responses. Scalping strategies lets traders benefit from minor price swings over short periods. Scalping is distinct from long-term investment because you execute an order at the market price in a minute or less, focusing on speed and discipline.

Traders aim for consistent results while minimizing long-term market risk by seeking frequent, small opportunities. Therefore, this approach requires discipline, a keen mind, and quick decision-making.

This article describes scalping, its characteristics, handy tools, and some of the most common approaches. This blog post will discuss how the scalping strategy supports other strategies, offer general suggestions, and summarize its advantages and disadvantages for readers.

Understanding Scalping

Scalp trading or scalping in crypto refers to a trading strategy that involves making small profits from multiple trades within a short period. The trading technique aims to take advantage of minor price movements in the market, usually lasting only a few seconds or minutes.

In other words, scalping is based on capturing minute price fluctuations over a short period. Therefore, scalpers frequently enter and exit positions within seconds, while regular investors may hold assets for weeks or months. They aim to gather many small successes that will eventually lead to significant outcomes.

Due to the small size of these earnings, traders must complete a large number of transactions in a session, which makes accuracy and self-control essential. Scalping strategy works best in markets with strong liquidity and small price differentials between buying and selling.

Besides, they can quickly enter and exit with these benefits at no large fees for transactions. However, as a slight delay can turn a winning deal into a loss, timing matters greatly.

Read More: What’s the Difference Between a Debtor and a Creditor?

Key Characteristics of Scalping

Scalping is ideal for short periods and dynamically responsive decision-making. It requires a level of impulsive precision and unwavering focus. When a trader is aware of these, it allows them to align with the appropriate mindset and other attributes necessary for trader success.

High Trade Frequency

To accumulate numerous small gains, a scalper trader executes multiple trades within a single session. Though it demands constant vigilance, the repeated trades help in the potential accumulation of gains. Thus, the key to scalping’s earning capability lies in repeated execution.

Very Short Holding Periods

A trade takes only seconds or minutes to close. The short duration reduces exposure to volatility and sharp movements. Thus, to capture fleeting opportunities, speed and precision are imperative.

Small Profit Targets per Trade

Each transaction aims for a small gain, usually a few ticks or pips. These profits, though individually minor, accumulate over repeated trades, making consistent minor wins essential for the strategy’s effectiveness.

Tight Stop-Loss and Risk Controls

Scalpers cut their losses on each trade by employing modest position sizes and strict exit conditions. A single losing transaction can outweigh numerous wins when gains are scarce and movement is high. Effective risk management plays a crucial role in this context.

High Liquidity and Tight Spreads

Scalping thrives in markets that feature high volume and narrow bid-ask discrepancies. These circumstances ensure effective entry and departure with minimal slippage. Besides, this approach keeps profit margins thin for each deal.

Heavy Reliance on Technical Analysis

A scalper trader studies charts, indicators, and price patterns for extremely short periods to execute transactions. Oscillators, moving averages, and support and resistance levels offer clear signals for immediate entry and exit.

Read More: Arbitrage Strategies with Binary Options

Tools for Scalping

Scalping requires specialized instruments that ensure speed, accuracy, and dependability. This equipment enables traders to react quickly to fleeting opportunities. Therefore, in fast-moving situations, scalpers may struggle to execute trades successfully without these tools.

Fast Trading Platform

A dependable and low-latency platform is essential for a scalping strategy. Execution delays may lead to potential losses. Traders can rapidly identify opportunities and verify that their strategies are consistent with current market trends.

Live Market Feeds

Scalpers seek immediacy, and real-time information provides it. The system displays a price fluctuation the moment it occurs through a standard update. Traders make accurate decisions to take advantage of the price movement by acting quickly on the real-time information they observe within a short period.

Custom Layouts and Hotkeys

Having interfaces that are efficient can save time that could be costly during a fast-paced exercise. Hotkeys, or keyboard shortcuts, eliminate hesitancy by allowing users to execute transactions with a single click. Besides, scalpers gain control by handling numerous transactions in seconds, utilizing layouts tailored to their preferences.

