Avalanche (AVAX), a popular smart contracts ecosystem, is upgrading Avalanche Rush — a liquidity mining program with a focus on incentives. Avalanche is collaborating with the decentralized exchange GMX_io to make Avalanche Rush a tool to prop up the price of AVAX crypto and intensify DeFi interest.

The initiative involving Avalanche Rush assumes significance as Avalanche’s DeFi space is witnessing TVL (Total Value Locked) degrowth. Avalanche Rush came to the fore in 2021 as a $180 million program for liquidity miners but hasn’t taken off since. With GMX coming into the mix, the Rush ecosystem will benefit as liquidity pools will get to earn from trading.

Here is a Twitter post that illustrates Avalanche’s excitement:

@GMX_io allows for deep liquidity with its $GLP token, a liquidity provider token allowing LPs to earn fees from trading.

Currently, there is over $60 million in $GLP staked 🔒

Learn more about GMX and #Avalanche Rush ⬇️https://t.co/rOjNvSSh69

— Avalanche 🔺 (@avalancheavax) November 7, 2022

Can a revamped Avalanche Rush impact AVAX crypto prices?

Past experience shows that growth in TVL helps propel specific cryptos. Something similar happened with Polygon when it trounced Solana to take up the fifth place on the DeFi roll of honor in August. Since then, Polygon (MATIC) crypto prices have been on an upward trajectory.

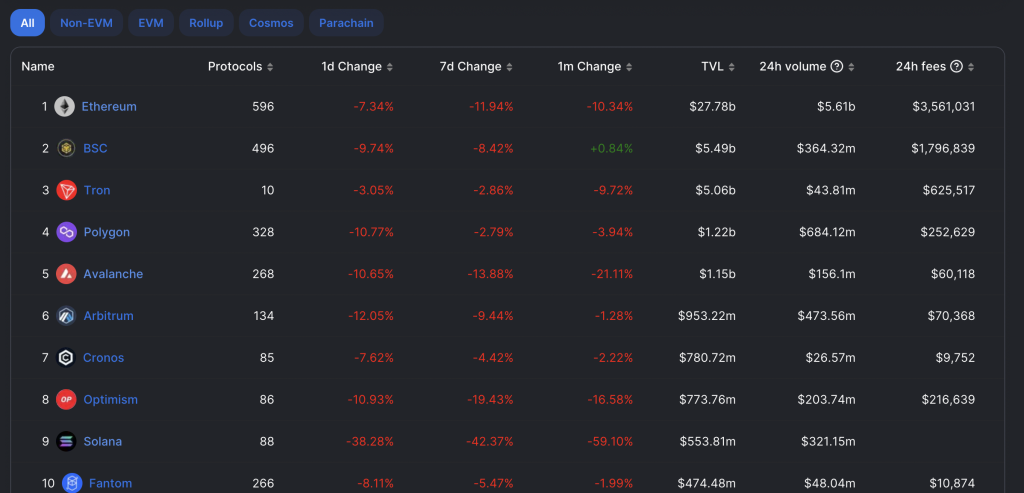

With trading coming to Avalanche Rush — courtesy GMX — Avalanche aims to alter its DeFi standing. Currently, Avalanche is ranked fifth on the TVL list despite a 13.88% week-on-week dip against its name, according to DefiLlama.

Avalanche is one of the more promising DeFi projects and has over 268 protocols built into it. The current TVL is at $1.15 billion, and as you can see, it is breathing down Polygon’s neck for the 4th place. However, for that to happen, the ecosystem will need a TVL boost — which a revamped Avalanche Rush plans to bring.

AVAX TVL: DefiLama

Regarding the prices, AVAX is currently seeing a counter-wise sell-off—validated by the red volume pillar. AVAX crypto prices are close to the $15.31 mark, and the daily chart shows that the moves are showing a descending channel pattern. However, if AVAX can see some positive price action around the nearest support zone of $14.58, it still has a chance to move toward the channel’s upper trendline.

AVAX price action

If AVAX crypto prices breach the upper trendline, they might move close to the $18-$20 zone. As always, we recommend DYOR.