Crypto naysayers were proved right in 2022. Or so it appeared as financial assets of all shades, including cryptos, witnessed a massive drop in prices. Only commodity exporters managed to keep their heads above water in a year that is thankfully drawing to a close.

The annus horribilis unfolded with Putin ordering his troops to march into Ukraine in February. The dramatic crash of Terra Network shook up the crypto sphere, followed by the collapse of DeFi giants and the FTX fiasco in November that dealt a body blow. Macroeconomics didn’t help either, as Fed rate hikes sucked out liquidity from the system, impacting riskier asset classes such as stocks and crypto.

Yes, the winter is on, and the crypto market is yet to fend off these massive blows. Yet, the greater the project is decentralized, the stronger it emerges. For example, The Merge of the Ethereum Network, the growth of the Polygon Network, and the growth of Cardano stood out. And, yes, how can we miss the NFT boom? This was 2022 for you if you are a discerning crypto enthusiast.

Now, what’s in store for the crypto market in 2023? Well, you should expect nothing and continue to back the fundamentally strong crypto projects that solve real-world problems. Rewards would follow.

Here we summarize the highlights of Messari’s future-gazing analysis—Crypto Theses-2023—that will throw some light on the coming year.

Messari’s Crypto Theses-2023

Bitcoin an ESG asset

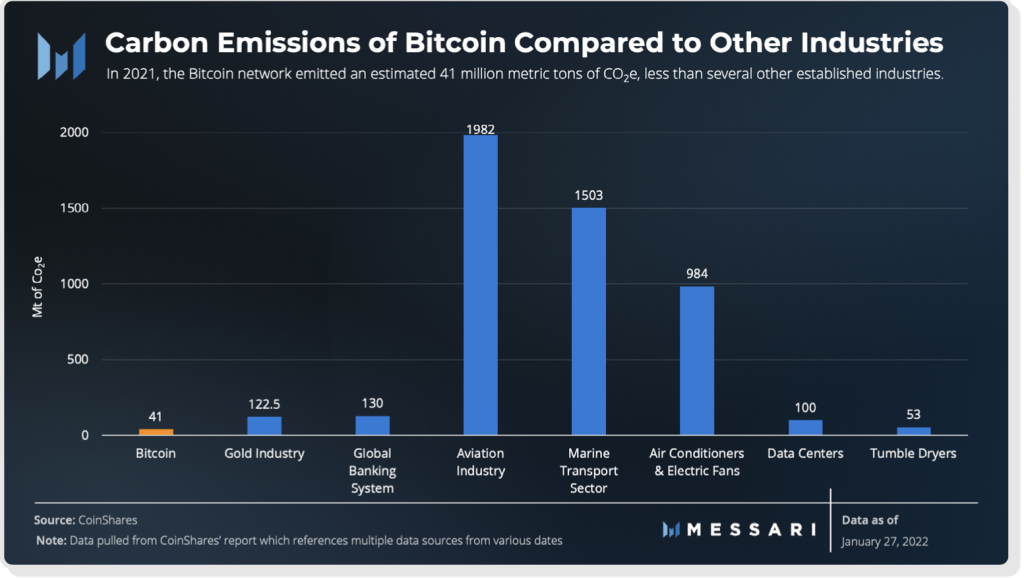

Although Bitcoin has dropped by over 75% from its peak, talks still center around carbon footprint from its mining process. However, estimates have shown that bitcoin mining consumes less energy and leaves a lower carbon footprint than mining gold or the aviation industry.

However, things are changing as over 39% of mining energy requirements are fulfilled by renewable sources. Experts are exploring the prospects of using waste flared gas to power bitcoin mining rigs, which could potentially offset the network’s CO2 emissions.

So, will it make Bitcoin an ESG asset? We may see it happening in the near future.

