Surrendering a life insurance policy is ending the policy before its maturity date. This would be done when policyholders want to cash in the surrender value. It is also an option when there are changes in financial needs or the policy is no longer suitable to achieve the objectives. After surrender, the insured receives a lump sum amount after deductions like the insurer’s costs, expenses, and surrender charges. This is referred to as the surrender value.

One should exercise caution when making decisions to surrender, as it will terminate all future benefits of the policy. Moreover, early surrender can result in reduced payout. Therefore, it is essential to understand the policy’s terms before making a decision. To begin with, you should learn about the documents required to surrender the LIC policy. Let’s dig in.

Key Documents to Surrender a Life Insurance Policy

There are several key steps involved in surrendering a life insurance policy. To ensure the process is legal and smooth, policyholders are required to endorse specific documents. The documents serve to identify the person, establish the surrender request, and facilitate the transfer of the surrender value to the designated bank account. Here’s the list of documents required to surrender the LIC policy.

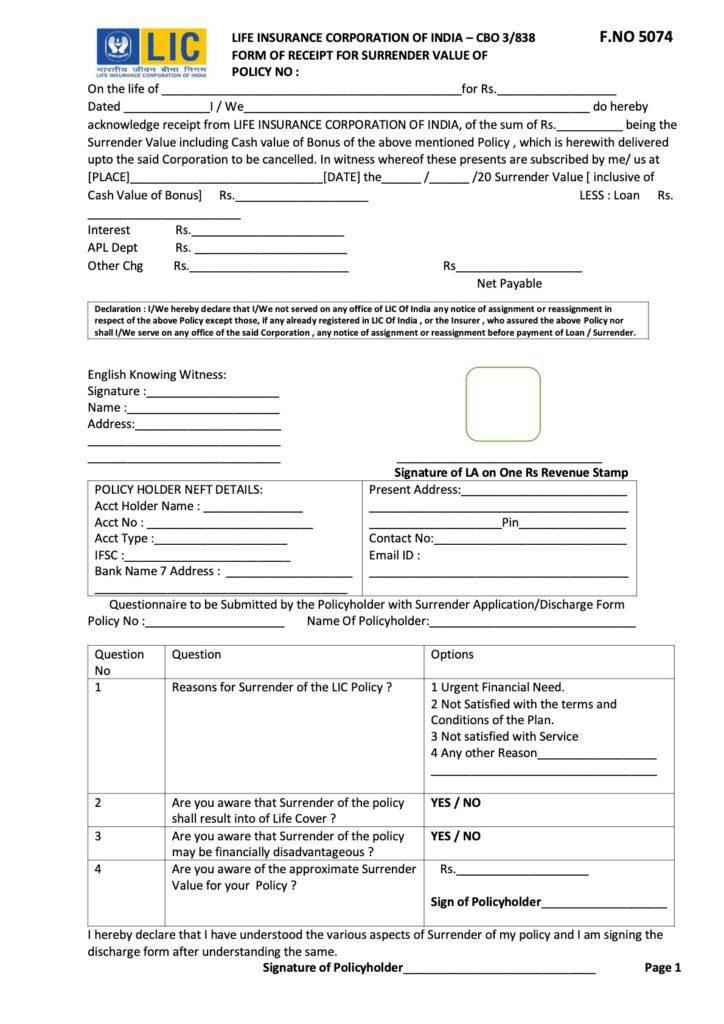

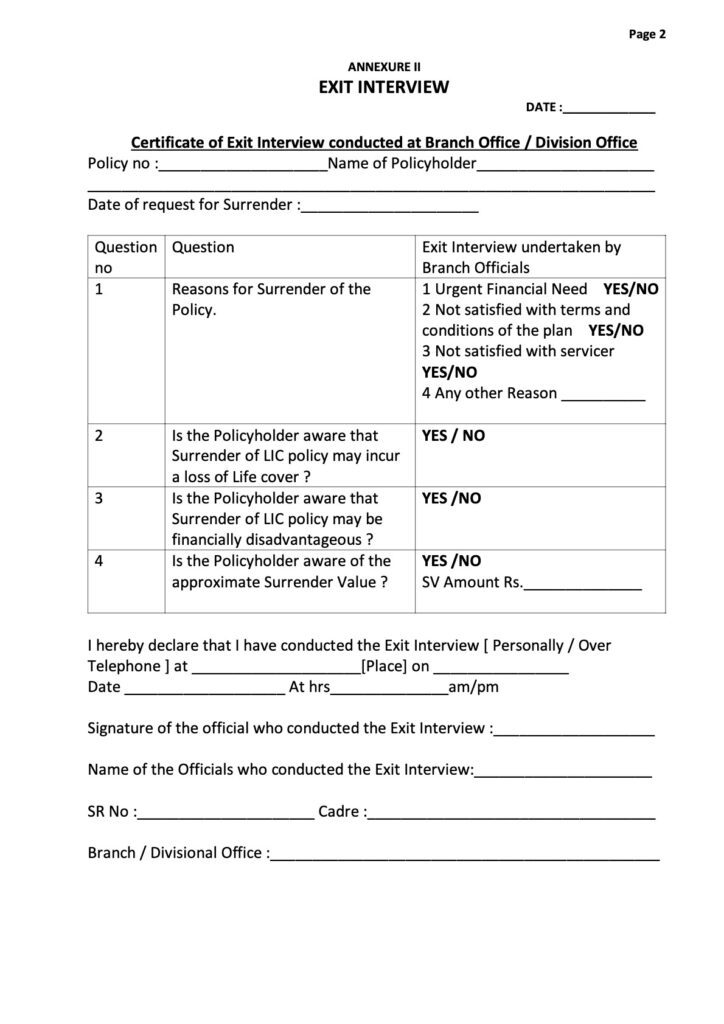

The Surrender Discharge Form

The most important document is the Surrender Discharge form, also known as Form 5074. This form is offered by the LIC. The policyholder must fill it out and sign it. This is a formal way of informing the LIC that a policyholder intends to surrender the policy. The surrender process cannot be initiated without this form.

NEFT Mandate Form

The NEFT Mandate Form must be submitted to the LIC if one wishes to receive the surrender amount directly into their bank account. This enables LIC to transfer the surrender value via Nationwide Electronic Funds Transfer (NEFT). In this form, the policyholder should furnish the correct bank account information.

Identification Documents

