2022 was a turbulent year for crypto. The crypto market experienced one of the steepest price erosions in history, as rising inflation rates and subsequent monetary tightening sent the capital markets—and tech stocks in particular—into a downward spiral. Yet, it has also been a year of BUIDLing in crypto, marked with watershed events such as the Ethereum Merge.

The year will also go down in history as one of the foundational years for the evolution of regulatory guidelines for crypto, with regulators and enforcement agencies across the world stepping up to build their capacity, initiating unprecedented enforcement actions and setting the tone for potential regulations for the industry. To give you a complete picture of the evolution of crypto in India, my colleagues Sukant Dukhande, Abhishek Singh and Sumana Satyamurthy have compiled a timeline of these major events toward the end of this piece.

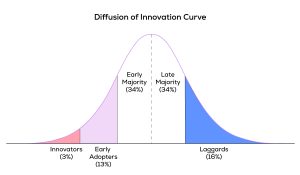

At the outset, such regulatory actions are often viewed as a shocking development. But as someone who has worked at the intersection of technology and law for over two decades at companies such as WhatsApp, Netflix, Snapdeal, Jio, and eBay, I realise that is far from the case. Regulation always follows innovation. It’s a feature and not a bug. Placing the rules before the technology developments can do more harm than good. That said, the true value of transformative innovations often cannot be fully realized until the regulatory context takes shape. Engagements and knowledge-sharing help regulations catch up and fully grasp the technology. The year 2022 laid the foundation for this evolution in crypto, especially in India.

Last year, India framed the first pieces of crypto regulations—from taxation to advertising guidelines to cybersecurity standards to KYC. All these were aimed at protecting the consumers; ensuring KYC, transparency, and traceability; and increasing tax revenue of the country. Crypto was also on the radar of various enforcement agencies, including the Enforcement Directorate and state police departments. While these engagements have not yet reached a conclusion, it is safe to say that these events are a reminder to India’s nascent yet eclectic crypto industry to be transparent and responsible, and not lure customers with false promises and irresponsible growth hacks. Investors, on their part, should double down on DYOR (Do Your Own Research).

In the Indian Parliament, lawmakers asked more than 100 questions on crypto, NFT, Web3 and blockchain in 2022:

This shouldn’t come as a surprise. Crypto is a new technology, and as such the lawmakers, too, are learning the nuances of the technology and the different business models it has enabled. Various government and law enforcement agencies also invested significant time and effort in building their knowledge, capabilities and tools to understand crypto. In fact, the UPSC exams in 2022 had questions on NFT and Web3. If you are a UPSC aspirant, do browse through educational articles and videos on CoinSwitch—it can’t get better than this.

To advance a responsible crypto industry in India, CoinSwitch also conducted nine knowledge-sharing sessions with law enforcement agencies in six states—Haryana, Odisha, Uttar Pradesh, West Bengal, Kerala, and Karnataka. These knowledge-sharing sessions were attended by over 250 law enforcement officers from departments such as the Economic Offences Wing and Special Task Force of Odisha, Cyber Crime Department and Criminal Investigation Department of West Bengal, Special Task Force of the Uttar Pradesh Police, Cyberdome of Kerala Police, State Intelligence Department of Karnataka, and the Haryana State Police.

Such knowledge-sharing sessions are particularly important as the crypto industry had witnessed several high-profile collapses in 2022, including but not limited to the LUNA crash and the FTX fiasco, both of which have led to legal charges against the proprietors or founders of these businesses in their respective home jurisdictions. Such events remind the industry to prioritize trust and solvency. The silver lining is that several crypto exchanges conducted an independent review of their crypto and fiat currency holdings through reputable financial firms. You can find CoinSwitch’s Proof of Reserves release here.

All’s well that ends well. The year 2022 signed off on a positive note with the Reserve Bank of India piloting retail and wholesale CBDC, and India assuming the presidency of G20, where crypto regulations are one of the key agendas.

I’m bullish on the future of crypto in India.

