Regulations are like water. It takes the shape of its surroundings. India’s nascent but promising crypto industry is all too familiar with this. The Union Budget (the Finance Act 2022), for the first time, Virtual Digital Assets (VDA) and the taxes applicable to them. At the outset, clarity on the taxes should have brought greater transparency in crypto. The real-world impact, however, narrates a different story.

But first, let’s recap. Last year, the union government imposed a 30% tax on gains from the transfer of virtual digital assets. There was no provision to offset any loss or carry forward it to the next financial year. Further, it levied a tax deducted at source (TDS) at the rate of 1% on every sell transaction over a certain threshold (₹10,000 for individuals and ₹50,000 for specified persons). The tax provisions came into effect on 1 April 2022, and TDS on 1 July 2022.

While welcoming the clarity in defining and taxing VDA, CoinSwitch had flagged the high TDS and the lack of offset or carry forward—provisions applicable in other asset classes—as a possible challenge to compliance. A year since, data on the impact of these taxes, and the TDS in particular, show they have had the unintended consequence of incentivizing non-compliance and driving crypto transactions away from KYC-compliant, India-registered platforms to offshore entities and the grey market.

This is so as the TDS has a compound effect on the liquidity in the crypto market. Applicable at every sell transaction, it locks up 1% of the capital available to high-frequency traders at every transaction. This dries up the capital available to such traders, who are the source of liquidity in the market. As it turned out, investors shifted their transactions outside the tax-compliant platforms to preserve their capital and commercial activity.

Unintended Consequences

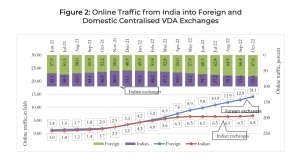

This flight to foreign exchanges was first documented by a Bloomberg article published in September 2022. The report relied on data on app downloads on Google Play Store and Apple Store to draw a comparison of India’s tax-compliant exchanges against foreign exchanges.

A more comprehensive study of the impact of the TDS on the Indian crypto industry was published this January by the Esya Centre, in collaboration with Taxsutra. The key findings of this study are as follows:

- Between February 2022 and October 2022, cumulative trade volume worth around $3,852 million (₹32,000 crore) shifted from Indian centralized VDA exchanges to foreign exchanges.

- Between July 2022 and October 2022, the total trade volume contributed by Indians on foreign centralized VDA exchanges was to the tune of $9,670 million (₹80,000 crore).

To address this, the Esya report put forth the following recommendations:

- The government should consider lowering the TDS rate to curb its distortionary effect.

- The government to gather hard evidence on the optimal tax rate for the VDA market.

- The government should resort to a progressive tax structure with differentiated rates for short-term and long-term gains akin to international best practices.

- And finally, the government should enhance international coordination and institutional oversight of VDA exchanges.

The impact of the TDS was also highlighted by other credible Indian publications through articles and opinion pieces such as: “An impractical impost” and “Impact Of 30% Tax On Crypto Assets A Year On, And Industry’s Expectations From Budget 2023”.

Brain Drain

A more recent industry report by Chase India and IndusLaw took a slightly different approach to study the impact of TDS, providing a stakeholder-driven perspective on the matter. The report specifically looks at the impact of high TDS on the government, the industry, and the investors. The high TDS has had a material impact on the country’s startup ecosystem and investor sentiments beyond just the drop in trading volume, the report found.

The flight of users to foreign exchanges has effectively made the domestic crypto industry less conducive for innovation, the report finds, causing a brain drain of the nation’s best minds in the sector to countries deemed friendlier to crypto and Web3. A recent NASSCOM report, too, had called out this long-tail impact; nearly 300 Indian Web3 Indian startups had moved their operations outside India, it said.

Besides being a setback to Ease of Doing Business, every startup lost to a foreign shore is a hit to India’s tech-driven growth story … and its ambition to shape the next ‘techade‘.

All is not lost, however. These reports and representations the crypto industry has made to the government, including those by CoinSwitch, are aimed at providing the authorities with a broader view of the ecosystem and the impact the TDS has had on them. Our Chief Financial Officer (CFO), Ramesh Bafna, led a delegation of the Bharat Web3 Association (BWA) that briefed the Ministry of Finance on the concerns and issues being faced by the industry and users, as well as shared the data regarding the impact of the TDS on the sector.

The meeting itself was a result of several notes, documents, and representations submitted to the government over the last year. Ramesh had also articulated these points at a pre-budget panel discussion hosted by Taxsutra; he penned down his thoughts on tailoring the crypto tax to India’s needs in a recently-published article.

CoinSwitch’s Public Policy Head R. Venkatesh and CFO Ramesh Bafna also shared their expertise at an online knowledge-sharing session, called “Series on new Facets of Income Tax – III – Crypto Currency”, hosted by The National Academy of Direct Taxes (NADT), Ahmedabad. In the session, they walked the Academy graduates through blockchain and VDAs, as well as the promise of the technology and how India can shape its future.

Way Forward

Provided a conducive regulatory environment, Indian crypto startups can grow and take the lead in shaping this cutting-edge technology. The hope is the government would refine the taxes on crypto during the Union Budget 2023 so that it enables compliance—as against driving users to the grey market.

But regulatory clarity should go beyond taxes, Chase India and Indus Law recommend several measures that would help establish a responsible and trustworthy crypto ecosystem in India:

- Whitelisting Tax-compliant Exchanges: The government could create a directory of ‘valid’ exchanges that follow the tax norms and create a regulatory mechanism to “whitelist” such entities. Such a whitelist can guide investors as well as help other government agencies.

- Making KYC Mechanism Mandatory: The government must issue a notification to all exchanges/platforms to conduct a detailed e-KYC authentication on all investors/traders in line with the rules mentioned in Aadhaar (Authentication and Offline Verification) Regulations, 2021.

- Customer Due Diligence: The platforms/exchanges must also perform customer due diligence to collect and evaluate relevant information about a customer or potential customer. This also finds a mention in the FATF Guidelines.

- Self-Regulatory Organization (SRO): An SRO to be set up to protect the customer and promote ethical and professional standards amongst the exchanges. The SRO will require a group of stakeholders across sectors, and at least one-third of members on the Board of Directors should be independent and not associated with member organizations.

- Building awareness: The industry participants and experts should educate authorities and investors on the implications of non-adherence of VDA-based TDS by certain grey market players. Awareness should incorporate the drawbacks and showcase the cascading impact that both the state and the investors would undergo if the current non-compliance persisted.