They call it home-country bias; we call it building India-first solutions. At CoinSwitch, tailoring our products and services to the unique needs of Indian users comes naturally. Our desi upgrade to the recently launched Crypto Options product testifies to this, complete with INR-denominated Crypto Options and Options Seller Mode—more on those later.

It’s an exciting time to be an investor, as traditional financial tools like futures and options are being increasingly adopted in the crypto world. Originally popular in stock and commodities markets, these products offer new opportunities for crypto traders. CoinSwitch, India’s largest crypto app, is among the few to launch INR-denominated crypto options trading in India. Currently, the Crypto Options product is available on the CoinSwitch mobile app.

CoinSwitch is one of the few crypto platforms in India to offer a truly localized, investor-first crypto options experience. Let’s explore how it works and learn how to do crypto options trading on CoinSwitch.

What are crypto options?

Crypto options are financial contracts that give users the right, but not the obligation, to buy or sell crypto assets like Bitcoin or Ethereum at a predetermined price before a specific expiry date. Traders use them to profit from price movements or protect against losses without directly owning the crypto. Options come in two types: call options (right to buy) and put options (right to sell).

The underlying concept is similar to options contracts in the traditional financial market; both offer investors innovative ways to speculate on prices and diversify their investment strategies.

INR Crypto Options and Options Seller Mode

CoinSwitch continues to lead crypto innovation in India, providing traders with innovative tools and strategies to enhance their trading experience. Our newly upgraded Crypto Options product offers several features. Let’s discuss some of those in detail:

- INR Crypto Options: INR-denominated crypto options on CoinSwitch eliminate the need for dollar conversion and protect against exchange rate volatility, allowing users to trade more efficiently. This makes crypto options more accessible and aligned with the Indian financial environment.

- Options Seller mode: CoinSwitch also offers Options Seller mode, a feature designed specifically for income-focused strategies. They allow:

- Real-time ROI visualization on margin deployed

- Live options chain with insight into premium and OTM expiries

- Smart tool to optimize trade selection and execution

- Easy access: CoinSwitch is a mobile app that can be easily downloaded on any smartphone. After a quick sign-up, users can trade Bitcoin and Ethereum options directly from the CoinSwitch app with ease.

Features of crypto options trading on CoinSwitch at a glance

Crypto options empower traders to bet on the future price of cryptos like Bitcoin and Solana without actually owning them. The newly added INR Crypto Options and Options Seller Mode are the cherry on the cake. Here are some features of our Crypto Options product, listed in no particular order.

- Low fees: CoinSwitch offers one of the lowest trading fees in the crypto options market, starting at just 0.015%. This ensures that traders keep most of their profits without worrying about high charges eating into their returns. Lower fees make a big difference, especially for frequent traders, as they help maximize gains.

- Trade 24/7: Unlike traditional stock market options, which are limited to specific trading hours, CoinSwitch’s crypto options allow investors to trade at any time of day. Since the crypto market operates 24×7, traders can leverage buy or sell options whenever they want, ensuring flexibility without missing out on trading opportunities.

- Daily expiries: On CoinSwitch, traders can choose from 11 different expiry periods when trading crypto options. This includes options that expire daily, weekly, monthly, and quarterly. These flexible expiry choices help traders to base their trades on short-term moves or long-term trends, depending on the strategy.

- High implied volatility: Crypto options on CoinSwitch offer high potential for returns, with annual volatility levels ranging between 50% to 75%.

- Start Small: Trade options with small lot sizes, as low as 1 USDT (about ₹90), making it easy and affordable for beginners to get started.

- Instant Settlement: Once your trade is completed, the settlement is done instantaneously. This means profits or losses are reflected in the investor’s account in real-time, offering a smooth and quick trading experience.

A step-by-step guide to crypto options trading on CoinSwitch

You can start crypto options trading on CoinSwitch just by downloading the app and following the steps below:

- Create an account or log in to your existing account.

- Complete the mandatory Know Your Customer (KYC) procedure.