Stablecoins to rule

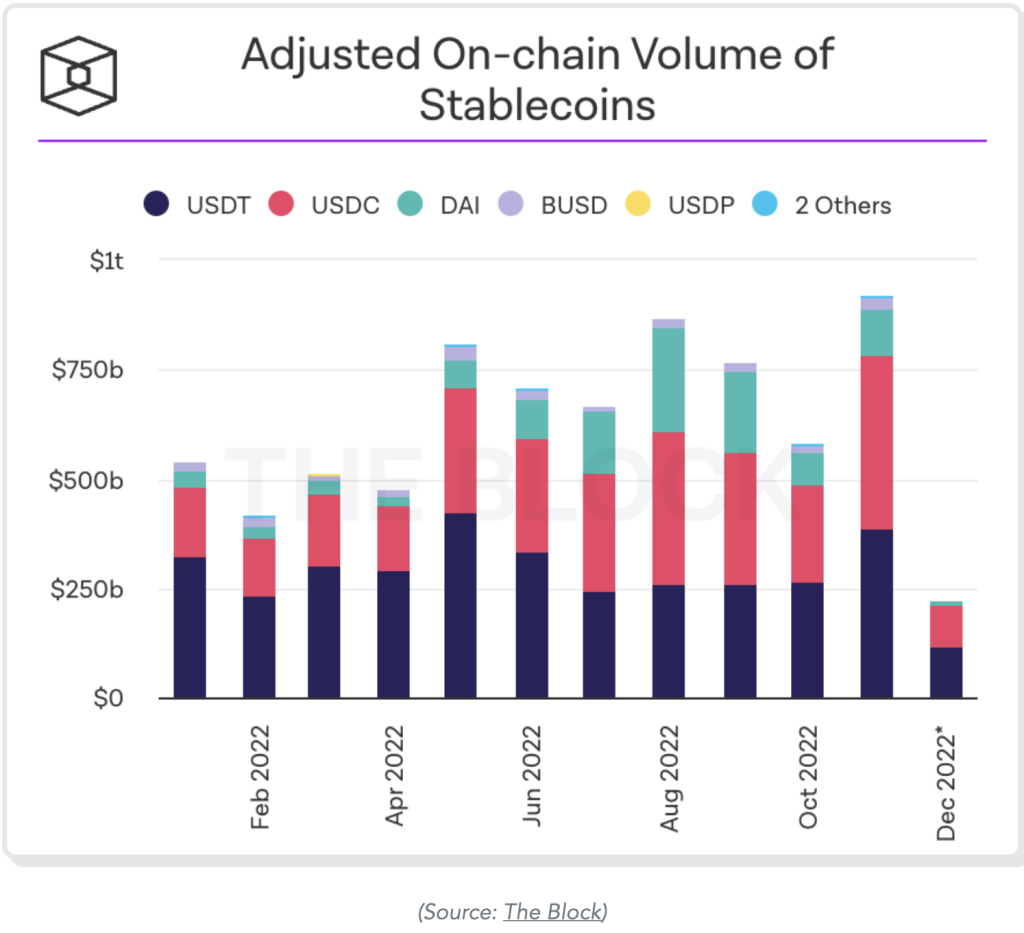

As inflation rocks the rich and the poor worlds in varying degrees, USD-backed stablecoins will find more acceptance around the world as the greenback continues its dominance as the world’s reserve currency.

For perspective, the adjusted on-chain volume of stablecoins has doubled from the start of the year and is close to the $1 trillion level.

We are likely to witness the rise of USD-denominated fully-reserved stablecoins such as the USDT, USDC, and BUSD.

However, crypto-collateralized stablecoins like the DAI and others have been losing their market share.

Ethereum

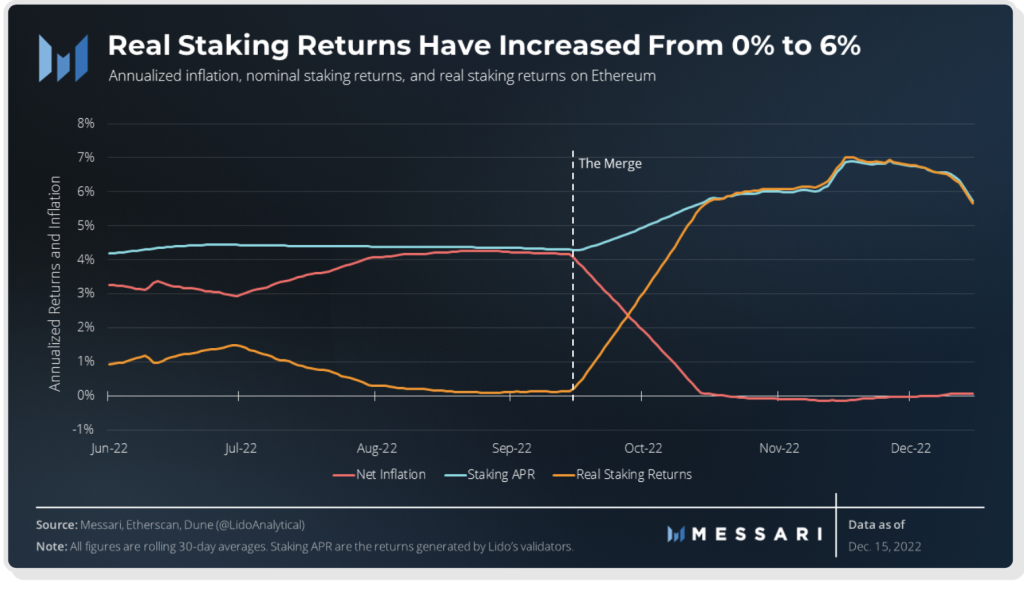

The euphoria surrounding the Merge was palpable as it was a major technical update that was six years in the making. It changed tokenomics entirely, marking a fundamental shift in the economic model of Ethereum.

