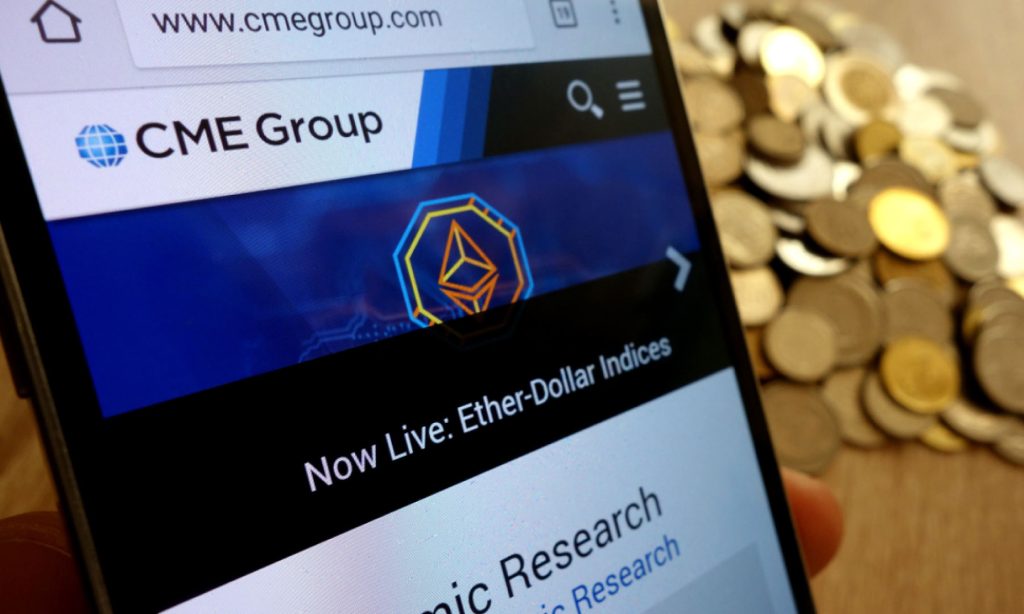

Chicago Mercantile Exchange (CME), the world’s largest financial derivatives marketplace, has announced the launch of euro-denominated Bitcoin and Ether futures contracts. As per a company press release, the BTC futures contract will have a lot size of 5 BTC, and the Ether futures contracts will have a lot size of 50 ETH per contract.

All the euro-denominated BTC and ETH futures contracts will be based on the CME CF Bitcoin-Euro Reference Rate and CME CF Ether-Euro Reference Rate and cash-settled.

According to the press release, Tim McCourt, Global Head of Equity and FX products says: “Our new Bitcoin Euro and Ether Euro futures will provide institutional clients, both within and outside the US, with more precise and regulated tools to trade and hedge exposure to the two largest cryptocurrencies by market cap.”

The offering was first announced earlier this month. It is meant to complement the exchange’s dollar-denominated BTC and ETH futures contracts.

In December 2017, the CME Group launched its first BTC futures contract. The contract proved to be very successful, attracting a huge trading volume. It peaked at $108 billion in October last year. However, the futures contract was reported to be down in July, at $38 billion.

In recent months, there has been a change in crypto derivatives trader preferences. The bulk of the trading volume has shifted away from the traditional financial derivatives marketplace like CME to centralized crypto exchanges. In July 2022, the derivatives trading volume on centralized exchanges stood at over $3 trillion, up by 13% from June.

The CME Group is also launching ETH options on 12 September 2022, just ahead of the Merge.