Introduction

In the fast world of financial markets, it is important to understand market sentiment to succeed. And crypto trading is known for being particularly unpredictable. Crypto traders thus need all the tools they can find to handle price changes. The Long Short Ratio comes from trading volume. This number helps show how market participants are acting together. By looking at this ratio, traders can better understand market sentiment and make smarter trading decisions.

Understanding the basics of Long Short Ratio in crypto trading

The Long/Short Ratio is a useful tool for traders who want to understand the mood of the crypto market. It shows if more people think the price of crypto will go up or down soon. This ratio is especially important in futures trading, where traders make decisions based on what they believe will happen to prices.

Using this information can help traders plan their strategies according to the market feel. This could lower risks and increase possible profits. However, it should not be the only method used for figuring out market direction. It works best when combined with other technical indicators and fundamental analysis.

Defining the Long Short Ratio

The Long/Short Ratio is found by dividing the total number of open long contracts by the total number of open short contracts. If this ratio is over 1, it means more traders are in long positions. This shows a positive market feeling. If the ratio is under 1, it shows more open short positions, indicating a negative market feeling.

When the Long/Short Ratio increases, especially with rising prices, it hints at a stronger uptrend. This could mean new money is coming into the market, possibly pushing prices higher. On the flip side, if the ratio decreases while prices are rising, it might suggest a weakening trend. This can occur during a short squeeze, where traders need to cover their positions.

Traders use this ratio to understand the balance of positive and negative sentiment in the market. This helps them predict price changes. However, this ratio should be interpreted carefully. It should be checked alongside other indicators for a better view of the market.

Read More: What is Long Short Ratio In Crypto Futures Trading?

The role of long and short positions in crypto futures

In crypto futures trading, traders make deals to buy or sell an asset at a certain price on a date in the future. If a trader thinks the price of a crypto will go up, they take a long position. This means they agree to buy the asset at a chosen price later.

If a trader expects the price to go down, they take a short position. They agree to sell the asset at a fixed price in the future. The profit or loss for the trader comes from the difference between the future price and the set price they agreed on.

The Long/Short Ratio helps us understand how traders feel about the market. It shows which way they think the price will change. However, we should not look at this ratio alone. It’s important to think about other factors, such as trading volume and general market trends, to make good trading decisions.

The importance of Long Short Ratio for crypto traders

The Long/Short Ratio is not just a figure; it shows the mood of the market. By looking at the ratio, investors can see if the market feels positive or negative about a specific crypto.

This helps them plan their trades. For example, if the ratio shows strong optimism, traders may take long positions. But if it shows pessimism, traders might choose to go short.

Predicting market movements with Long Short Ratio

The Long/Short Ratio cannot predict market movements exactly. However, it is a useful tool when used with other types of analysis. For example, if the ratio rises with increasing trading volume and prices are going up, it shows a strong bullish trend in the market. This situation usually brings in more buyers, which helps push prices even higher.

On the other hand, when the ratio goes down along with falling prices and lower trading volume, it often means the trend is getting weaker. This can lead to a downward trend where traders might sell off their positions, making prices drop more.

It’s important to keep in mind that the crypto market can be affected by many things apart from the Long/Short Ratio. News stories, changes in regulations, and overall market sentiment can all play a big role in price action. Therefore, it’s best to look at the entire market picture when analyzing trends.

How the Long Short Ratio reflects market sentiment

The Long/Short Ratio shows what’s happening in the market. It reveals the trading choices of market participants. When this ratio is high, it usually means that a lot of traders, often called “smart money,” believe that prices will go up. This suggests a positive, or bullish, feeling in the market.

On the other hand, a low ratio often means many traders think prices will drop. This indicates a negative, or bearish, feeling in the market. Knowing this overall mood helps traders make better trading decisions.

Still, it is important to keep in mind that the market can change quickly. Relying only on the Long/Short Ratio might not give the full picture. To understand the market better, it’s a good idea to combine this ratio with other tools for technical and fundamental analysis.

Analyzing the Long Short Ratio in Action

Looking at real-world examples of the Long Short Ratio, especially for well-known cryptos like Bitcoin, can teach traders important lessons. Bitcoin is the leading crypto and often sees big changes in its ratio. This makes it a great case to study how the market affects this important indicator.