Merge reduced the new token issuance rate by 90% and eliminated $500 million monthly selling pressure from miners. Since the EIP-1559 went live that activated the token burning mechanism, about 85% of the transaction fees collected are burned. If the transaction fee burn rate exceeds the network’s staking rate, the network could have a steady deflation rate of 1-2% per year.

Depending on the number of stakers on the Ethereum network and network activity, the yields could range from 5 to 7% in 2023.

DeFi

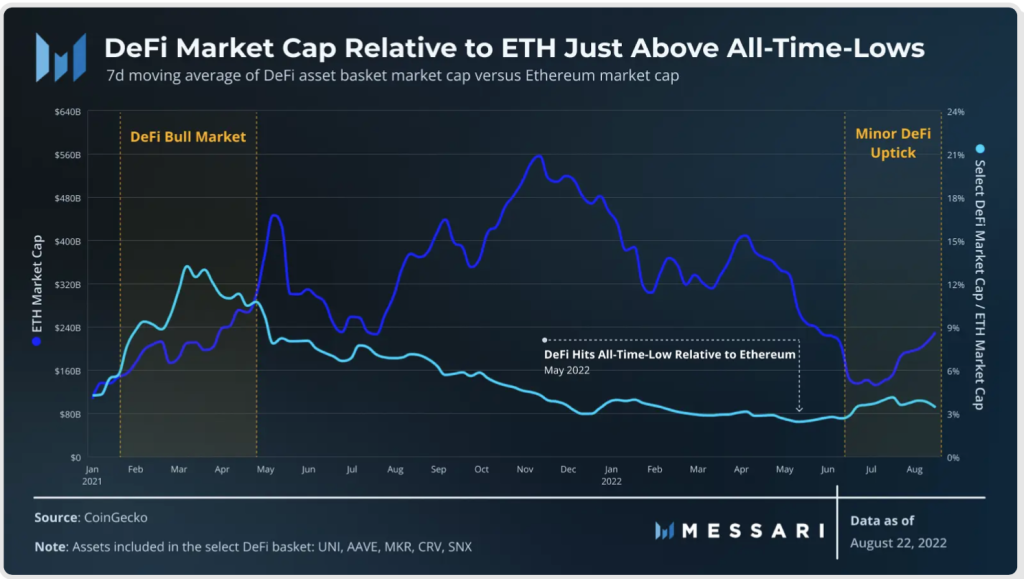

DeFi imploded in 2022, with total value locked in DeFi projects slipping below $40 billion from a high of $180 billion at the beginning of the year, according to DappRadar.

Amid the collapse of CeFi protocols after the Terra Luna crash, UniSwap was able to successfully dodge the bullet as DEX found greater acceptance among crypto investors.

Ethereum is facing a bit of a struggle due to a lack of scaling ability, and most of the transactional volumes are shifting to sidechains such as Polygon, Optimistic Rollups, or any other customized chains. Now, UniSwap, Lido, and OpenSea generate more monthly fees on a combined basis than the entire Ethereum L1.

When market sentiments improve, DeFi is most likely to dominate the crypto space, and its market cap will rise quickly compared to Ethereum.

With Ethereum turning deflationary, the real returns on each processed block to validators have spiked to 6%. Further, when withdrawals go live with the Shanghai upgrade planned for sometime in 2023, the risk of staking ETH will fall considerably, and the minimum duration of staking is likely to fall to 27 hours.

The biggest beneficiaries will be liquid staking platforms like Lido and Rocketpool, as they will emerge as the top fee-generating dApps in 2023.

The NFT craze: Not Fun, Though!

2022 wasn’t the best year for NFTs. It is easy to see why.

Data from DappRadar suggests that till Q3 2022, the NFT market capitalization was a mere $14 billion. Well, it pales in significance if we compare it against the $17 trillion asset class—physical art.

And while the standard digital art forms gave up most of their 2021 gains, PFPs or Profile Picture NFTs like CryptoPunks managed to hold their own. PFP sales volume shot through the roof in 2022, amassing $5 billion by the third quarter.