- Deposit funds to your CoinSwitch wallet via bank transfer or UPI.

- Go to the ‘Pro’ section on the app and select ‘Options’ from the bottom left corner.

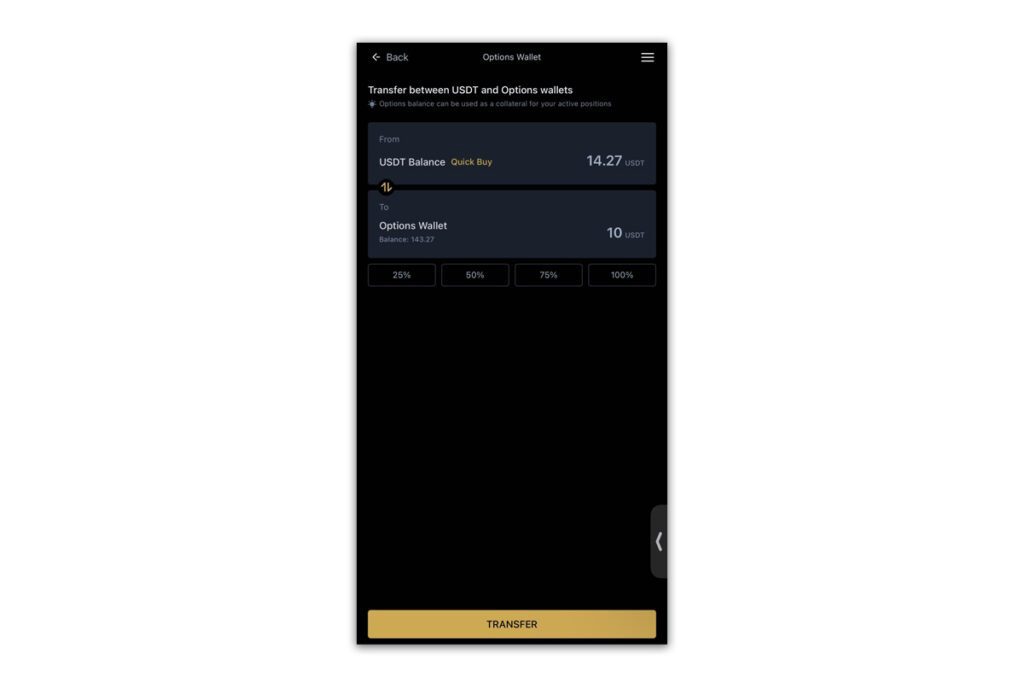

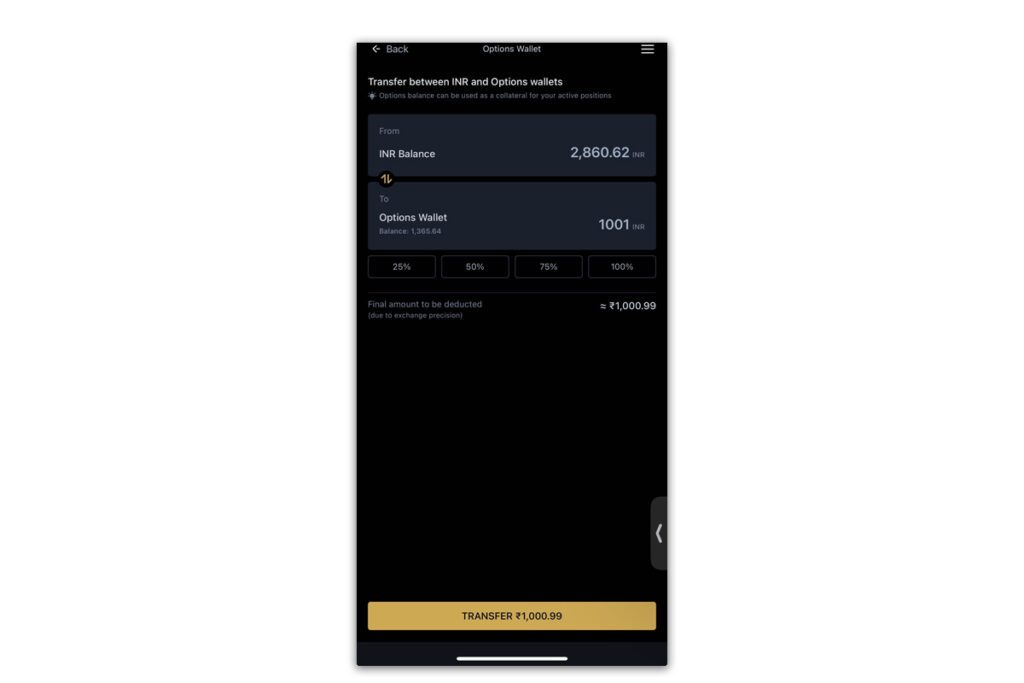

- Transfer INR or USDT to your ‘Options Wallet’ from ‘CoinSwitch Wallet.’

- Visualized prices in INR

- Visualized prices in USDT

Note: You can trade using both INR and USDT