A summary of all regulatory, judiciary, law enforcement, and industry-related developments in India during the year 2022

Research: Sukant Dukhande, Abhishek Singh, and Sumana Satyamurthy

| Month in 2022 | Subject | Brief description of the event |

| Tax Developments | ||

| January | Tax | Karnataka High Court stayed the demand of Income Tax authorities to levy 1% TDS on crypto transactions under Section 194-O of Income Tax Act, 1961—meant for e-commerce platforms. |

| February | Tax | The definition of Virtual Digital Assets and taxation for the same were introduced in the Finance Bill, 2022. |

| March | Tax | Certain aspects of the crypto tax proposals in the Finance Bill, 2022 were amended. The most important being not allowing offset of losses from crypto trading. |

| June | Tax | Clarifications were issued to the mode and manner of tax deduction at source and relevant tax forms. A summary of these clarifications are:

[Look for para 6.3 in this document] |

| June | Tax | Certain types of NFTs linked to underlying tangible assets were excluded from the definition of Virtual Digital Assets. |

| Other Regulatory Developments | ||

| February | ASCI | Advertising Standards Council of India (ASCI) issued guidelines for advertising and promotion of virtual digital assets services. These guidelines came into effect on 1st April 2022. |

| April | CERT-In | The Indian Computer Emergency Response Team (CERT-In) issued certain directions under sub-section (6) of section 70B of the Information Technology Act, 2000 which included specific KYC and transaction record maintenance obligations of virtual asset service providers, virtual asset exchange providers and custodian wallet providers. |

| October | CBDC | RBI launched the pilot project on wholesale CBDC. |

| December | G20 | Discussions in G20 kicked off on possible crypto regulations. |

| December | CBDC | RBI launches the pilot project on Retail CBDC. |

| December | SEBI | SEBI issued a consultation paper on the Securities Index, excluding crypto indexes. |

| Industry Developments | ||

| April | Industry (NPCI) | National Payments Corporation of India (NPCI) issued a press release stating that it is not aware of any crypto exchange using UPI services for purchase of cryptos. Post this press release, the industry witnesses a sudden stoppage of UPI services on crypto platforms. |

| July | Industry (Association) | The Blockchain And Crypto Assets Council (BACC), which was operating under IAMAI, was dismantled. |

| August | Industry (Exchange ownership) | A Twitter debate between founders of an Indian exchange and a foreign-based exchange regarding ownership and control. |

| November | Industry (Association) | The industry players joined hands and formed a new industry body under the name Bharat Web3 Association. |

| November | Industry (Proof of Reserves) | The FTX collapse led to the demand on exchanges to show proof of reserves. Indian crypto exchanges started to release their Proof of Reserves and financial review reports under Indian Accounting Standards for Agreed Upon Procedures. |

| Court Orders | ||

| February | Court Orders (Bail) | Bombay High Court rejected anticipatory bail application filed by the person alleged to have been involved in crypto-related frauds. |

| February | Court Orders (Bail) | Karnataka High Court declined to cancel the bail granted to an accused of a crypto scam by the lower court. |

| March | Court Orders (Bail) | Kerala High Court granted bail to the accused of crypto-related fraud, as the accused claimed that they themselves were victims of the fraud committed by the relevant crypto firm. |

| March | Court Orders (Bail) | Punjab and Haryana High Court granted bail to the accused of the crypto scam on the condition that the accused will deposit the amount involved in the fraud with the court as security. |

| March | Court Orders (Bail) | Madhya Pradesh High Court granted bail to the accused of a crypto scam on the prayers that the accused himself was a victim of the scam undertaken by other persons who were absconding, and the accused has already been in jail for many months. |

| April | Court Orders (Quashing of FIR) | The Supreme Court of India directed Vivek Bhardwaj (brother of Amit Bhardwaj, the mastermind in GainBitcoin Scam) to divulge details of the username and password of crypto wallets to the Enforcement Directorate. |

| May | Court Orders (Bail) | Bombay High Court denied anticipatory bail to the accused for allegedly inducing the complainant and his friends to invest money in Crypto through www (.) coin24 (.) live and promised high returns. The accused purchased the crypto with the amount deposited by the complainant and his friends but the accused neither repaid the invested amount nor returned the investment thereon, as promised. |

| September | Court Orders (Bail) | Madhya Pradesh High Court denied bail to the accused who allegedly duped his employer and employer’s customer by allegedly fraudulently transferring 25 BTC and 30ETH worth amounting to ₹6,70,00,000/- from the customer’s wallet to some suspended fake wallet addresses. |

| September | Court Orders (Intellectual Property) | Delhi High Court granted relief to the TATA brand which was used by a London-headquartered crypto firm to launch its crypto token in the name of TATA. This crypto token name was subsequently renamed HKUN. |

| September | Court Orders (Bail) | Madhya Pradesh High Court allowed the withdrawal of Anticipatory Bail Application filed by the accused. As per the allegations money which was taken by the accused from the complainant was never invested in Cryptocurrency (Bitcoins) and siphoned off. |

