I. Introduction

There is no doubt that traders can benefit from studying chart patterns. There are many patterns one could observe, but one of the important ones everyone—whether you’re a beginner or a pro trader—should learn to spot is the symmetrical triangle pattern. So, if you are new to trading or want to upgrade your trading skills and success rate, you should consider mastering this one.

A. A brief overview of the importance of patterns in financial trading

The symmetrical triangle chart pattern is a widely used chart pattern in trading. It is primarily a subcategory of the triangle pattern in trading. Like the triangle pattern, this pattern also plays a crucial role in predicting the future price movement of the stocks/shares.

B. Introducing the symmetrical triangle pattern as a powerful tool

The symmetrical triangle pattern is one of the most popular chart patterns traders use to make trading decisions. Most experts recognize that a symmetrical triangle chart pattern is a powerful tool while studying financial markets; it plays a vital role in guiding trading decisions. As a result, mastering this pattern can effectively improve your trading approach and chances of success.

II. Understanding the symmetrical triangle pattern

If you are looking forward to mastering the symmetrical triangle pattern, you must develop a basic understanding of how the chart pattern looks and how it works. The symmetrical triangle is also known as a coil, for its formation of trend lines that create a narrowing slope pattern that resembles triangles.

A. Definition and basic characteristics

The symmetrical triangle is a part of the technical analysis technique of predicting market movements. It is used to spot price breakouts and changes in trends. It comprises two trend lines converging, in which one represents the highs and the other represents the lows of an asset price.

B. Visual representation through charts

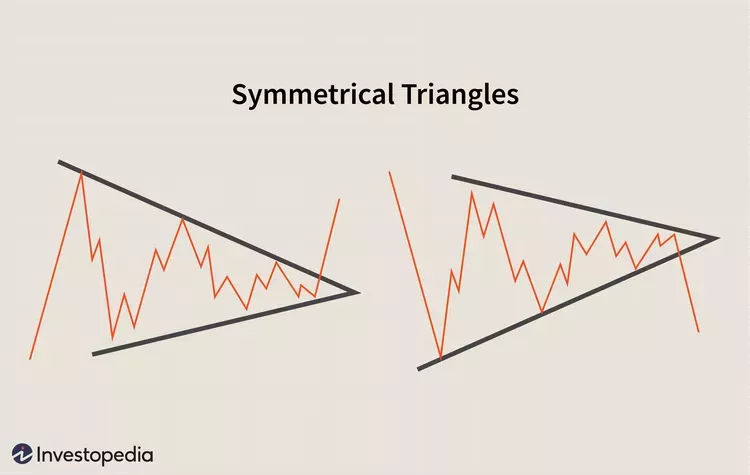

On the chart, the symmetrical triangle pattern is seen as a triangle formed by two converging trendlines. The upper trendline connects the falling tops, while the lower trendline connects the rising bottoms. This formation embodies a form of equilibrium between bulls and bears as the pattern tightens. It signals a forthcoming significant price movement.

C. Significance of trendlines and converging support/resistance

The symmetrical triangle pattern contains two trend lines that are converging. It indicates a period of consolidation before a possible breakout or breakdown. The trend lines signify the ups and downs of the asset price. The trend lines meet at a point that forms a symmetrical triangle. The lower trend line indicates possible downside breakouts. On the other hand, the high trend line indicates possible upside breakouts, helping traders implement stop-loss or support/resistance actions.

This triangular chart pattern is like pennants and flags, which also signal a continuation in price trends. However, a sudden shift usually occurs before flag and pennant forms. Symmetrical triangles don’t require this type of prior movement.

III. How to identify a symmetrical triangle

Identifying a symmetrical triangle pattern is quite simple. Here are some common ways you can identify symmetrical triangle chart patterns.

A. Highlight key elements to look for

You can easily identify a symmetrical triangle chart pattern by locating some of the key elements of this chart pattern. These key elements include:

• The pattern forms through the convergence of two trend lines.

• One line indicates peaks of the asset’s price

• Another trend line indicates the lows of the asset price

• The intersection of these two trend lines forms a triangular shape.

In addition to this, indicating indecision in the market, volumes tend to drop as the pattern develops. A significant drop in trading volume can thus be a crucial sign that a symmetrical triangle is forming.

B. Real-world example for clarity

The real-world examples always provide better insights into the triangle pattern. So, here is one for you.

This is the triangle pattern of the Northwest Bancshares (NWBI)’s trading chart. As shown in this example, a symmetrical triangle means that the market is going into a typical consolidation phase prior to moving strongly in one direction or another. The expected price movement is equal to the vertical height of the triangle added (in the case of an upward breakout) or deducted (for a downward break) from its apex.

For an upward breakout at $17.20, the price target should be $19.02 ($17.20 + bearish change). Support and safety on any upward breakout should be to place the stop-loss just below breakout point: at $16.40 so as not to let false breaks or reversals stir up trouble. For a lower limit the end object should be put at maybe only half an inch higher than that. It is associated with either recent resistance or breakdown points: say at $17.20 to limit losses if somehow price reverses.

C. Avoiding common mistakes

● One of the common mistakes to avoid while using this pattern is placing the stop-loss order below the support line or above the resistance line.

● When stock price breaks out, chasing it with a big candlestick is another common mistake that must be avoided.

IV. Decoding market sentiment with symmetrical triangles

A symmetrical triangle pattern is a great tool in technical analysis that helps to analyze market sentiment with the help of historical data. Here are a few ways symmetrical triangles decode market sentiments.