Technical Indicators

A scalper trader is guided by short-term insights from indicators like oscillators or moving averages. During turbulent sessions, these tools draw attention to entrance and exit signals. Traders become confident to execute quick, well-informed trades through the exact interpretation of these.

Risk-Management Features

Automated stop-loss and take-profit orders protect your investments effectively. Discipline is imposed, and exposure to abrupt reversals is minimized. Therefore, by taking these precautions, scalpers can trade with confidence and minimize the risk of incurring large losses.

Types of Scalping Strategies

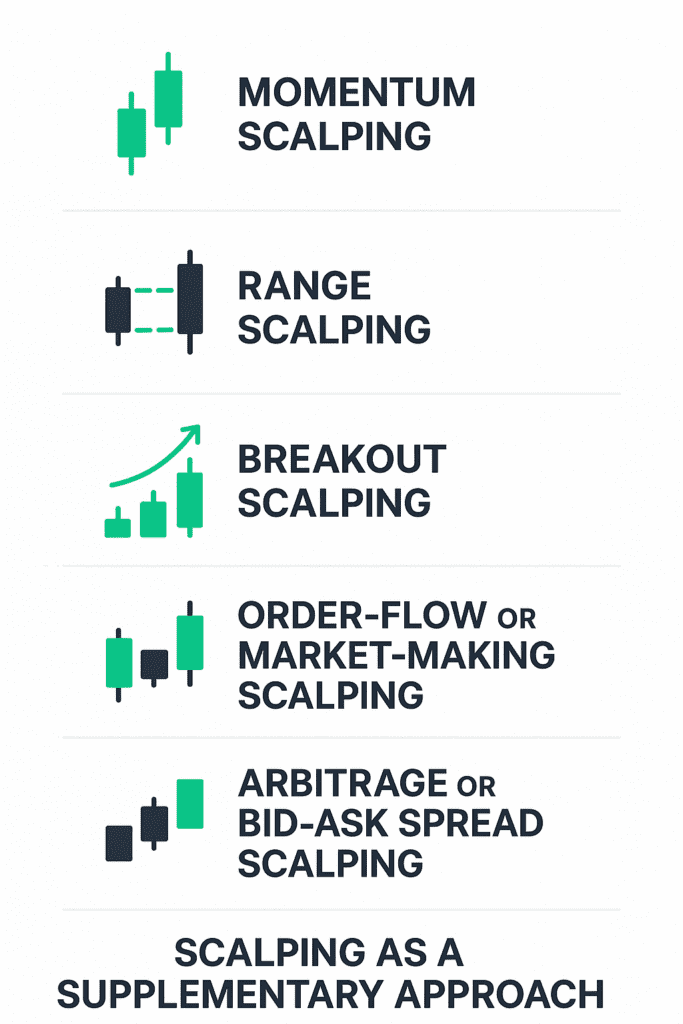

Scalping offers various strategies based on market conditions and individual preferences. Therefore, being aware of these allows you to apply your strategy to your objective.

Momentum Scalping

This tactic leverages sudden changes in volume or pricing. As momentum increases, traders rush in, and when it subsides, they leave. Quick action in response to these surges helps identify subtle, yet powerful trends before they disappear.

Range Scalping

A range-based scalper trader looks at price fluctuations between levels of support and resistance. They sell near the upper range boundary and buy near the lower boundary. When markets move consistently within narrow bands, this approach works effectively.

Breakout Scalping

This strategy involves riding the first spike for quick gains and entering when prices break through key levels. When these breakouts happen, traders take action, and when the activity decreases, they pull back. Therefore, this tool effectively identifies fleeting directional movements.

Order-Flow or Market-Making Scalping

Scalpers use the real-time order book as a guide, buying when demand exceeds supply and selling when the opposite occurs. This method relies on deciphering microstructure hints to predict changes before they happen.

Arbitrage or Bid-Ask Spread Scalping

Traders exploit minute variations in prices or venues. They profit from the spread by selling at a slightly higher price than their purchase price. This method locks in minor inefficiencies by requiring speed and accuracy.

