CoinSwitch transformed the crypto experience in India by simplifying the process of buying and selling crypto for millions of Indians. Our app provided a user-friendly interface that was highly appreciated by our users. Over 19 million Indians now trust CoinSwitch for their crypto trading.

We understand that simplicity is key, especially for retail users that make up the majority of our user base. Creating wallets, managing seed phrases, and ensuring good security practices can be a demanding task. We recognized the need for a safer and simpler experience for our users and thus employed industry-grade solutions to safely and securely hold our users’ crypto assets.

To demonstrate our robust practices and our commitment to protecting user funds, we published the key findings of an independent Proof of Reserves review on November 17, 2022—making CoinSwitch the first in India to do so. Additionally, we provided users with the ability to verify our holdings by making our wallet addresses public.

We pledged to continue this practice of transparency and trust-building. As part of our ongoing efforts, we are now publishing the second edition of our Proof of Reserves. The latest edition confirms that CoinSwitch holds sufficient crypto assets and fiat balances (Indian Rupees) to cover all user redemptions. The review verifies that we maintain a ratio of 1:1 or higher for both crypto and INR balances. This means that even in extreme scenarios, all CoinSwitch users can fully redeem their assets.

The independent review of our crypto and fiat holdings was conducted by a qualified chartered accountancy firm in accordance with the standards prescribed by the Institute of Chartered Accountants of India (SRS 4400) for the status of cryptos and INR held as on March 31, 2023—the closing day of the financial year. The findings of this report, along with an updated list of our wallet addresses, are being published in this blog.

What’s POR?

- Proof of reserves (POR) establishes transparency and verifiability of a crypto platform’s claimed assets. This is achieved through an independent review and on-chain validation.

- The independent reviewer verifies the platform’s crypto and fiat holdings (Indian Rupees) and compares them with users’ assets and balances.

- A ratio of 1:1 or higher means the platform holds all user assets and fiat balances, allowing users to redeem or withdraw them at any time.

- CoinSwitch commissioned a qualified firm to conduct our second POR. The independent review was carried out on March 31, 2023.

- The POR aligns with the end of the financial year and adheres to the standards prescribed by the Institute of Chartered Accountants of India (SRS 4400).

- To confirm the findings, users can cross-reference our wallet addresses shared in this blog post using blockchain explorers.