A. Analyzing the psychology behind the pattern

The symmetrical triangle pattern is highly dependent on market sentiment. So, understanding the psychology behind the pattern is essential to utilizing it for your decision-making. If you can analyze the market psychology behind the pattern, you can easily avoid false breakouts and risks associated with it.

B. Differentiating between bullish and bearish scenarios

Symmetrical triangle patterns can be further subcategorized into bullish and bearish patterns. The bullish pattern reflects bullish market sentiment, while the bearish pattern indicates a bearish market sentiment. A breakout from the upper trend line indicates the beginning of the bullish symmetrical triangle pattern, while a breakdown from the lower trend line can indicate the start of a bearish scenario.

C. Recognizing potential breakout points

The breakout is a critical point in a symmetrical triangle pattern to note. It usually occurs when the price of a stock breaks out forcefully and completely out of the upper trend line or resistance line or opposite the lower resistance line or trend line. The first instance is called a breakout and the other is called a breakdown, indicating a particular market sentiment associated with the stock price.

V. Strategies for trading with symmetrical triangles

Symmetrical triangle patterns are great analytical tools for both traders and sellers to identify the right equilibrium of price movement. Here are some trading strategies that use symmetrical triangle chart patterns.

A. Entry and exit points

The entry and exit points are one of the most popular strategies that you can use to reap profits from a symmetrical triangle pattern in trading. For both bullish and bearish patterns implementing entry and exit points helps mitigate risks and limit your loss. Setting entry and exit points for your symmetrical triangles is quite beneficial as you can easily enter and exit from the market when the market situation meets your needs.

B. Setting stop-loss and take-profit levels

Another essential strategy you should consider while implementing a symmetrical triangle pattern is stop-loss and take-profit levels. Setting up stop-loss and take-profit levels is essential to mitigate the risk associated with false breakouts. When you apply this strategy you can set levels for your loss and profits, allowing yourself to protect your investment portfolio from any greater risk.

C. Risk management tips for a successful trading plan

The symmetrical triangle pattern is a very useful pattern to note in the stock trading market. However, there are several risks associated with this pattern. To mitigate the risks associated with symmetrical triangle chart patterns, be patient and make sure you can distinguish the pattern from other similar-looking patterns. Also, invest time in learning about the pattern and observe historical data to execute successful trades.

VI. Common pitfalls and how to avoid them

Like any other technical analysis pattern, the symmetrical triangle chart pattern also includes several drawbacks or pitfalls. However, taking appropriate precautionary measures can help you benefit from the pattern while reducing risk.

A. Discussion on risks associated with trading patterns

There are several risks associated with symmetrical triangle chart patterns, such as:

• It takes a lot of time to identify and implement symmetrical triangle patterns.

• The patterns tend to overlap sometimes, making pattern detection harder.

• This pattern is also subject to market volatility and is highly dependent on market sentiment.

• It can also indicate false breakouts that can lead to losses.

B. Tips to mitigate potential losses

However, you can take several precautionary steps to minimize the potential risks associated with this pattern. Some such steps include:

• Implication of entry and exit points.

• Apply stop-loss and take-profit levels.

• Use professional advice for pattern identification.

• Backtest the pattern before making any decision.

• Equip yourself with all essential knowledge about the pattern before implementing any decisions based on it.

VII. Tools and resources for analyzing symmetrical triangles

There are various tools and resources available to help you analyze symmetrical triangles. Learning about them is essential before moving toward implementation.

A. Introduction to charting platforms

Symmetrical triangle patterns are very helpful when it comes to identifying market price movements. You can use them to your advantage by incorporating charting platforms that enable trading through charts. Nowadays, various popular and reliable charting platforms come with pre-built pattern detection, trading action suggestions, and more.

B. Recommended reading and educational materials

You can also enhance your knowledge about symmetrical triangle patterns and how to implement decisions based on these patterns successfully through reading. There is a wide range of open-source reading materials on symmetrical triangle patterns. Also, there are a couple of trusted newsletters, such as Switch Weekly, which share information about patterns to enhance your knowledge.

VIII. Conclusion: Closing thoughts on the journey to financial success and a call to action

The primary feature of a symmetrical triangle chart pattern, as we have seen, is that it always comprises two trend lines converging and forming a triangular shape. You can implement stop-loss and take-profit levels, and entry and exit points to mitigate risks.

This pattern is one of the most popular and helpful chart patterns for traders and investors. It is a widely used pattern and can upgrade your trading approach and increase your success rate. It marks a consolidation phase before a breakout/breakdown.

The symmetrical triangle pattern is a very powerful tool. However, it is also relatively complex and intricate when it comes to distinguishing it from similar chart patterns. It would be wise to practise your identification skills with a historical chart.

Financial success through trading is not easy. You can only ensure profit when you correctly and properly implement this chart pattern and successfully mitigate risks associated with it. Remember, patience is the key to excelling with this pattern.

FAQs

Is the symmetrical triangle pattern bullish or bearish?

The symmetrical triangle reflects a period of indecision and consolidation. Thus, the pattern cannot be predetermined as bullish or bearish.

How do you trade a symmetrical triangle?

When a stock price breaches the symmetrical triangle’s trend lines, a breakout occurs. Traders enter a position in the direction of the breakout. This helps them anticipate a breakout.

What is the symmetrical triangle in RSI?

The RSI (Relative Strength Index) along with the symmetrical triangle pattern is used by traders to analyze the strength of a specific trend.