The last 24 hours saw the broader crypto market correcting a bit—dipping by a marginal 1.01%. Despite the day-on-day dip, the week has been spectacular, returning unrealized gains of almost over 5%.

Talks about the upcoming Ethereum merge dominated most of the weekly conversations, followed by Netflix’s foray into the metaverse, Iran’s pro-crypto approach, and Taiwan opening its doors to Web 3.0.

Key highlights

It’s a Friday, but for the broader crypto space, it is only the fifth day of an event-packed week. Before we head into the weekend, here are the key market highlights to take note of, especially for investors, traders, and HODLers.

- The total market volume dropped by 4.38% over the past 24 hours, showcasing a minor dip in trading action.

- Bitcoin’s dominance dipped by 0.31% to hold steady at 40.06%.

- CRE8—India’s first onshore crypto rupee index— corrected by 0.96% in the last 24 hours.

Key coins

While the highlights help you zoom out a bit, here are some of the key cryptos that moved the most in the last 24 hours. Ankr, a multi-chain provider focusing on infrastructure, saw its native token ANKR soar by 60.85%. The project gained after it launched its token staking feature and received fresh capital. ANKR’s trading volume is also up by 1,357%.

Following ANKR is Ethereum Classic (ETC), which gained 8.47% day-on-day and over 196.41% over the past month. Speculations regarding a new Proof-of-Work fork for Ethereum, expected immediately after the completion of the merge, have been driving the prices up.

As for the big players, BTC corrected by 0.96% day-on-day, while ETH continued to gain, registering a 1.49% uptick.

Crypto Fear and Greed Index (CFGI)

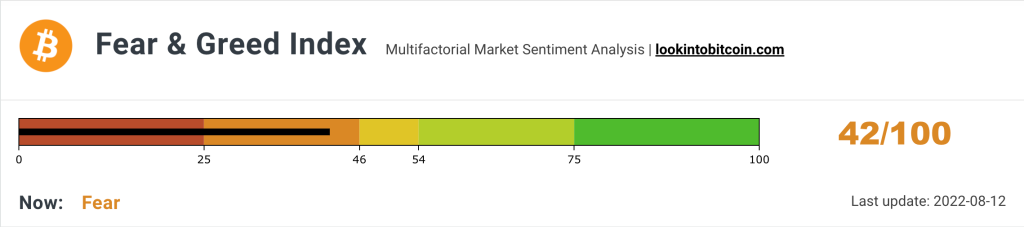

The Fear and Greed Index is a widely-watched measure that tracks market sentiment. At publishing time, CFGI is at 42, which is a massive improvement over the last month’s reading of 15. The improvement has been primarily brought upon by Ethereum (with Merge talks), but is now percolating through the entire market.

The index values are measured between 0-100 with higher levels signifying greed in the market, leading to more buying action. At its lowest, the market is usually fearful with the index showing levels closer to 0.

Meanwhile, the market looks steady, awaiting updates on Ethereum developments with bated breath. Keep a watch on sentimental movers (including BTC price, Polygon updates, etc) that can have a bearing on the market. Yet, as always, you should focus on DYOR (doing your own research) to stay ahead of every broader development in the market.