Crypto transactions are broadly classified into two categories: on-chain transactions and off-chain transactions. This blog post discusses these in detail. Let’s dig in.

Understanding On-chain

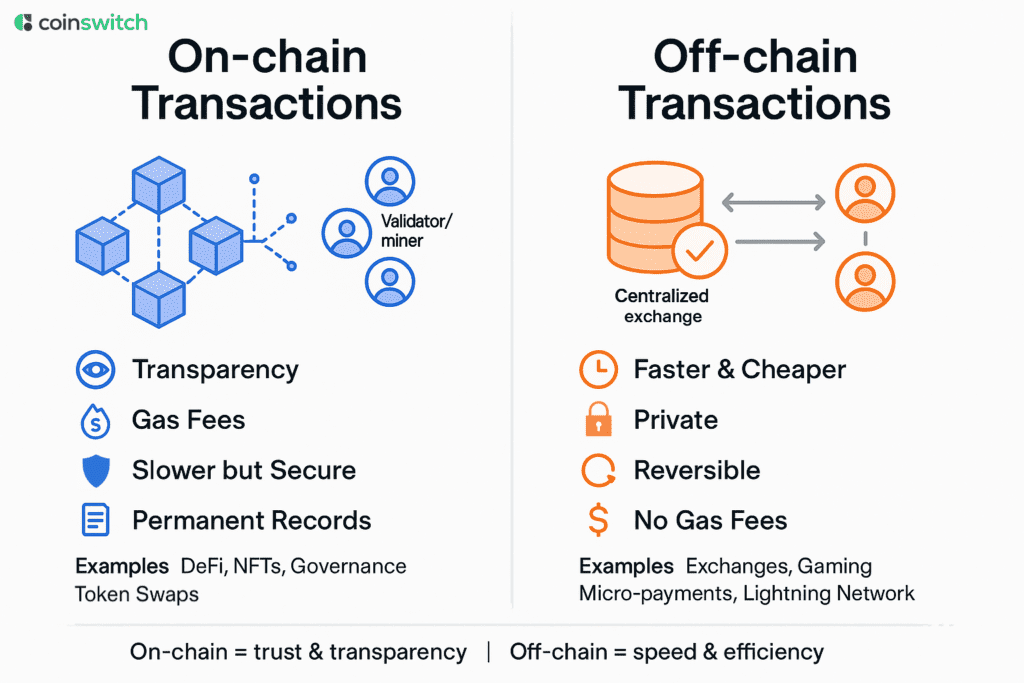

On-chain transactions are recorded directly on a blockchain. They operate within a decentralized environment where every move gets validated, time-stamped, and stored permanently. When someone sends crypto, triggers a smart contract, or interacts with a decentralized protocol, that action becomes part of the network’s public history. It’s the original way to move digital assets and still powers many of the most important blockchain applications today.

These transactions go through a process called consensus. Depending on the network, this could be proof of work, proof of stake, or a different validation model. Validators confirm the transaction, secure the network, and help maintain trust in the system. Once confirmed, the transaction becomes visible on public explorers for anyone to track.

People turn to on-chain transactions when they want complete transparency. These records create a real-time audit trail. For example, in decentralized finance (DeFi), on-chain transparency helps users verify liquidity levels, token swaps, or lending activity. That trust layer makes DeFi work.

Security also plays a major role here. On-chain actions get locked in permanently. After validators approve a transaction, it becomes part of the blockchain forever. This permanence gives on-chain systems a strong edge in legal, financial, and institutional use cases.

Every on-chain action includes a small fee called gas. This fee compensates validators and keeps the network active. People can speed up their transactions by paying a bit more gas. Or they can save some by waiting for a less congested time. This system gives users flexibility over how fast their transactions move.

Timing depends on block generation. Bitcoin creates a new block roughly every 10 minutes. Ethereum runs faster, with blocks every 12 seconds. Solana works even quicker. This block rhythm sets the pace for finalizing transactions. Traders and developers plan their activities around this timing.

Some common use cases make on-chain transactions valuable: swapping tokens on decentralized exchanges like Uniswap, sending assets across chains, minting NFTs, and joining governance proposals. Builders rely on this system to trigger smart contracts, track execution, and build apps with full transparency. For anyone working with public crypto infrastructure, on-chain still runs the show.

Understanding Off-chain

Off-chain transactions happen outside the blockchain, but still involve the movement of digital assets or crypto. They use alternate systems—centralized databases, payment channels, or messaging protocols—to settle balances without needing a public ledger entry. In other words, off-chain transactions occur on second-layer blockchains, networks, or applications and are therefore prone to interference.

These systems work best when users need faster action or cost savings. Since they skip blockchain consensus, there’s no need for gas, validators, or waiting on block confirmations. This speed makes off-chain options attractive for exchanges, gaming platforms, and peer-to-peer applications.

Picture this: one user sends crypto to another operating on a centralized exchange. The exchange updates internal records. No blockchain interaction occurs at that moment. The network stays quiet, gas fees stay untouched, and the transaction completes instantly.

This offers several benefits. First, it helps with microtransactions. Games and apps that send tiny payments every few seconds can’t afford to wait on a blockchain. Off-chain gives them a lightweight, low-cost solution.

