The broader crypto market continues to trade in the green, registering a 2.99% uptick at the time of writing. Yes, the bears scared investors off for a bit yesterday when key cryptos like BTC and ETH dipped a bit. Yet, the top guns were back to trading flat by the end of yesterday.

Today, as we discuss, bitcoin (BTC) is down by 0.03%. The minor correction could be some usual profit-taking and might not be anything alarming. Yet, we recommend DYOR (Doing-Your-Own-Research) and caution. ETH, despite the early reds, has moved into the positive territory today, registering a 0.54% upmove, at release.

As for the market drivers, the ‘Merge’ anticipation continues to propel the crypto space further, followed by Polygon surpassing Solana’s total value locked (TVL) last week. For the uninitiated, Polygon currently holds the fifth spot in terms of DeFi TVL (according to DeFillama), marginally behind Avalanche.

Key highlights

The crypto market continues to look strong despite fears of a deeper correction. As of now, here are the major market highlights that deserve your attention:

- The global crypto market capitalization stands at $1.14T, down by half a percentage point over the past 24 hours.

- Bitcoin’s market dominance dropped under 40% (39.98% today), opening doors for altcoins.

- India’s onshore crypto index (CRE8) was trading at ₹3,314.81 at release, up by a flattish 0.29%.

Key coins

When it comes to the top 10 cryptos by market capitalization, Dogecoin (DOGE) and Ripple (XRP) seem to be outperforming the broader market with gains of 8.83% and 3.77%, respectively. However, if we delve deeper into the market, smart contract-friendly project EOS is one of the top Wednesday gainers, charting close to 24.03% in unrealized profits over the past 24 hours.

Other key movers include JasmyCoin (JASMY) and the eco-friendly project Tezos (XTZ) with day-on-day up moves of 10.78% and 7.30% respectively.

The biggest loser today is Civic (CVC)—a Web 3.0-focused project—tumbling by almost 7.15% on the back of an 85% drop in trading volumes.

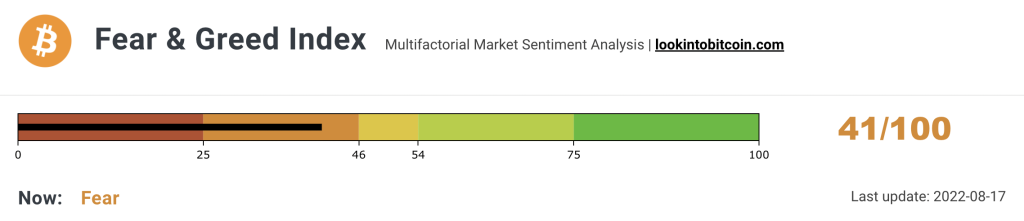

Crypto Fear and Greed Index (CFGI)

The Crypto Fear and Green Index managed to hold above the 40 level, despite investors expecting a market sell-off. At present, the index is at 41, which still indicates fear. However, things seemed to have settled for good as compared to the last month’s extreme fear, when the indicator was moving around 20.

For now, the market looks steady, more so with the new (hastened) merge dates surfacing a few days back. While some are expecting a dump right before the merge (rapid sell-offs), it is best to ignore speculations. We would also suggest that you follow a data-backed approach to market analysis.