Satoshi Nakamoto, Creator of the World’s First Crypto

The story of Bitcoin began with one name: Satoshi Nakamoto. This is the person or institution that published a whitepaper on October 31, 2008, titled “Bitcoin: A Peer-to-Peer Electronic Cash System.” This document had it all. It explained a decentralized digital currency that would be backed by a technology called blockchain. Satoshi coded the first version of Bitcoin, set the rules, and mined the genesis block, Block 0, on January 3, 2009.

That block carried a message. It quoted The Times’ headline: “Chancellor on brink of second bailout for banks.” This clearly shows that Satoshi wanted to build an entirely new financial system, with no bank at its center.

Bitcoin has a cap of 21 million coins. And Satoshi stuck around till 2010. Then suddenly, he disappeared. Till 2010, he communicated with developers, fixed bugs, and handed over the project. No one ever confirmed the identity behind the name. But the foundation Satoshi laid still holds strong.

Bitcoin didn’t rely on banks, governments, or centralized tech. The code itself made the rules. And the world sat up and took note.

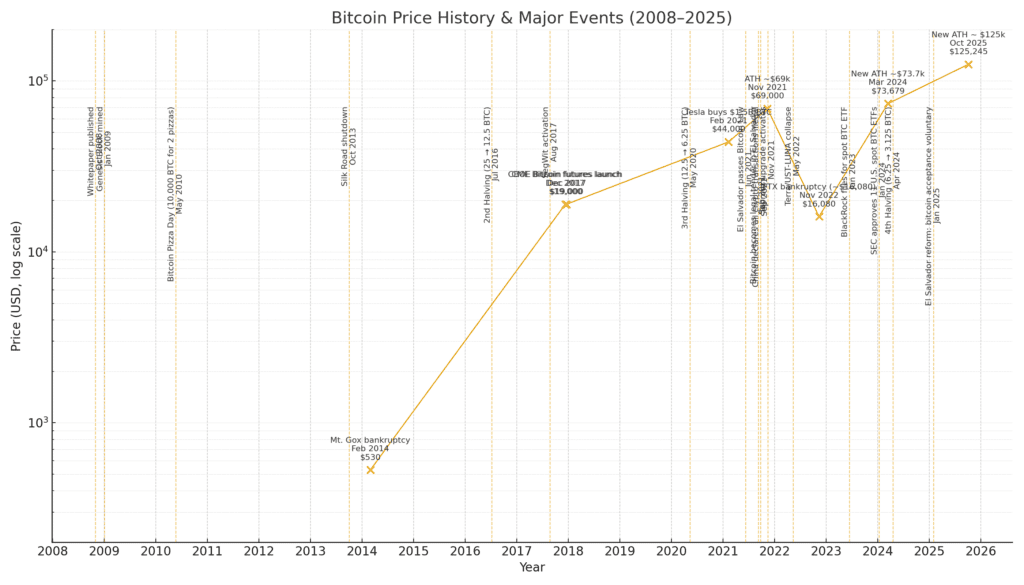

Bitcoin Timeline and Price History

Bitcoin’s price journey became a reflection of how investors started understanding and valuing decentralization. Each phase brought new investors, new doubts, and new reasons to believe. From obscure mailing lists to billion-dollar exchanges, Bitcoin continued to grow.

Here’s how the Bitcoin price history unfolded.

2008 – 2010

Bitcoin’s earliest days weren’t about price. They were about code, miners, and early adopters.

In early 2009, Satoshi mined the Genesis block, then followed it up with Block 1 six days later. The reward? 50 BTC per block. Back then, Bitcoin held no dollar value. It was mined, discussed, and shared among cryptography fans.

In October 2009, NewLibertyStandard published the first exchange rate: 1 USD = 1,309 BTC. This was calculated based on the electricity cost to mine Bitcoin. It wasn’t an official price, just a simple method for personal transactions.

The first recorded transaction took place in May 2010. Laszlo Hanyecz paid 10,000 BTC for two Papa John’s pizzas. That trade gave Bitcoin its first market value, $41 for 10,000 BTC, or $0.004 per coin.