By watching how the ratio connects with Bitcoin’s price changes over time, traders can learn how to understand this indicator and use it in their trading strategies. Keep in mind, that every market movement tells a story. The Long/Short Ratio is key in telling those market stories.

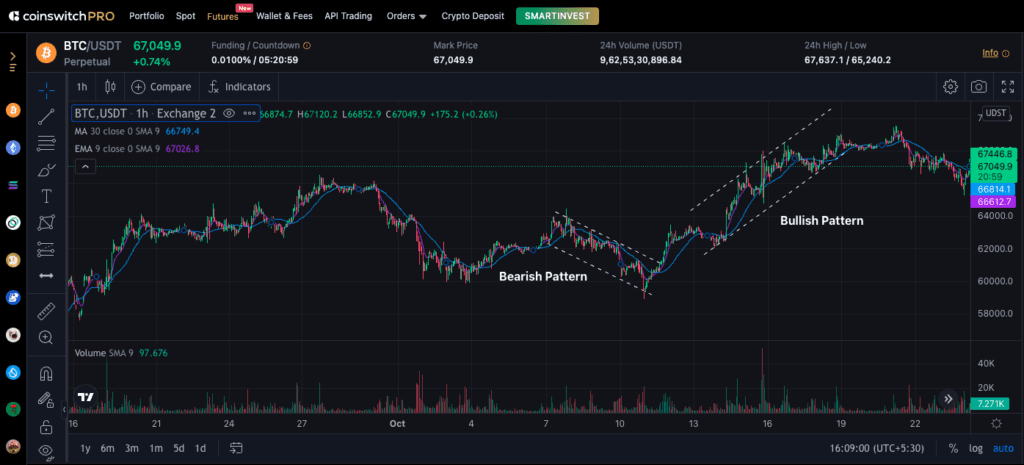

Case study: Bitcoin’s Long Short Ratio trends

Looking at Bitcoin’s Long Short Ratio during a specific period can give helpful insights. When there is a lot of market activity, a big rise in the ratio with high trading volume and a steady increase in Bitcoin’s price shows strong bullish sentiment.

On the other hand, when a bull run is at its peak and the ratio is very high, it could hint at a trend reversal. Experienced traders might see this as a sign of overbuying. They may start taking profits, causing prices to drop even with a high ratio.

Additionally, if the ratio stays low along with low trading volume during a bear market, it might mean an oversold situation. Smart traders could view this as a chance to buy, expecting prices to bounce back. Still, to support these ideas, it is necessary to look at other technical and fundamental indicators.

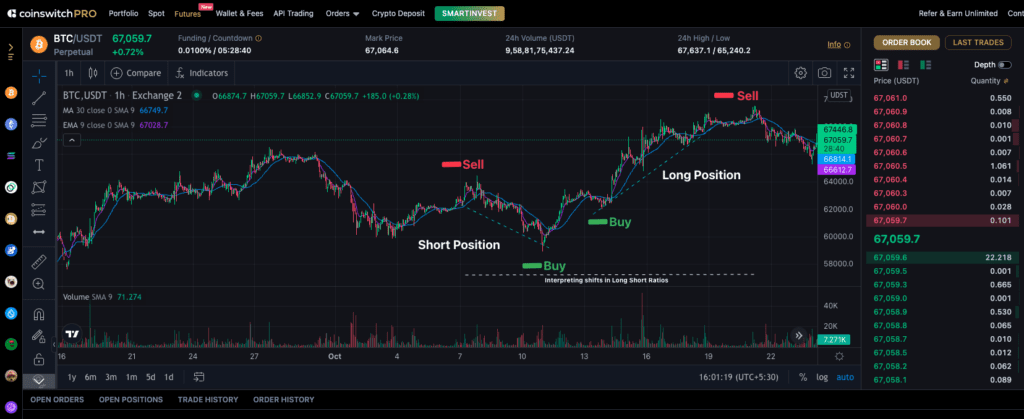

Interpreting shifts in Long Short Ratios

Sharp changes in the Long Short Ratio should be looked at closely, especially if they go against the current price trend. For example, if the ratio suddenly drops while prices are rising, it may suggest that buyers are losing strength. This can happen if early buyers take their profits and new buyers are not ready to jump in at these price levels. It might be a sign of a possible trend change.