There is a need to ensure that the identity of the individual who is surrendering the policy is recognized by LIC. For this, you will need to provide identification documents. In most cases, PAN and Aadhaar cards are acceptable. If the policyholder is unable to furnish these, he can submit other officially accepted identity proofs. These records help LIC ensure that the request is from the original policyholder.

Original Policy Document

Another essential requirement is the original policy documentation on life insurance. This indicates that the policy exists and that the policyholder is surrendering the right one. To surrender the policy, LIC requires the original document. A photocopy will not suffice.

Cancelled Cheque

A cancelled cheque leaf from the policyholder’s bank account should be presented. This assists LIC in verifying the IFSC code and account number with the name. It should be the same account that appears on the NEFT Mandate Form. The step is necessary to ensure that the amount of the surrender is also directed to the correct individual.

Revenue Stamp of ₹1

A one-rupee revenue stamp is another minor detail, yet it is mandated as part of the documentation. It contributes to fulfilling the legal requirements of the surrender procedure.

Reasons for Surrendering the Policy

Sometimes, the insured may decide to surrender the LIC policy. We have listed some reasons why people give up their LIC policy.

Financial Emergency

Most people will surrender their policy in cases where they require cash urgently. This could be due to a medical emergency, loss of employment, or financial crisis. Giving up the policy enables them to receive the surrender value, which is helpful in hard times.

Increased Opportunities for Investment

Some discover other investment means with better returns. It may appear more lucrative to invest in mutual funds, stocks, or fixed deposits. Therefore, they opt to leave the life insurance scheme prematurely and allocate their funds to other avenues.

Unaffordable Premiums

Occasionally, individuals struggle to pay premiums regularly because their income or expenses fluctuate. In this scenario, it becomes a burden to carry on with the policy. They would rather give it up than incur penalties or lapses.

