A recent peer review of Financial Stability Board’s Crypto Framework shows significant gaps and inconsistencies in implementation of regulations, highlighting the need for jurisdictions to do more to reach full and consistent implementation.

The Financial Stability Board, an international financial watchdog, published its global regulatory framework for cryptoasset activities in July 2023. This framework consists of high-level recommendations for the regulation, supervision and oversight of crypto-asset markets and activities (CA recommendations) and global stablecoin arrangements (GSC recommendations).

During India’s G20 Presidency, leaders endorsed the recommendations and asked the FSB and other standard setting bodies to “promote the effective and timely implementation of these recommendations in a consistent manner globally to avoid regulatory arbitrage.”

Over the last two years, both the cryptoasset markets and regulations have evolved rapidly. A recent peer review of FSB’s regulatory framework, however, reveals significant gaps and inconsistencies in the implementation of the recommendations by jurisdictions.

This blog captures key observations of the peer review to evaluate progress in implementing the FSB’s global framework, including recommendations on cryptoasset service providers and stablecoin arrangements, data reporting and collection, and cross-border cooperation and coordination. The review report was released during the G20 Finance Ministers and Central Bank Governors’ meeting in Washington DC on October 16, 2025.

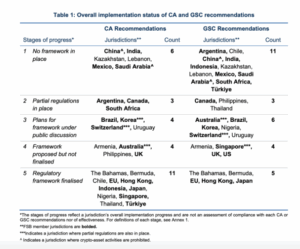

Overall status of implementation of the cryptoasset and global stablecoin arrangements recommendations in India is tagged as stage 1 in the report, meaning ‘No framework in place’. The report, however, adds that the Government of India is “examining policy approaches” to implement the recommendations.

Implementation of Cryptoasset Recommendations

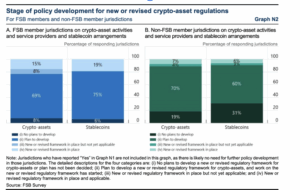

Most jurisdictions participating in this review have taken steps to regulate cryptoasset activities, with an increasing number prioritising financial stability alongside other risks such as financial integrity, consumer protection, and market integrity.

To date, 11 jurisdictions (39%) in the review have finalised a regulatory framework for cryptoassets that addresses financial stability, while eight jurisdictions (29%) are in process of consulting on or finalising frameworks. Three jurisdictions (11%) have a framework that partially addresses financial stability risks, while six jurisdictions (21%) remain at an early stage, with no comprehensive frameworks in place or publicly announced plans.

Jurisdictions have broadly adopted two approaches to regulate financial stability risks of cryptoasset activities, reflecting the different legal frameworks, regulatory powers, and policy priorities. The first approach extends existing financial regulations to encompass cryptoassets (Argentina, Australia, Canada, Hong Kong, Japan, Nigeria, Singapore, South Africa, Switzerland, and Türkiye), aligning oversight of new entities (e.g., CASPs) and activities (e.g., cryptoassets) with traditional financial regulatory frameworks.

On the other hand, the second approach introduces bespoke regulatory frameworks tailored to the unique characteristics of cryptoassets, addressing areas such as prudential safeguards, governance, and risk-based supervision (Armenia, Bermuda, The Bahamas, Chile, the EU, Indonesia, the Philippines, and Thailand).

Enforcement is a critical aspect of effective crypto-asset regulation. Jurisdictions can generally be grouped into three categories based on the comprehensiveness of their enforcement tools: Comprehensive Enforcement Frameworks, Partial Frameworks with Gaps, and Minimal or Undefined Frameworks.

Implementation of the Global Stablecoin Arrangements recommendations

Progress in the implementation of comprehensive regulatory frameworks for global stablecoin arrangements remains uneven and slower compared to the cryptoasset recommendations. To date, five jurisdictions (21%) reported having a finalised regulatory framework for stablecoins, compared to 11 (39%) for cryptoassets. However, 10 jurisdictions (34%) are in the process of consulting on or finalising GSC frameworks, suggesting significant progress may be made in the coming year or two, while three jurisdictions (10%) have partial regulations in place and eleven (38%) remain at an early stage with no framework.