On the other hand, if there is a quick rise in the ratio while prices are falling, but trading volume stays low, this could mean a short squeeze. In this case, short sellers might be scared of losing more money and have to buy the asset back, which can cause the price to go up even though the market is generally down.

It’s important to remember that understanding these shifts means looking at the full market picture and other technical signals. Just focusing on the Long/Short Ratio without knowing the overall market conditions can lead to significant market risks.

Practical tips for using Long Short Ratio in trading strategies

Integrating the Long Short Ratio into trading strategies can help you make better decisions. One common way to use it is as a confirmation tool with other technical indicators. For example, if a trader sees a potential buy signal from chart patterns, a rising ratio can boost their confidence in the trade.

But, it’s important to note that this ratio is not a magical indicator that guarantees trading success. It’s just one part of the bigger picture. Depending only on it without looking at other factors can lead to bad trading decisions.

Incorporating long short ratio into technical analysis

Traders can use the Long Short Ratio as an extra tool in their technical analysis. For example, when looking at stock price charts, if there is a difference between the ratio and the price action, it can offer helpful clues. If a stock price reaches new highs but the ratio does not, this may show weakening bullish momentum. This might signal a possible change in trend.

Here are some ways traders can use the Long Short Ratio:

- Confirmation: Use the ratio to back up signals from other indicators like moving averages or RSI.

- Sentiment Analysis: Check the overall market sentiment toward an asset by looking at how the ratio moves.

- Risk Management: Change position sizes based on the ratio. For example, a trader might cut position size if the ratio shows strong bullishness, sensing a possible overbought situation.

It’s important to remember that the Long/Short Ratio is just one part of the bigger picture. Good technical analysis takes a full view, looking at various indicators and market contexts.

Avoiding common pitfalls in long/short ratio interpretation

The Long/Short Ratio is a helpful tool, but using it wrongly can lead to bad trading decisions. One common mistake is to use only extreme readings as clear buy or sell signals. A very high ratio does not always mean that prices will go up more. Likewise, a very low ratio does not mean prices will keep going down. These extremes can also point to possible changes in trends.

Another mistake is overlooking the bigger market picture. The importance of the ratio can change depending on the market cycle. For example, in a strong bull market, even small drops might come with high ratios. These shouldn’t be seen as signs of trouble.

To avoid making these mistakes, traders should use the Long/Short Ratio along with other technical indicators. They should also think about market sentiment before making trading decisions. Looking at past data and how the ratio has acted before can help traders make better choices.

Conclusion

In conclusion, knowing the Long/Short Ratio in crypto trading is important for smart market choices. Traders can look at this ratio to predict how the market will move and understand market sentiment better. Using the Long/Short Ratio in trading strategies can give helpful insights for technical analysis. It is important to understand any changes in the ratios correctly and stay away from predictable mistakes. By using this ratio wisely, traders can improve their skills and may achieve better results. Keep yourself informed, stay strategic, and stay ahead on your crypto trading journey.

FAQs

1. What does a high Long/Short Ratio indicate in crypto trading?

A high Long/Short Ratio in crypto trading usually shows a positive market feeling. This means many people are starting long positions rather than short ones. It shows a greater demand for the asset, which could lead to even higher prices. A rise in open interest and trading volume adds to this signal.

2. How can traders leverage the Long/Short Ratio for market predictions?

Traders can look at past and present open interest data. They can also check Long/Short Ratios. This helps them find possible changes in the market. For example, if the ratio increases while the market is going up, it could mean the trend will keep going. This might lead traders to think about starting long positions.

3. Are there any tools to track Long/Short Ratios in real time?

Yes, many platforms let you track Long/Short Ratios in real-time. They do this by looking at the changes in open interest and the total number of outstanding contracts. TradingView, Coinglass, and some exchange platforms are popular options.

4. How does the Long/Short Ratio compare between different cryptocurrencies?

The Long/Short Ratio can change a lot for different cryptos. This change shows how much people participate, their risk levels, and how they feel about the market for each asset. Crypto that has a high total open interest may have a more stable ratio. This is different from a lesser-known asset, which might be more volatile.