Bitcoin hits fresh highs and sustains momentum

Bitcoin is currently trading above $124,000, having reached a new all-time high of $126,000 on Oct. 6, driven by favorable macro factors. The rally signals renewed bullish conviction across the crypto market, driving up altcoins such as ETH, DOGE, and BNB.

Macro and political uncertainty push capital to “safe havens”

Amid the ongoing US government shutdown tensions, investors are turning toward assets that are considered hedges, such as Bitcoin and gold. The uncertainty is reinforcing Bitcoin’s role as a “flight to safety” instrument when traditional markets falter.

Institutional inflows and ETF demand

There’s clear evidence of heavy institutional interest: Bitcoin spot ETFs have seen massive inflows in recent weeks, supporting further upside. This influx of capital is giving the market structural backing.

Altcoins riding the ripple effect

ETH, DOGE, and BNB are also showing strength, contributing to a broad rally in the crypto market. ETH surged to a three-week high, and BNB surged past $1,200, hitting a fresh all-time high. This suggests capital rotation into high-beta tokens following BTC’s lead.

Technical breakouts and momentum structuring

Bitcoin recently broke out of a downtrend or consolidation structure, which now may act as support zones—allowing room for extension toward new highs. Technical momentum supports continuation, provided resistance and support zones hold firm.

Market outlook and key Levels

Support zones to watch

If pullbacks occur, watch for Bitcoin holding near prior resistance-turned-support levels (e.g., around $120,000–$122,000).

Resistance and targets

The immediate resistance zone is near $126,000–$127,000 (recent highs). A successful break above those levels could give Bitcoin room to test $130,000+ territory.

Risks to monitor

Volatility is still high. Any negative macro surprise like weak economic data, sharper-than-expected rate hikes, or regulatory moves could trigger sharp pullbacks. Also, watch for heavy token unlocks or profit-taking, especially from speculative traders.

Top 5 Investor Action Points

- Mark support/resistance zones: Keep tabs on $120K–$122K as support and $126K–$127K as resistance.

- Watch macro and fiscal signals: US shutdown updates, Fed commentary, inflation, and employment data will remain key market drivers.

- Track ETF and institutional flows: Heavy inflows tend to sustain trends; these are early warning signals.

- Diversify smartly: Use BTC as the anchor. Pair it with strong altcoins like ETH, SOL, or BNB to ride secondary strength.

- Prepare for retracements: Use pullbacks to scale in, not all-in aggressively in one trade. Volatility can offer better entries later.

Top Gainers (24 hours)

Date: 07 Oct. 2025, 11:36 a.m.

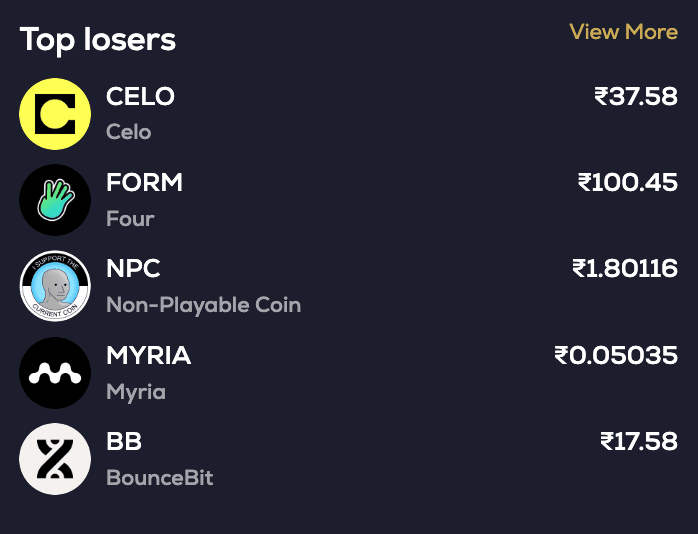

Top Losers (24 hours)

Date: 07 Oct. 2025, 11:36 a.m.