Holdings Ratio of 1:1 or More

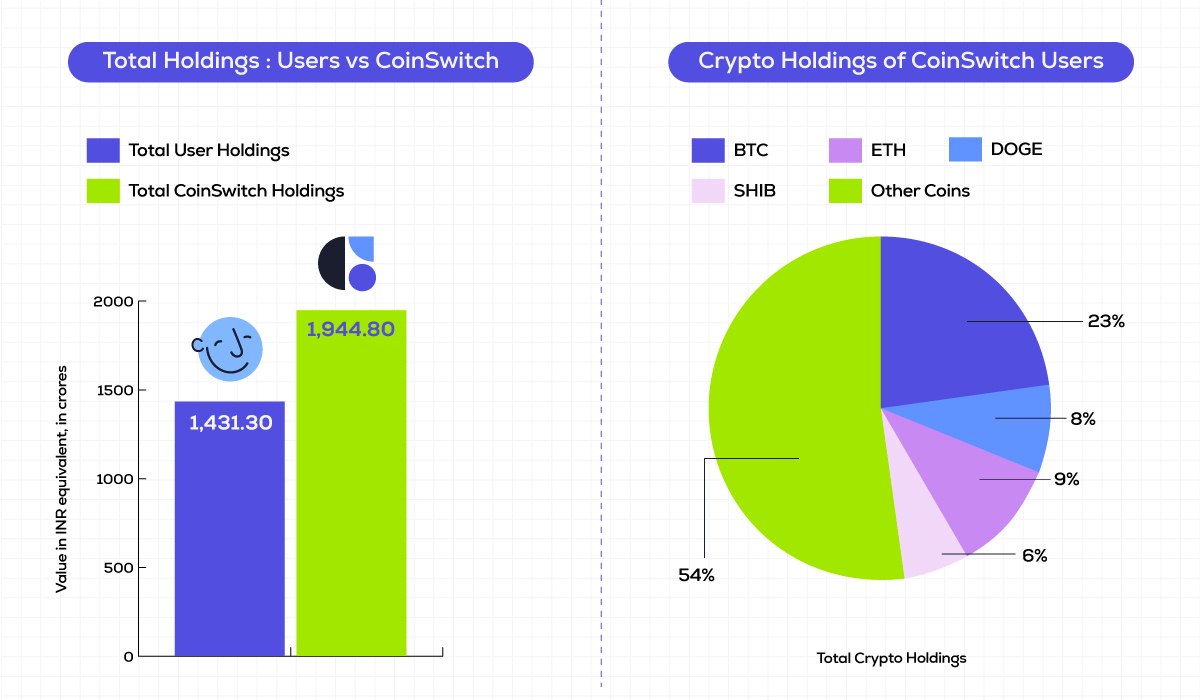

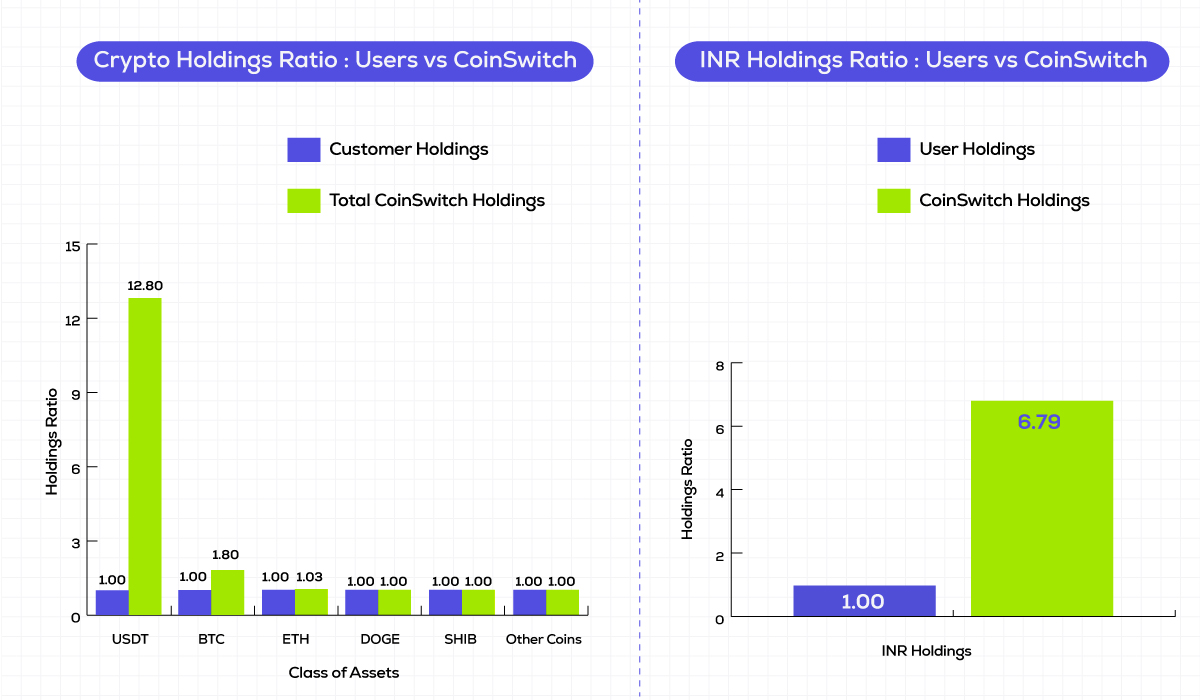

- CoinSwitch’s total holdings are greater than its users’. The INR value of the total holdings, including crypto and fiat, of the users is Rs 1431.30 crore; the INR value of the total holdings of CoinSwitch, including crypto and fiat, is Rs 1944.8 crore.

- That is, CoinSwitch maintains a holdings ratio of 1:1 or more. This ratio is even higher in some cases: For USDT, the ratio is 12.8:1; for BTC, it is 1.8:1; and for ETH, it is 1.03:1. The higher ratio is on account of CoinSwitch’s own assets.

- CoinSwitch’s cash and cash equivalent balance is 6.79 times the INR balance of its users. The higher ratio is on account of CoinSwitch’s own INR balance.

.

No Blind Spots: Our CEO Answers All Your Questions

Q. Could you give a summary of the POR review?

Ashish Singhal: Proof of Reserves or POR is a process to verify that a crypto platform holds the assets it claims to. It establishes transparency and gives users the confidence that the platform can be trusted.

This is CoinSwitch’s second such POR review. The review was carried out as per the standards prescribed by the Institute of Chartered Accountants of India (SRS 4400) for the status of cryptos and INR held as on March 31, 2023, which is the closing day of the financial year 2022–23.

The review found that CoinSwitch’s total holdings are valued at Rs 1,944.8 crore, higher than the value of our user holdings, Rs 1,431.30 crore. Further, CoinSwitch’s cash and cash equivalent balance is 6.79 times the INR balance of our users.

This is to say, every crypto that a user has bought on our platform is fully accounted for and can be redeemed, that is sold, at any time. And every rupee that a user has kept with us is fully accounted for and can be withdrawn anytime.

As you can see, our holdings ratio is much greater than 1:1. Which means, CoinSwitch holds significantly more assets and cash than those of our users in our custody.