Scalping as a Supplementary Approach

Scalping can complement other strategies. A trader uses fundamentals to maintain long-term holdings and scalps for short-term returns. This combination delivers stable profits without market swings. Scalping diversifies, lessening dependence on a single approach. Over-scalping can hinder long-term tactics, so balancing is essential. Scalping enhances performance by accumulating regular small gains rather than relying on large trades with self-control. Consequently, the approach acts as a prime and powerful supporting approach.

Tips for Novice Scalpers

Scalping strategy may seem intimidating in the beginning, but it can be mastered with a structured approach. You will need clarity, processes, and training habits to master this style of trading effectively. For this reason, the framework below includes some introductory basics.

Understand the Basics and the Market

For scalping properly, you will need to understand the fundamental market and strategy. Novices should familiarize themselves with the volatility, market dynamics, and normal behavior of the financial instrument. A strong foundation enables confident decision-making in fast-paced situations.

Choose the Right Platform and Broker

It is critical to choose a broker with a solid infrastructure, fast execution, and narrow spreads. These types of platforms, which utilize real-time data and adjustable interfaces, reduce the risk of slippage. This allows novice traders to execute precise and efficient transactions.

Use Tight Risk Management

Large loss avoidance is of primary importance to a scalping strategy where numerous trades are executed with small profit targets. Keep the number of your trades limited based on your capital and employ stop-loss orders. Consequently, setbacks remain minimal.

Trade Liquid Markets and Watch Costs

Choose assets with low spreads and good liquidity to enable a smooth execution. Inexpensive venues help maintain the thin margins needed for effective scalping, as frequent trading raises expenses.

Develop Discipline and Patience

Scalping can lead to impulsive trading actions. Stick to your plan to the letter and await the best possible opportunities to circumvent impulsive actions. An effective scalper trader typically stands out from others based on their consistency and calmness.

Pros and Cons of Stock Scalping

Scalping offers opportunities for rapid entry and exit, as well as the potential to accumulate small profits in the long term. Yet, there are certain risks entailed with its high frequency and excessive trading. By comparing the pros and cons, the traders can select one that is appropriate to their use and nature.

Quick Profits and Frequent Opportunities

Scalping enables traders to generate profits regularly from small price movements. There are various opportunities for gains with regular trading. Thus, the method promotes small gains that can add up over time.

Limited Market Exposure and Reduced Overnight Risk

Short-term transaction holding reduces exposure to overnight volatility or larger market fluctuations. Unexpected price gaps due to the news can be evaded by scalpers. Besides, short-term focus also makes it easier to shield money from unexpected events.

High Transaction Costs and Slippage Concern

Multiple entries and exits are extremely costly in spreads and commissions. Slippage due to rapid market movement can also occur because execution prices fail to perform as desired. These can wipe out the profits very quickly.

Intense Focus and Emotional Strain Required

A scalping strategy demands complete focus, quick decisions, and unwavering discipline. These mixed requirements can lead to mental stress and fatigue. In this stressful environment, traders must manage their emotional state; otherwise, mistakes can accumulate quickly.

The Bottom Line

Scalping is a fast strategy for making consistent, small gains through careful execution. The right tools, strict risk management, and emotional control drive success. It demands effort and can be costly, but it presents numerous opportunities and enhances broader trading plans.Therefore, a scalping strategy suits a trader who makes quick decisions and thrives under pressure. Traders may use its potential by combining practice and dedication.

FAQs

1. What is the most profitable scalping strategy?

Successfully applying momentum and breakout strategies with discipline can fetch good returns. However, traders should have the ability to juggle multiple strategies. Profitability depends on their consistency, risk management, and ability to adjust their approach in response to changing market conditions.

2. Is scalping a profitable trading strategy?

Successful scalping involves following rules strictly, making prompt decisions, and being frugal. Therefore, even though every gain or profit might be small, collectively these outcomes can translate to huge profits by repeated consistency.

3. How to master scalping trading?

Being disciplined is all about practice. Traders need to become proficient with their setups in simulators, maintain a trading journal, and adjust their strategy regularly based on feedback and changing market conditions.

4. How much profit do scalpers make?

Profits depend on the frequency of trade, cost, and skill. Although a scalper trader typically makes only a small profit per trade, these small profits can accumulate to a substantial total return after many years of continuous trading.