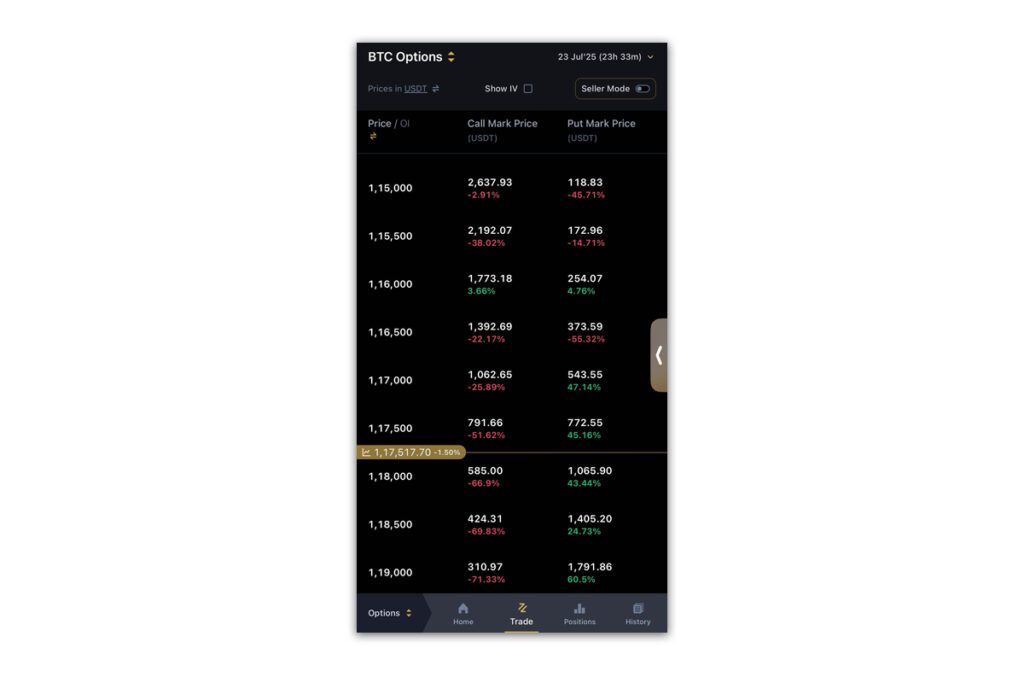

6. Select the option chain of the crypto you want to trade in and select the contract “Buy or Sell” based on your preference. You can trade more than 1,100 contracts of BTC, ETH, and SOL.

7. Enter the “Lot Size” you want to trade. The required amount will be shown at the bottom. You can check the estimated P&L (profit & loss) at the bottom.