Q. What are the exchanges that CoinSwitch work with? Are user assets held in them?

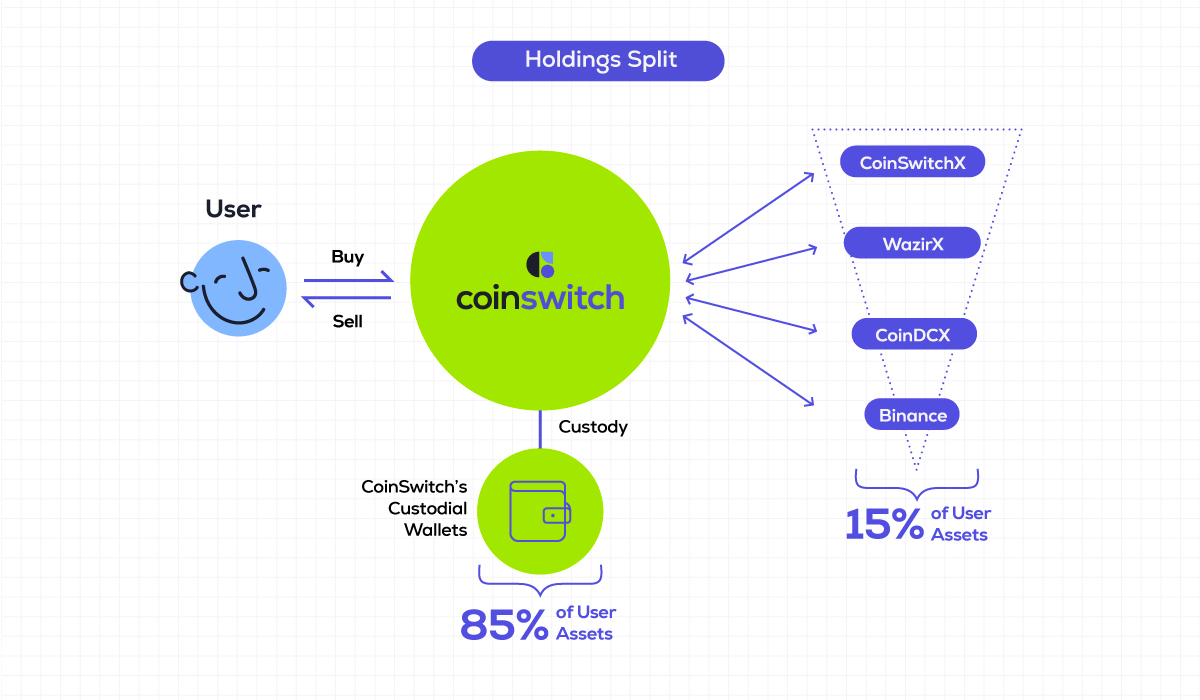

Ashish: CoinSwitch is an exchange aggregator. That is, CoinSwitch pools liquidity from multiple exchanges to provide users with a seamless experience to buy and sell crypto in Indian Rupees. On CoinSwitch PRO, users can select from multiple exchanges to make a trade, as well as trade across them to make use of the arbitrage opportunities.

The exchanges we work with include CoinSwitchX, WazirX, CoinDCX, and Binance. On CoinSwitch PRO, our users can choose between CoinSwitchX and WazirX, and trade across them.

As far as asset holdings are concerned, as a best practice, we hold nearly 85% of the crypto assets on custodial wallets; only the remaining is held on the exchanges to execute fast trades. The custodial wallets we use are provided by institutions of international repute, and access to these wallets is stringently managed through multi-party computation.

Further, the assets held on exchanges are majorly concentrated on CoinSwitchX, and less on other third-party exchanges. This allows us to maximize our ability to execute transactions in real-time and minimize counterparty risk.

Q. Can a user independently verify the findings of the report?

Ashish: Yes. CoinSwitch’s POR report brings together the reliability of proven standards and the transparency of blockchain technology. Alongside the review of our holdings, we are also making public our wallet addresses. While our wallet addresses have been public since January 2023, we have refreshed this list in this blog. The assets held in these wallets can be verified using blockchain explorers, giving users an up-to-date view of the holdings.

Q. Are there any liabilities on users’ assets?

Ashish: No, there are none. We do not reinvest or leverage our users’ assets. The assets of our users are theirs; not ours to be considered in our balance sheet. CoinSwitch simply holds on them on their behalf to simplify their crypto experience. Users can redeem their assets at any time of their choosing.

Wallet Addresses and Latest Crypto Holdings

The addresses of our major wallets are provided below. CoinSwitch’s total crypto holdings, including user and company assets, at the time of publishing this blog, i.e. July 26, 2023, 24:00 hours IST, is Rs 1419.35 crore. Of this, the assets held on the wallets listed below, as of July 26, 2023, 24:00 hours IST, is ₹1174.73 crore.

At the time of evaluation (July 26, 24:00) this accounted for approximately 83% of all user assets in our custody. The remaining are held on exchanges, and the value of these assets is ₹244.62 crore.

- Total value of crypto assets on custodial wallets (July 26, 24:00): ₹1174.73 crore.

- Total value of crypto assets on exchanges: ₹244.62 crore.

Full POR Report

Download the full POR Report