Second, it adds flexibility. Many off-chain systems allow changes or reversals before finalizing the transfer. Users can edit transaction details or cancel them entirely, which is not possible with on-chain systems.

Third, it provides privacy. Since transactions stay off the public record, wallet addresses and amounts remain hidden. Institutions use this approach when discretion matters. Developers favor it for compliance and scalability. And small users enjoy the simplicity.

These transactions are often anchored to the blockchain later. When the system wants to finalize its data or bridge back to an on-chain network, it sends one large settlement transaction. This way, it balances the speed of off-chain with the security of on-chain.

Off-chain activity happens in many places: peer-to-peer apps, exchanges, OTC trading desks, and state channels like Bitcoin’s Lightning Network. These platforms move millions of dollars every day without putting every step on-chain.

They use messaging systems, cryptographic proofs, and internal recordkeeping to track movement. Since miners and validators aren’t involved, the cost and delay decrease significantly.

This setup lets builders create smoother user experiences. No one waits around for block confirmations. No one stresses about gas spikes. Apps load faster, payments go through instantly, and users get results without complexity.

Off-chain options power everyday crypto use. From transferring tokens between users to processing game rewards and managing trading bots, they cover high-frequency, high-volume tasks that benefit from speed.

Comparing On-chain & Off-chain Transactions

On-chain and off-chain systems solve different problems. They complement each other across platforms and help crypto scale.

Start with speed. On-chain runs on block time. Even fast blockchains like Solana still add a short wait. Off-chain clears instantly. For real-time trades, flash loans, or micro-rewards, off-chain brings an edge.

Next comes cost. On-chain fees fluctuate with traffic. High gas fees can raise costs for small transactions. Off-chain skips those fees. By staying off the ledger, users avoid network congestion and move assets without incurring additional costs.

Transparency gives on-chain its biggest strength. Public explorers track every move. Smart contracts execute in full view. DAOs, NFT drops, and liquidity pools depend on this visibility. Auditors and regulators appreciate it, too.

Off-chain keeps things quiet. This discretion helps exchanges, institutions, and apps that prioritize privacy. It gives room for experimentation without broadcasting every step. Internal systems operate efficiently without sharing their playbook.

Control is another differentiator. On-chain depends on user wallets and validators. The system follows rules built into the protocol. No one edits the ledger once a transaction gets confirmed. That gives users independence.

Off-chain relies on platforms to manage balances. That platform could be a firm, a protocol, or a payment channel. They set the rules, handle reversals, and settle disputes. This trust layer speeds things up but adds responsibility.

Flexibility plays a key role. On-chain moves lock in. There’s no undo button. Off-chain systems allow reversals or edits before finalization. That helps with refunds, accidental transfers, or flagged activity. Customer-facing platforms favor this flexibility.

Security depends on architecture. On-chain gets protected by decentralized validators, cryptography, and consensus. The blockchain holds firm as long as nodes agree. Smart contracts and private keys become the security perimeter.

Off-chain platforms handle security internally. They rely on servers, databases, and encrypted messaging. These systems need active monitoring, access controls, and strong user authentication. They move fast but require safeguards.

Scalability follows different paths. On-chain solutions need upgrades like sharding, rollups, or Layer 2 integrations. These take time, community coordination, and code changes. Off-chain scales by adding servers or updating databases. The growth is fast and light.

Both systems play their part. Many platforms combine them. A game might track points off-chain and push major rewards on-chain. A DEX might route trades internally, then settle balances through a smart contract. This hybrid approach blends speed with transparency.

More builders now treat these systems as useful tools. On-chain anchors trust. Off-chain drives performance. Each works best in the right context.

Institutions use both. Retail users experience both. Developers build for both. As the crypto space grows, this mix will keep evolving.

FAQs

- What is the difference between side chain and off-chain?

A side chain is a separate blockchain connected to a main blockchain through a bridge. It runs its own consensus, but remains interoperable with the main network. Off-chain refers to any activity that doesn’t touch the blockchain until final settlement, like internal exchange transfers or payment channels.

- What’s an example of an off-chain transaction?

Let’s say a user sends USDT to another user inside CoinSwitch or Binance. That transfer never touches the blockchain. Instead, the exchange just updates its internal balance sheet. One account goes down, the other goes up. No gas fees, no public hash, no wait time. It all happens behind the scenes, fast, cheap, and off-chain.

- What’s an On-Chain Transaction?

An on-chain transaction runs straight through the blockchain. It could be a simple token transfer or a smart contract interaction. Either way, it goes live on the ledger. The network confirms it, validators lock it in, and a gas fee gets charged. Once it clears, anyone can track it through a block explorer. It stays public and permanent.

- What’s the difference between on-chain and off-chain in crypto?

On-chain activity moves through the blockchain. Validators confirm it, and the whole transaction gets recorded on a shared ledger. That’s what powers DeFi, DAOs, and NFTs. Off-chain, on the other hand, skips the blockchain entirely. It runs through private systems, think internal exchange transfers, payment channels, or cross-app balances. Off-chain keeps things faster and cheaper. On-chain brings transparency and trust.