| October | Court Orders (Investigation) | Calcutta High Court denied the continuous presence of an advocate when ED is investigating the accused of an online gaming app that used cryptos to undertake money laundering activities. |

| October | Court Orders (Intellectual Property Rights) | Delhi High Court granted relief to the parent company of the microblogging platform “Koo” by directing Godaddy and ISPs to takedown certain domain names using Koo name which were providing crypto-related services. |

| November | Court Orders (Bail) | Gujarat High Court denied bail to the accused who was involved in the sale of contraband items and facilitated financial transactions through cryptos. |

| December | Court Orders (Bail) | Kerala High Court denied the bail of Petitioner who was purchasing and selling narcotic drugs from various states in India and dealing in purchase and sale through the dark web. |

| Actions by Enforcement Directorate | ||

| February | Action by Enforcement Directorate | The Enforcement Directorate (ED) initiated a probe into the use of the darknet and cryptocurrencies by India’s most-wanted fugitive, Dawood Ibrahim. |

| April | Action by Enforcement Directorate | The Enforcement Directorate took charge of the case filed against a former IPS officer and a cyber expert. The cyber cell seized crypto worth ₹6 crore from the officer’s wallet. |

| July | Action by Enforcement Directorate | The Enforcement Directorate has provisionally attached assets valued at Rs.14 crore in the Morris Coin Crypto cheating case under PMLA, 2002. Total attachment, in this case, stands at ₹50.72 crore including a hospital in Kochi and 52 acres of agricultural land in Tamil Nadu. |

| August | Action by Enforcement Directorate | The Enforcement Directorate conducted searches at various premises of a fintech company and a Crypto exchange and ordered to freeze its bank balances, payment gateway balances and Crypto balances totalling ₹370 crore (approx. $46 million) worth of assets under PMLA, 2002. |

| August | Action by Enforcement Directorate | The Enforcement Directorate conducted searches on the premises of a couple of large domestic crypto exchanges (more on this here and here). |

| September | Action by Enforcement Directorate | The Enforcement Directorate conducted searches under PMLA, 2002 (on 14 September 2022) at six premises in Delhi, Ghaziabad, Mumbai, Lucknow, and Gaya in connection with a money laundering probe into HPZ Token crypto scam and related entities, resulting in freezing of ₹46.67 crore in various virtual accounts and recovery of incriminating documents. |

| November | Action by Enforcement Directorate | The Enforcement Directorate carried out a search operation on a crypto Wallet/User ID leading to the freezing of 150.22 Bitcoins equivalent to ₹22.82 crore under PMLA, 2002, in respect to an investigation being conducted relating to the Mobile Gaming Application, namely E-nuggets. |

| December | Action by Enforcement Directorate | As per the Economic Times, the Enforcement Directorate attaches ₹907 crore assets of crypto exchanges under PMLA. Minister of State for Finance Pankaj Chaudhary said in the case of a major crypto exchange, assets worth ₹289.68 crore have been seized from the exchange and its Directors for violation of the provisions of the Foreign Exchange Management Act. |

| Actions by Police | ||

| January | Action by Police | An investigation by the Delhi Police’s Intelligence Fusion and Strategic Ops (IFSO) division has reportedly revealed that Hamas was behind a cryptocurrency wallet hack. The cryptocurrency theft was worth ₹30.6 lakh at the time of the incident. The crypto was stolen from a Delhi-based businessman routed through various private wallets before it landed in the wallet operated in Gaza by al-Qassam Bridges, the military wing of Hamas, an entity sanctioned by the US authorities. |

| February | Action by Police | The Maharashtra police arrested 11 people related to a cryptocurrency scam of ₹44 crore ($5.4 million) stolen from around 2,000 investors. |

| February | Action by Police | A police officer and seven others were arrested for kidnapping a crypto trader and forcing him to transfer over ₹32 lakh ($40 million) in cryptocurrency, as well as ₹8 lakh ($10,700) in cash. |

| February | Action by Police | Maharashtra Police initiated an investigation of Satish Kumbhani, founder of BitConnect, for fraudulently raising about $2.4 billion from investors for his cryptocurrency exchange. Kumbhani was last reported to be in India, as per the charges filed against him by the US Securities and Exchange Commission (SEC). |

| April | Action by Police | The Bangalore City Police arrested four people for their ties to a cryptocurrency scam that operated through an app named ShareHash. The group launched a cryptocurrency, Helium Crypto Token (Crypto Miner-HNT), and conducted their activities using the app while promising investors high returns. |