No Policy Is Required

Aspirations in life evolve. Individuals might have purchased the insurance when they were young, with dependents. In the future, they may find themselves no longer needing the policy after their children have become financially independent.

Unsatisfaction with Policy Performance

When the policy does not provide the expected returns or benefits, the policyholder might be disappointed. This frustration may lead to abandoning the policy.

Loyalty to another policy

There are occasions when individuals can obtain a better policy with greater benefits or lower premiums. When this happens, they abandon the former policy and choose another one. You should carefully go through the surrender value and terms before surrendering the policy, and you should also learn about the documents required to surrender the LIC policy.

Read More: What Does a Financial Advisor Do?

Submission to the Relevant Branch

When surrendering a life insurance policy, submitting the required documents to the correct branch of LIC is crucial. This surrender request is to be presented to the branch where the policy was initially issued. This assists in quick and efficient processing.

The name and address of the branch that issued the policy are usually mentioned in the original LIC policy document. The policy paper should always be checked before it is submitted. If the papers are submitted to the wrong branch, it can lead to a delay.

You will need to bring all the documents required to surrender the LIC policy. This comprises original policy bond, filled surrender discharge form, NEFT mandate form, ID proof, cancelled cheque, and one revenue stamp of 1 Rupee. Ensure that every form is filled out and signed.

Visit the branch during working hours and present the documents at the customer service desk or the surrender counter. As evidence of submission, you should keep a copy of the acknowledgement receipt.

When you submit the correct set of documents to the designated branch, you can be assured that your surrender process will proceed smoothly without any issues. It also minimizes the prospects of follow-up visits and delays in getting the surrender value.

LIC Surrender Form

Using the LIC Surrender Value Calculator

It is convenient to use the LIC Surrender Value Calculator before you surrender your policy. This web-based calculator provides you with an estimate of the money that you are likely to receive if you terminate the policy ahead of its due date. It is a calculator located on the official LIC site. Locate the section labeled “Surrender Value Calculator.” Provide your policy information, like policy number, sum assured, policy term, as well as the premium payments you made.

After you enter the information, the calculator will display an approximate amount to you. This figure is in accordance with the terms and conditions of LIC. It helps you understand the financial benefits of surrendering your policy. The calculator is easy to use and free.

One has to provide documents required to surrender the LIC policy, such as the original policy document, surrender discharge form, ID proof, a cancelled cheque, a 1-rupee revenue stamp, and the NEFT mandate form. The procedure makes the surrendering process smooth and prevents any confusion in the future. Nevertheless, always read the information thoroughly before acting.

Read More: FDs and Unit-Linked Insurance Plans (ULIP): Which is better?

Conclusion

The process of surrendering a life insurance policy is a financial decision. It can be done when the policy is no longer necessary or is not affordable. It is essential to be aware of the surrender value and any associated charges before proceeding with this step. Planning can be done using the LIC Surrender Value Calculator.

Further, make sure that you have all the documents required to surrender the LIC policy. Correct documentation is one way of preventing delays. Never surrender in haste, as the benefits of the policy cease once you surrender.

FAQs

1. What documents are required for policy surrender?

You will require the original policy bond, filled up LIC Surrender Form, bank account details form, a cancelled cheque, and a written letter as to why you are surrendering the policy. You will also be required to bring a copy of your ID and any other documents that are specifically required by LIC.

2. What is the process of surrendering a life insurance policy?

To surrender a policy, one has to pay premiums regularly. With most life insurance policies, there is no surrender value until after the premiums have been paid off continuously for a specified duration, typically three years.

3. What documents are required to claim life insurance?

Present a photo of the insured. Death Certificate of the insured issued by a government authority. Photographic identification of the claimant. The Aadhaar Card, Valid Passport, or Voter’s ID is taken as proof of the claimant’s address.

4. How much money will I get if I surrender my policy?

If you are surrendering your LIC policy, the surrender value that you will receive is dependent on the number of years you have been paying premiums, and according to the terms of the policy. On average, you will get 30% of the total premium paid after three years.