Jurisdictions exhibit varying approaches and stages in regulating stablecoin issuers and their arrangements. Some jurisdictions have implemented, or are in the process of implementing, specific regulatory frameworks tailored to stablecoins, including Armenia, The Bahamas, Bermuda, the European Union, Hong Kong, Japan, Singapore, and the US.

Others, such as Australia, Canada, Chile, Mexico and Uruguay classify stablecoins under existing financial product laws but apply different approaches: Australia, in certain cases, treats stablecoins as financial products, such as non-cash payment facilities or derivatives; Canada primarily classifies them as securities or derivatives; Chile, Mexico and Uruguay consider them as payment instruments under existing regime but the specific stablecoin regulation has yet to be drafted in such countries.

A group of jurisdictions, including Argentina, Nigeria, South Africa, and Türkiye, apply the same rules as other cryptoassets to stablecoins, while South Africa primarily regulates them from the AML/CFT perspective. Meanwhile, another group of jurisdictions, including Argentina, India, Indonesia, and Kazakhstan have no specific framework or approach in place.

By end-2025, a majority of FSB members expect to reach alignment with the CA and GSC recommendations (62% and 50%, respectively); by end-2026, 70% of members expect to align both frameworks. However, some FSB members have yet to commit a date to reach alignment with the CA and GSC recommendations (24% and 20% respectively).

Recommendations

Based on the findings there are eight recommendations, which are addressed to jurisdictions as they develop their regulatory regimes, and to the Financial Stability Board, standard setting bodies, and international organisations as they consider further work on the subject.

- Jurisdictions should review their current plans to ensure that, when implemented, they will amount to full implementation of the FSB Crypto Framework. They should also prioritise their implementation of the FSB Crypto Framework given the rapid pace of developments in the crypto-asset markets, drawing reference from the good practices identified in the peer review report to monitor and safeguard global financial stability.

- The FSB, as well as the other SSBs and international organisations, should continue to promote comprehensive and aligned implementation of the FSB Crypto Framework, including by engaging with jurisdictions beyond the FSB membership, particularly those not covered in this review, in which implementation progress remains unknown.

- Jurisdictions that have implemented or are currently developing a regulatory framework for CASPs should close any identified gaps, based on a comprehensive gap analysis or other appropriate assessment against the FSB’s 2023 CA recommendations, in particular regarding CASP activities that give rise to financial stability risks and implement the supervisory reporting requirements that are relevant in their jurisdiction.

- Jurisdictions that have implemented or are currently developing a regulatory framework for GSCs should close any identified gaps, based on a comprehensive gap analysis or other appropriate assessment against the 2023 GSC recommendations, in particular requirements for liquidity risk management, capital buffers, stress testing, user redemption, custody of and eligibility for the reserve of assets, and recovery and resolution planning (including insolvency frameworks).

- Jurisdictions should improve their data capabilities and infrastructure to be able to monitor financial stability risks within the crypto-asset market and between the crypto-asset market and traditional financial markets, including by leveraging regulatory and supervisory reporting from CASPs, stablecoin issuers, and other market participants to close data gaps.

- In the course of its further work, and as appropriate, the FSB should work closely with the SSBs and international organisations to consider ways to promote further alignment of regulatory approaches and frameworks for stablecoin arrangements, including through information sharing to facilitate capacity building, as well as analysis of the vulnerabilities stemming from GSCs with multi-jurisdictional issuances.

- At the appropriate time, jurisdictions should conduct an assessment of the scale and nature of cross-border crypto-asset activities into and out of their jurisdictions. Based on this assessment, jurisdictions should utilise existing tools available to engage in cross-border cooperation, develop (as needed) bilateral and multilateral arrangements to ensure pro-active cross-sectoral and cross-border cooperation, and consider if any additional tools for cooperation across borders might be needed to deal with the corresponding cross-border risks.

- In the course of its further work, the FSB, as well as relevant SSBs, should consider potential best practices and solutions to fully implement CA and GSC recommendation 3 and to address the challenges identified in this report and promote the wider adoption of those best practices and solutions to achieve more effective cross-border cooperation and coordination.

The full report can be accessed here.