| July | Action by Police | The cyber police station of Delhi police busted a gang of criminals for allegedly cheating people on the pretext of facilitating online loans and converting the ill-gotten funds into cryptocurrency by purchasing USDT on a foreign-based crypto exchange. |

| September | Action by Police | Police (Economic Offences Wing) of Maharashtra detained two people on suspicion of conducting a crypto scam that defrauded over 1,400 investors of approx₹49 crore ($6 million) to approx ₹98 crore ($12 million). |

| September | Action by Police | The Hyderabad Narcotic Enforcement Wing arrested a gang of drug traffickers operating through the dark web and arrested two ‘dark web kingpins’, besides six other alleged drug peddlers for illegal crypto transactions. These transactions were made through several crypto exchanges in India and abroad. |

| October | Action by Police | The Odisha Police on 29 October 2022 arrested a government engineer after cryptocurrencies valued at over ₹1.75 crore were found in his possession. |

| December | Action by Police | Delhi Police opened an investigation into a group of individuals for duping people of around ₹500 crore on the pretext of investing in a cryptocurrency. |

| Capacity building by govt agencies | ||

| June | Good initiatives by Police | IIT-Kanpur provides Uttar Pradesh Police with an indigenously developed tool, called HOP, to track down or detect fraudulent crypto transactions. |

| June | UPSC Exams | Questions on NFT and Web3 appeared in the UPSC examination papers. NFT (Question 69) Web3 (Question 32) |

| August | Good initiatives by Police | The Goa Police signed a memorandum of understanding (MoU) with blockchain startup 5ire to adopt a blockchain-based record-keeping system. As per the Senior officer, MoU is a step by the Goa Police to go paperless, as well as improve security and transparency to provide better policing services to citizens. The police aim to go completely paperless and improve security and transparency by the end of the year. |

| October | Good initiatives by Police | Firozabad Police pilots OxPolygon modular blockchain technology to register police complaints. Through the use of policecomplaintonblockchain.in means, complaints will not be tampered with and remain immutable and transparent. |

| October | Good initiatives by Police | At the 90th INTERPOL General Assembly in New Delhi, the global police organization unveiled the first-ever Metaverse specifically designed for law enforcement worldwide. The INTERPOL Metaverse allows registered users to tour a virtual facsimile of the INTERPOL General Secretariat headquarters in Lyon, France, interact with other officers via their avatars, and even take immersive training courses in forensic investigation and other policing capabilities. |

| December | Good initiatives by Police | The world’s first ‘Token of Appreciation’, the Soulbound Token, issued on 1st December 2022 by Dr K Jayanth Murali IPS, Director General of Police, Idol Wing CID, Tamil Nadu to outstanding members of his team. |

| Parliament Questions & Answers | ||

| February | Parliament Q&A (Lok Sabha) | Member of Parliament (MP) Doddaalahalli Kempegowda Suresh asked:

(a) Whether the Government has constituted a committee to study the issues related to virtual currencies and its impact on the economy. (b) Specific recommendation on prohibiting the cryptocurrencies in the country (c) Government steps to implement recommendations Answer by Minister of State for Finance, Pankaj Chaudhary: (a) Government had constituted an Inter-Ministerial Committee (IMC) on 2 November 2017 under the Chairmanship of Secretary (EA) with member representatives from Ministry of Electronics & Information Technology (Meity), Securities & Exchange Board of India (SEBI) and Reserve Bank of India (RBI) for examining the issues of Virtual Currencies (VC) and to propose specific action to be taken in this matter (b) Committee recommended that all private cryptocurrencies, except any cryptocurrency issued by the State, be banned in India. (c) The Government is in the process of such consultation. |

| February | Parliament Q&A (Rajya Sabha) | MP Priyanka Chaturvedi asked:

(a) Government data on the number of subscribers in India across various cryptocurrency exchanges (b) value of cryptocurrencies investment by Indian citizens (c) framework for check and balance on the cryptocurrency market currently? Answer by Minister of State for Finance, Pankaj Chaudhary: (a) & (b) Government does not collect data on the number of subscribers in India across various cryptocurrency exchanges and the value of cryptocurrencies investment by Indian citizens. (c) RBI vide its circular dated 31 May 2021 has advised its regulated entities dealing in virtual currencies to continue to carry out customer due diligence processes in line with regulations governing standards for Know Your Customer (KYC), Anti-Money Laundering (AML), Combating of Financing of Terrorism (CFT) and obligations of regulated entities under Prevention of Money Laundering Act, (PMLA), 2002 in addition to ensuring compliance with relevant provisions under Foreign Exchange Management Act (FEMA) for overseas remittances. |

| March | Parliament Q&A (Lok Sabha) | MP S. Ramalingam asked:

(a) Government data on number of cryptocurrency exchanges (b) GST evasion cases and action taken by the Government. Answer by Minister of State for Finance, Pankaj Chaudhary: (a) Government does not collect any data on cryptocurrency exchanges. (b) Penalty imposed on certain companies for GST evasion |

| March | Parliament Q&A (Lok Sabha) | MPs Ravneet Singh Bittu and Vijayakumar asked:

(a) Awareness of the Government of the huge demand of blockchain engineering talent in the country; details thereof and if not, the reasons. (b) steps taken by the government job generation in blockchain engineering/ details of it and reasons if not (c) Details of training programmes in blockchain technology conducted in the present/future Answer by Minister of State for Electronics and IT, Rajeev Chandrasekhar: (a) Government of India issued a National Strategy on Blockchain in Dec 2021, which focuses on R&D, innovation, Technology which in turn creates Blockchain talent and capabilities in the Tech workforce. (b) The Government has facilitated rollout of Blockchain based courses in the educational/academic and Research & Development (c) Training programmes in Emerging Technologies: Digital India Dialogues, a series of 100 knowledge-sharing sessions on emerging technologies (3.46 lakh candidates); Blockchain courses are offered SWAYAM Portal of Ministry of Education |

| March | Parliament Q&A (Lok Sabha) | MPS T.R.V.S. Ramesh, Sridhar Kotagiri, B.B Patil, Sanjay Kaka Patil asked:

(a) whether the RBI has proposed any mechanism for trading of crypto assets (b) whether the Government proposes to define cryptocurrencies as securities /financial instruments & details of the steps taken to formulate transparent/regulatory measures for digital currencies/cryptocurrencies rather than the intended banning with details. Answer by Minister of State for Finance, Pankaj Chaudhary: (a) No Sir. (b) Cryptocurrency sector is unregulated. RBI has been cautioning users, holders and traders of Virtual Currencies(VCs) on risk associated via public notices on: 24 December 2013, 1 February 2017, 5 December 2017 RBI vide its circular dated 31 May 2021 advised due diligence with regulations governing standards for Know Your Customer (KYC), Anti-Money Laundering (AML), Combating of Financing of Terrorism (CFT), obligations under Prevention of Money Laundering Act (PMLA), 2002, etc. |

| March | Parliament Q&A (Lok Sabha) | MP Karti P. Chidambaram asked:

(a) current legal status of cryptocurrency in India. (b) infrastructure costs incurred in mining cryptocurrencies/treated as cost of acquisition and are therefore permissible deductions (c) while losses incurred due to the transfer of virtual digital assets cannot be set off against any other income, whether the losses arising from the sale of one virtual digital asset can be set off against the gains arising from another virtual digital asset; and/details. Answer by Minister of State for Finance, Pankaj Chaudhary: (a) Cryptocurrencies are unregulated in India. (b) Finance Bill, 2022 (the Bill) has proposed to insert section 115BBH to the Income-tax Act,1961 (the Act) to provide for taxation of income from transfer of virtual digital assets (VDA). As per the proposed section, any income from transfer of VDA shall be taxed at the rate of 30%. (c) As per the provisions of the proposed section 115BBH to the Income-tax Act,1961 (the Act), loss from the transfer of VDA will not be allowed to be set off against the income arising from transfer of another VDA. |

| March | Parliament Q&A (Lok Sabha) | MP Feroze Varun Gandhi asked:

(a) Government assessment the increase in demand for energy from the mining of digital currencies including cryptocurrencies. (b) demand for power from mining is expected to grow in the current year/details (c) Government is adequately equipped to meet this increased demand Answer by Minister for Power and New & Renewable Energy, R.K. Singh: (a) The Central Electricity Authority (CEA) conducts Electric Power Survey (EPS) of the country every five years for estimating the electricity demand of the country on medium and long term basis as obligated under Section 73(a) of the Electricity Act-2003. (b) The demand for energy from mining of the digital currencies including cryptocurrencies is less than the projected demand. |

| March | Parliament Q&A (Lok Sabha) | Question by MP Rattan Lal Kataria:

(a) Policy to check the attempts to mislead the youth through exaggerated promises and non-transparent advertisements on investing in cryptocurrency. Answer by Minister of State for Finance, Pankaj Chaudhary: (a) The Government and RBI to protect the interest of consumer / investor, cautioning users, holders and traders of cryptocurrency, about the potential economic, financial, operational, legal, customer protection and security-related risks associated in dealing with cryptocurrency. |

| March | Parliament Q&A (Lok Sabha) | Question by MP Rakesh Singh

(a) Government’s awareness on use of cryptocurrency for money laundering by cyber criminals /details thereof (b) Apprehension of money laundering activities in the country (c) Identification people involved in such activities Answer by Minister of State for Finance, Pankaj Chaudhary: (a)&(b) Reports have been received from Law Enforcement Agencies (LEAs) in connection with usage of cryptocurrency by cybercriminals. The Directorate of Enforcement (ED) is investigating seven cases under PMLA, 2002 in which cryptocurrency has been used for Money Laundering. (c) Foreign nationals and their Indian associates have laundered the Proceeds of Crime (PoC) through cryptocurrency accounts at certain exchange platforms, ED has attached PoC amounting to ₹135 crore approx. under PMLA. |

| March | Parliament Q&A (Rajya Sabha) | Question by MP Brij Lal:

(a) whether the Advertising Standards Council of India (ASCI) has proposed a clamp down on the advertisements related to cryptocurrency and NFT (Non-Fungible Token) / Rules followed Answer by Minister for Information and Broadcasting, Anurag Singh Thakur: (a) Advertising Standards Council of India (ASCI) is a non-statutory, non-Governmental organization of the industry. It has informed that a guideline for advertising Virtual Digital Assets and linked services was issued by it on 23 February 2022. |

| March | Parliament Q&A (Rajya Sabha) | Question by MP Sukhendu Sekhar Ray:

(a) Government awareness of a sharp increase in opening cryptocurrency exchanges /advertising of cryptocurrency. Government’s approval on it (b) If not, the action initiated by the Government against such business of cryptocurrency which is not legal tender? Answer by Minister of State for Finance, Pankaj Chaudhary: (a) Government does not maintain data on the opening of cryptocurrency exchanges or advertisements on cryptocurrency. (b) Cryptocurrency sector is currently unregulated in India. |

| March | Parliament Q&A (Rajya Sabha) | Question by MP K.C. Ramamurthy:

(a) Details of costs, be it for printing, storing, distribution, etc., incurred by Government or RBI annually on currency and how much it incurred on the above during the last five years, year-wise; (b) whether digital currency will reduce operational costs, such as printing, distribution, storage, etc. for RBI; and (c) whether RBI will have a centralized service or is it going to allow other financial institutions, including Public Sector Banks, to play their role in digital currency transactions? Answer by Minister of State for Finance, Pankaj Chaudhary: (b) & (c): RBI is currently working towards a phased implementation strategy for the introduction of Central Bank Digital Currency (CBDC) and examining use cases which could be implemented with little or no disruption. Introduction of CBDC has the potential to provide significant benefits. |

| March | Parliament Q&A (Rajya Sabha) | Question by MP Sanjay Singh:

(a) Government is planning to introduce a cryptocurrency that will be regulated by the (RBI)/ details of it. (b) Government is aware that cryptocurrency is unregulated and free from Government intervention (c) Difference between the RBI cryptocurrency and traditional paper currency? Answer by Minister of State for Finance, Pankaj Chaudhary: (b) Currently, cryptocurrencies are unregulated in India. (c) RBI does not issue cryptocurrency. Traditional paper currency is a legal tender and is issued by RBI in terms of provisions of RBI Act, 1994. A digital version of traditional paper currency is called Central Bank Digital Currency (CBDC). |

| April | Parliament Q&A (Lok Sabha) | Question by MP Locket Chatterjee:

(a) Government plans to announce any regulations on Metaverse/Web 3 & details of the same. Answer by Minister of State for Finance, Pankaj Chaudhary: (a) Technologies related to Metaverse/ Web 3.0 are still evolving. Government is cognizant of the emergence of new technologies. Information Technology Act, 2000, covers the technology space. Technology startups working with the government or public service delivery. |

| April | Parliament Q&A (Lok Sabha) | Question by MP Ranjanben Dhananjay Bhatt:

(a) Are crypto/VDA used for drug trafficking and arms smuggling & details of the concrete steps to check it. Answer by Minister of State for Finance, Pankaj Chaudhary: (a) The Narcotics Control Bureau and Central Board of Indirect Taxes and Customs have unearthed the payment of approx. ₹2.2 crore through cryptocurrency in 11 cases linked to drug trafficking. Government is: conducting training for the field officers on cyber and forensic technologies/collection of evidence, regular liasoning with technical expert, coordination with foreign drug law enforcement agencies, assisting states for procuring of equipment including electronic surveillance systems, and setting up of e-surveillance and monitoring systems. |

| July | Parliament Q&A (Lok Sabha) | Question MPs Dr Pritam Gopinathrao Munde, Chandra Sekhar Sahu, Girish Bhalchandra Bapat, Rahul Ramesh Shewale:

(a) Whether Crypto and Non-fungible Tokens (NFTs) are considered as assets. (b) Any proposal to prohibit trading in private Crypto and NFTs. (c) any plans/proposals to regulate the trading in private Crypto and NFTs as well as their possession. Answer by Minister of State for Finance, Pankaj Chaudhary: (a) ‘Crypto’ not defined in the Income-tax Act, 1961, Finance Act, 2022, Section 2 (47A) defines virtual digital assets (VDA). Non-fungible token and any other token of similar nature are included in the definition. (b) Vide notification no. 75/2022 dated 30.06.2022, Central Government specified a token which qualifies to be a VDA, and does not include a non-fungible token whose transfer results in transfer of ownership |

| July | Parliament Q&A (Lok Sabha) | Question by MP Thirumaavalavan Thol:

(a) RBI instructions, circulars, directions, warnings etc. on restricting the issuance, buying, selling, holding and circulation of Cryptocurrency in the last 10 years /details. (b) Whether RBI has registered its concern over the effect of Cryptocurrency on the Indian Economy. (c) RBI recommendation for framing suitable legislation to restrict the flow of Cryptocurrency in India. (d) Government plans to legislate any law restricting the use of Cryptocurrency in India and if so, the time frame fixed for the same Answer by Minister for Finance, Nirmala Sitharaman: (a)RBI has been cautioning users, holders and traders of Virtual Currencies (VCs) public notices on

RBI issued a circular on 6 April 6 2018 prohibiting its regulated entities to deal in virtual currencies (VCs) which was set aside on 4 March 2020. (b) RBI mentioned that cryptocurrencies are not a currency as: Modern currency needs to be issued by the Central Bank / Government De-stabilising effect of cryptocurrency as the valuation of it depends on speculations and expectations unlike fiat currency. (c) to (d): RBI has recommended for framing of legislation on this sector |

| July | Parliament Q&A (Rajya Sabha) | Question by MP Derek O’ Brien

(a) note of the crypto startups exiting Indian markets; (b) details and reasons for the exit of crypto startups/ impact on economy (c) impact of their exit on the Indian economy Answer by Minister of State for Commerce & Industry, Som Parkash: (a) to (c): The Government does not maintain information on the exit of startups. It may be noted that the Reserve Bank of India (RBI) has cautioned users, holders and traders of Virtual Currencies. (b) RBI mentioned that cryptocurrencies are not a currency as: Modern currency needs to be issued by the Central Bank / Government De-stabilising effect of cryptocurrency as the valuation of it depends on speculations and expectations unlike fiat currency. |

| July | Parliament Q&A (Rajya Sabha) | Question by MP Dr Prashanta Nanda:

(a) Government considers ‘Crypto’ and ‘Non-Fungible Tokens’ (NFTs) as assets with reasons Answer by Minister of State for Finance, Pankaj Chaudhary: (a) Crypto’ not defined in the Income-tax Act, 1961, Finance Act, 2022, Section 2 (47A) defines virtual digital assets (VDA). Non fungible token and any other token of similar nature are included in the definition. (b) Vide notification no. 75/2022 dated 30 June 2022, Central Government specified a token which qualifies to be a VDA, and does not include a non-fungible token whose transfer results in transfer of ownership |

| July | Parliament Q&A (Rajya Sabha) | Question by MP Abdul Wahab:

(a) Government wants to exempt cryptocurrency transactions from taxes (b) Current status of the Indian Digital Rupee? Answer by Minister of State for Finance, Pankaj Chaudhary: (a) There is no such proposal under consideration (b) RBI has started the work for a phased implementation on Central Bank Digital Currency (CBDC) in the budget speech 2022-23. |

| August | Parliament Q&A (Raya Sabha) | Question by MP Sushil Kumar Modi

(a) KYC AML compliance on foreign nationals in crypto exchange. (b) Amount received by these crypto exchanges from global capital venture (c) Indian crypto platform used wallet infra of foreign exchange without any agreement (d) exchanges have facilitated foreign users’ request to convert crypto into another by using third party exchanges based overseas and earning commission. Answer by Minister of State for Finance, Pankaj Chaudhary: (a) to (d): Cryptocurrencies are unregulated in India. ED is investigating two cases related to Crypto-currency against WazirX under the provisions of Foreign Exchange Management Act, 1999 (FEMA). Indian Exchanges namely WazirX has allowed foreign users’ request by Binance. |

| August | Parliament Q&A (Rajya Sabha) | Question by MP John Brittas:

(a) Whether Government has taken note of RBI Governor’s statement on cryptocurrency being a threat. (b) policy on cryptocurrency Answer by Minister of State for Finance, Pankaj Chaudhary: (a) to (b): The specific statement referred to in the question is not clear. However, RBI has registered its concern over the adverse effect of Cryptocurrency on the Indian Economy. |

| August | Parliament Q&A (Rajya Sabha) | Question by MPs Niranjan Bishi, Dr Prashanta Nanda:

(a) plans/proposals to prohibit/regulate the possession of and trade in private ‘Crypto’ and ‘Non-Fungible Tokens’ (NFTs) Answer by Minister of State for Finance, Pankaj Chaudhary: (a) legislation for regulation or for banning possession of and trade in such a borderless sector(such as crypto and NFT’s) can be effective only after significant international collaboration. |

| December | Parliament Q&A (Lok Sabha) | Question by MP Bhartruhari Mahtab:

(a) Status of the crypto bill. Time frame for the bill opened for public input. (b) Ministry for regulation of cryptocurrency crypto token/ other virtual digital assets such NFT, Decentralised Applications or dApps, and other blockchain based assets etc. Answer by Minister of State for Finance, Pankaj Chaudhary: (a) Crypto is borderless, legislation on the subject can be effective only with significant international collaboration on evaluation of the risks and benefits and evolution of common taxonomy and standards. (b) Ministry of Finance. |

| December | Parliament Q&A (Lok Sabha) | Question by Dr. Umesh G. Jadhav, Sanganna Amarappa, L.S. Tejasvi Surya, Sha.BRA.DR. Jai Siddeshwar Shivacharya Mahaswamiji:

(a) Features of regulation for VDA/crypto (b) Government plans to forge international cooperation for regulation (c) size of the crypto currency market / number of registered/recognised crypto exchange (d) crypto exchanges which are under investigation for money laundering and tax evasion cases. Answer by Minister of State for Finance, Pankaj Chaudhary: (a) to (c): crypto assets are unregulated, legislation for regulation or for banning can be effective only with significant international collaboration. (d) ED, as on 14 December 2022, seized ₹907.48 crore, three persons arrested, four Prosecution Complaints filed before the Special Court, PMLA |

| December | Parliament Q&A (Rajya Sabha) | Question by MP Vivek K. Tankha:

Government awareness on: (a) Foreign Crypto exchanges operating in the country without any legal registration, policy position of the same. (b) Foreign Crypto exchanges operating in the country without any legal registration, policy position (c) Estimated loss caused due to migration of Crypto investors to offshore exchanges post 1 percent TDS mandate since July 2022, details of remedial steps Answer by Minister of State for Finance, Pankaj Chaudhary: (a) to (c): Government does not register foreign crypto exchanges. Regarding the 1 per cent TDS mandate, the CBDT administers direct tax laws like the Income Tax Act, 1961, Prohibition of Benami Property Transactions Act, 1988, Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act,2015 etc. Under the Income-tax Act, 1961, section 194S (on 1 July 2022) has been inserted through the Finance Act, 2022 for deduction of tax at source in respect of transfer of Virtual Digital Assets(VDAs) 1 July 2022. |

| December | Parliament Q&A (Rajya Sabha) | Question by MP Jose K. Mani:

(a) Lack of regulatory clarity in Crypto is pushing entrepreneurial talent away from India to other Crypto friendly countries (b) Why no clear regulations with respect to Crypto currency. (c) Expansion of Central Bank Digital Currency (CBDC) usage an details Answer by Minister of State for Finance, Pankaj Chaudhary: (a) to (b)any legislation for regulation or for banning can be effective only with significant international collaboration. (c) The CBDC pilots have been introduced in both wholesale and retail segments. Further expansion of the pilots has to be through a phased implementation strategy. |

Disclaimer:

This document/report is solely for information purposes, and is not intended to provide any legal, tax, accounting, or investment advice or recommendations. Users are strongly advised to do their own research (DYOR) before buying, selling, or storing any Crypto or INR on any Crypto platform. Crypto assets and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. Your usage of the CoinSwitch platform shall remain subject to various terms and policies as available on www.coinswitch.co.