Shortly after, BitcoinMarket.com launched in March 2010. It was the first real exchange where people could buy and sell BTC with US dollars. Trading picked up fast. By July, Bitcoin hit $0.08. Within days, it jumped to $0.10.

These early years were about proving that Bitcoin worked. The network stayed secure. Transactions cleared without banks. More people joined the mining game. Bitcoin’s code kept running.

And for the first time, a digital coin held value that people believed in.

Read More: Top 5 Bitcoin Investors: Institutions & Individuals (India & World)

2011 – 2014

Bitcoin crossed the $1 mark in February 2011. This small win kicked off a big wave. By June 2011, BTC reached $31. This 3,000% jump came from growing awareness and new exchanges like Mt. Gox.

But with hype came pressure. In mid-2011, Mt. Gox suffered a breach. Bitcoin dropped to $2. Still, believers held on. The market cooled, but development pushed forward.

2012 brought halving, the first of many. On November 28, the block reward dropped from 50 BTC to 25 BTC. This limited new supply increases long-term demand. That same year, WordPress began accepting Bitcoin. Real companies saw real utility in this digital currency.

In 2013, things took off again. Bitcoin crossed $100 in April. Cyprus’ banking crisis made people search for alternatives. Bitcoin felt like a hedge. By November 2013, BTC skyrocketed to $1,200. The world noticed. Media coverage exploded.

That same month, China’s Baidu accepted Bitcoin for certain services. Meanwhile, U.S. senators held hearings and called Bitcoin a “legitimate financial service.” That felt huge.

Then came turbulence. Mt. Gox, the biggest exchange at the time, froze withdrawals in early 2014. By February, it filed for bankruptcy, saying 850,000 BTC went missing. Prices dipped to around $400.

Despite this, the Bitcoin network kept ticking. Developers fixed bugs. Miners secured blocks. And new wallets and exchanges started popping up, stronger and more secure.

The idea stayed alive: a global currency beyond control.

2014 – 2017

This stretch marked a turning point. Bitcoin moved beyond its early volatility and started building the kind of trust that attracts both casual users and seasoned investors. Prices didn’t climb overnight, but the foundation got stronger with every passing month.

In 2015, Coinbase launched a fully licensed US exchange. This gave regular folks a familiar, compliant place to buy and hold Bitcoin. Until then, most trading platforms felt like underground forums. Coinbase changed the game. It looked clean, felt safe, and spoke to first-timers. That move opened the door to broader US adoption.

The same year, Ethereum entered the scene. While it didn’t compete directly, it expanded the idea of what blockchain could do. Developers now saw crypto as more than just money. Smart contracts brought a new wave of creativity, but Bitcoin remained the flagship. Its name held weight, and its network led the charge.

In July 2016, Bitcoin underwent its second halving. Block rewards dropped from 25 BTC to 12.5 BTC. That halving once again tightened supply, which built pressure on price. Real-world use cases gained visibility.

By early 2017, Bitcoin floated around $1,000. Then momentum kicked in. Curiosity turned into action. The media spotlight got stronger. ICOs flooded the market. Crypto chatter hit social feeds, lunch tables, and news anchors. Bitcoin became a trending word.

May 2017 saw Bitcoin crossing $2,000. Then it rolled past $3,000. By June, it had cleared $5,000. The climb felt fast. But the real buzz came in December. Bitcoin touched $19,783 on some exchanges. That figure made headlines around the world. Everyone wanted a piece. Students, cab drivers, office workers, and people across the board joined in.

The rise sparked an ecosystem of creators and educators. YouTube channels broke down wallets. Telegram groups shared price targets. Apps like Blockfolio tracked portfolios in real-time. Bitcoin had stepped into the mainstream.

In the background, big institutions took notice. The Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (CBOE) launched Bitcoin futures. These tools attracted hedge funds, family offices, and large-scale traders. Bitcoin wasn’t just a niche asset anymore; it had a seat at Wall Street’s table.