8. After verifying the above details, confirm your order.

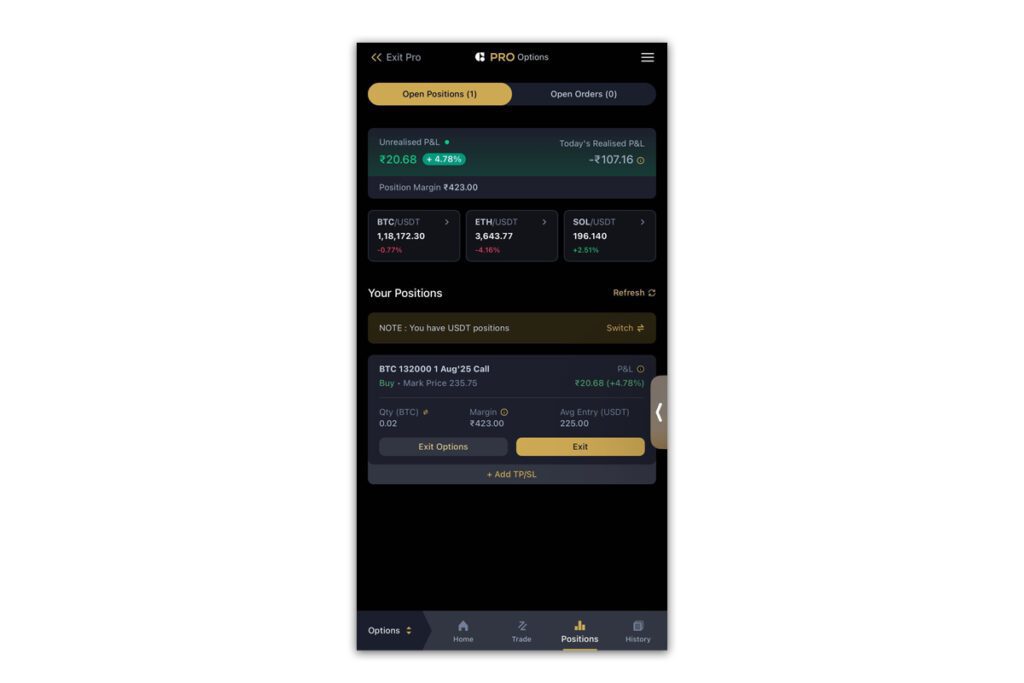

9. Track your active positions in the ‘Position’ tab in the bottom navigation. You can choose to square off anytime before expiry.

10. Track your Order, Trade, and Transaction history from the history tab in the bottom navigation.

You can also check out our YouTube video “Mastering Crypto Options Trading” to learn more about crypto options. It is a beginner’s guide to everything related to crypto options, from Call vs Put options to risk management strategies, with real-life scenarios for trading Bitcoin and Ethereum options.

Crypto options: Key terms you need to know

Crypto options are a novel concept even for seasoned traders in the crypto space. That’s why it’s crucial to familiarize oneself with some terms that are commonly used in crypto options trading. Here are some of them:

- Call option: A call option is a contract that gives the buyer the right to buy crypto assets like Bitcoin and Solana at a fixed price before a specific date without any obligation.

- Put option: A put option is a contract in the options market that gives its owner the right to sell a crypto asset at a certain price before a set date without any obligation.

- Strike price: Strike price is the predetermined price at which traders can buy or sell the underlying crypto asset, depending on whether it is a call option or a put option.

- Premium: The premium is the price the buyer pays to the seller for the right to buy or sell the asset at the agreed strike price.

- Crypto options chain: Crypto options chain is a table that lists all available crypto options with prices, expiry dates, and other details.

- Taxation on profit: In crypto options trading, profits and losses are treated as business income; no TDS is charged on trading.

- Lot size: Lot size is the number of contracts one is buying or selling in one trade. It also refers to the smallest quantity of crypto one can trade in a single transaction, depending on the platform’s contract specifications.

The upgraded Crypto Options product aligns perfectly with CoinSwitch’s broader mission of providing robust, user-friendly trading tools tailored to meet the demands of India’s growing crypto community.

For more information, please visit the PRO website.