Web 3.0, Play-to-Earn, and NFTs

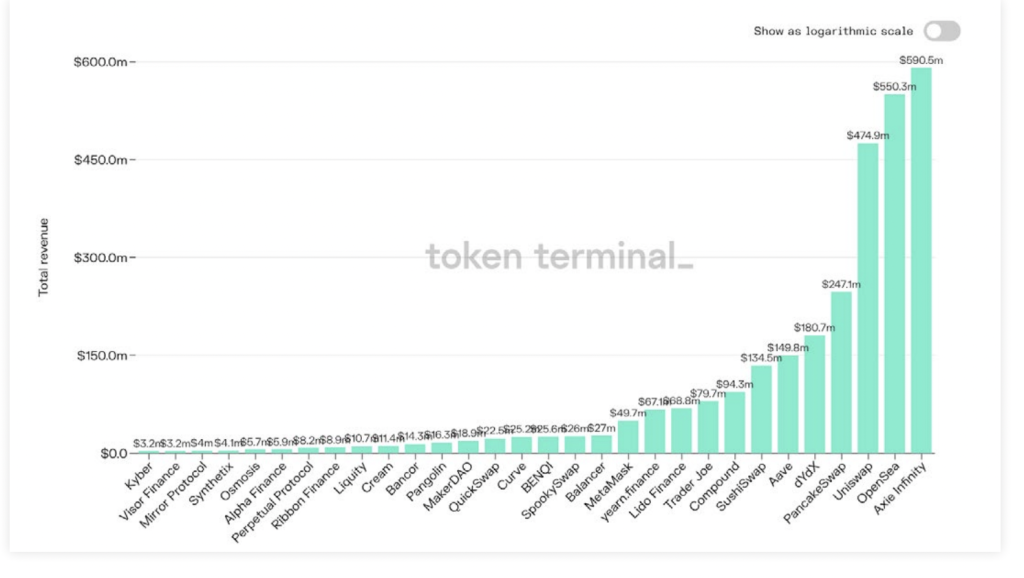

As we move into 2023, we can be sure of one thing: Web 3.0 is a lot more than a buzzword. In 2022, we saw it in different variants. For instance, the last three months witnessed the likes of Axie Infinity and OpenSea—two of Ethereum’s biggest revenue generators—accrue over $500 million each.

Uniswap, the DeFi peer, finished third with $475 million. So it’s noticeable that despite the lack of trading interest in the metaverse and NFT tokens globally, Play-to-Earn/Metaverses and NFT ecosystems continue to be the money spinners for Web 3.0. We do not see this trend budging in 2023.

The Web 3.0 gaming space had other instances of crazy success. Enjin—a famed blockchain project— announced a gaming fund worth $100 million, while a16z invested $150 million in Mythical Games.

Honorary mentions: Solana and Cosmos

Crypto assets weren’t the most buoyant in 2022. But their respective ecosystems didn’t stop being popular. Solana—the popular yet controversial layer-1 that once set out to challenge Ethereum—had a 17-hour outage to account for. And that outage was one of the many as Solana ebbed and flowed through 2022 with several hot and cold instances to account for.

While it got badly embroiled in the FTX contagion, Brave browser’s migration and dominance with regard to NFTs and gaming kept Solana afloat in 2022.

Cosmos, the modular blockchain, gained a lot of traction in 2022 courtesy of its IBC or Inter-Blockchain Communication Protocol. And as we move towards the end of Q4 2022, Cosmos might attract more attention thanks to its affordability and the DeFi-specific objective.

While this is the detailed report in a nutshell, the pointers do offer an approximation of how things panned out in 2022. More importantly, a study of patterns followed in the current year would give useful clues to what lies ahead for crypto in 2023.

FAQs

What’s covered in Messari’s 2023 crypto theses?

Crypto regulations, algorithmic stablecoins, CBDCs, the sanctions against Tornado Cash, CeFi trends, and so forth.

Are Messari’s projections accurate for crypto decisions?

Messari’s projections, like any financial predictions, carry a degree of uncertainty. While they provide valuable insights, remember that the cryptocurrency market is highly volatile and influenced by various factors. It’s wise to consider multiple sources, do your research, and consult with financial experts before making decisions.

What are Messari’s crypto predictions for 2023?

We’ve seen exciting leaps forward in scalability solutions, DeFi, NFTs, DAOs, and other sectors of the crypto economy this year. And macro forces might reemerge as a tailwind for bitcoin in 2023.