And even though the market cooled a bit after the rally, the spotlight stayed on. Bitcoin proved it could grab global attention. And keep it.

Read More: Bitcoin – The World’s First Cryptocurrency?

2018 – 2022

After the explosive growth of 2017, Bitcoin entered a new phase, one that tested the entire crypto world. The price settled. The hype faded. But the builders? They got to work.

In 2018, Bitcoin hovered around $6,000 for months. Then in December, it touched $3,200. That didn’t stop the core developers. Projects rolled forward. Tools improved. The Lightning Network, a second layer for Bitcoin, gained traction as it used micropayment channels to scale the blockchain’s capability and handle transactions more efficiently and cheaply. This layer-2 tech brought new possibilities for real-world use.

Exchanges raised their game. Interfaces became cleaner. Mobile access improved. And security? Top priority. Custodial services offered cold storage and insurance. That helped bigger investors enter the market with confidence.

Regulations came into sharper focus. Countries drafted new crypto tax laws. KYC rules got stricter. While some traders paused, many long-term holders appreciated the clarity. Legal rails gave Bitcoin a more stable foundation.

In 2019, Bitcoin climbed again. It reached $13,000 in June. Around the same time, Facebook unveiled its digital currency project, Libra. That announcement grabbed global headlines. Bitcoin got pulled into those conversations. People started seeing Bitcoin as the benchmark for all digital assets.

Then came 2020. The world changed. Covid-19 lockdowns confined people to their homes. Economies suffered. Countries released massive stimulus packages. That triggered a fresh wave of interest in Bitcoin. People searched for assets that could hold value over time. Bitcoin became part of that conversation.

May 2020 brought Bitcoin’s third halving. Block rewards dropped to 6.25 BTC. That tightened supply once more. Around that time, some major companies entered the scene:

- MicroStrategy added Bitcoin to its treasury, kicking off a corporate trend.

- Square made its first purchase, signaling confidence from fintech circles.

- PayPal allowed users to buy and hold Bitcoin inside its app, bringing millions of users on board.

- Tesla announced a $1.5 billion Bitcoin purchase and even accepted BTC as payment for a short time.

- El Salvador made history by adopting Bitcoin as legal tender.

Each move stacked credibility on top of the last.

In 2021, the excitement surged again. Bitcoin crossed $30,000 in January. It hit $50,000 in February. By April, it reached $64,000. And in November, it touched a new high, around $69,000.

The energy wasn’t just about price. NFTs dominated Twitter feeds. DeFi platforms let people earn and borrow. Meme coins like Dogecoin gained momentum. The crypto market exploded with new use cases. But Bitcoin still held center stage.

Large firms opened crypto divisions. Asset managers built Bitcoin products. Countries debated central bank digital currencies. Institutions ran reports. Bitcoin appeared on balance sheets, investment theses, and university case studies.

In 2022, the pace shifted. Market activity softened. Prices adjusted. Projects faced pressure. Some collapsed. Yet Bitcoin didn’t blink. The network kept processing blocks. The hash rate stayed strong. Miners ran operations. The ledger remained transparent.

Bitcoin walked through wild peaks and steep valleys. And through all of it, one thing stood tall: resilience.

Positive developments, such as the launch of BTC ETFs in the US in January 2024, gave a big boost to the world’s largest crypto and the crypto market in general. A pro-crypto administration in the United States, which initiated a series of crypto reforms, was a shot in the arm for crypto, culminating in BTC touching its all-time high of over $124,000 on Aug. 14, 2025.

Conclusion

Bitcoin’s journey runs deep. From Satoshi’s whitepaper to a trillion-dollar market, it stayed true to its roots, open, borderless, and secure. The bitcoin price history shows spikes and dips, hype and doubt, but always forward motion.

This timeline reflects more than price. It shows how trust, technology, and time shaped a new financial path. Each halving, each headline, each high and low added weight to Bitcoin’s story.

New chapters will follow. But this journey already holds a legacy.