Every trade starts with a decision: when to enter the market, when to exit, and how much control you want over both. In fast-moving crypto markets, prices shift by the second, and those few seconds can define profit or loss. That’s why understanding order types isn’t optional; it’s essential. Whether you’re trading Bitcoin, Ethereum, or a trending altcoin, the type of order you place shapes your outcome. A market order fills instantly, a limit order waits for your price, a stop-limit order manages risk, and a bracket order automates profit-taking and loss-limiting in a single transaction. These tools help you trade with intent, not emotion. Once you understand how each works inside an order book, you’ll trade like a strategist, precise, confident, and prepared for every move.

Order Books

At the core of every crypto exchange is an order book, a live, constantly updating record of buy and sell orders. It’s where supply meets demand. On one side, you have bids, traders ready to buy at specific prices. On the other hand, you have asks, traders willing to sell. The point where they meet forms the market price.

In crypto, order books run 24/7. There’s no closing bell, no downtime, just constant matching between buyers and sellers. This creates liquidity, the ease of entering or exiting a trade without major price swings. The thicker the order book, the healthier the market.

Let’s say Bitcoin trades around ₹1,03,36,000. You open the order book and notice thick buy orders at ₹1,03,00,000 and strong sell walls near ₹1,03,80,000. Those zones hint at where traders expect reversals. If you’re planning a quick trade, that insight matters. When you place your order, market, or limit, it gets added to this system. Market orders eat through available liquidity, while limit orders add to it.

Read More: A Starter’s Guide to Trading Order Types: Market, Limit, and Stop Orders in Crypto

Market Orders

A market order is the simplest and fastest way to trade. You click “Buy” or “Sell,” and the exchange fills your order instantly at the best available price. There’s no waiting, no condition, just execution.

In crypto, this speed is powerful, especially when reacting to sudden price swings or breaking news. If Bitcoin starts pumping and you want to get in immediately, a market order guarantees entry. But there’s a trade-off: you sacrifice price control.

For instance, if the order book has fewer sellers than usual, your market order might “slip,” meaning it fills at higher prices than expected. That’s slippage, the gap between expected and executed price. It’s small in high-liquidity pairs like BTC/USDT but can spike in smaller altcoins.

Picture buying Ethereum at the market price when the spread (difference between bid and ask) is wide. You might see ₹3,55,800 quoted but get filled at ₹3,56,900. The extra ₹1,100 is the cost of immediacy.

Read More: Understanding Leverage Trading in Crypto: A Simple Guide

Limit Orders

A limit order is your way of saying, “I’ll trade, but only on my terms.” It allows you to set a specific price for buying or selling. The order executes only when the market reaches that price.

Let’s say Ethereum trades at ₹3,55,800, but you believe it’ll dip to ₹3,45,000 before rising. You place a buy limit order at ₹3,45,000. When sellers offer ETH at that level, your order triggers. If prices never reach it, your order stays open.

This type of order gives you control; you know exactly what you’ll pay or receive. It’s also efficient when you’re away from the screen since the system executes automatically once conditions match.

Crypto traders rely heavily on limit orders for strategic entries and exits. For instance, if Bitcoin hits resistance at ₹1,04,00,000, you could set a sell limit slightly below it at ₹1,03,90,000 to catch profits before the crowd reacts.

The downside is missing opportunities if the market doesn’t touch your level. If prices bounce before hitting ₹3,45,000, your order never executes. Still, the trade-off is worth it; limit orders prevent emotional mistakes and impulsive entries.

The limit price itself is crucial; it’s your boundary. Set it too tight, and you might miss trades. Set it too loose, and you lose precision.

Read More: What is Crypto Arbitrage Trading?

Stop-Limit Orders

Now comes a slightly advanced tool, the stop-limit order. It’s a combination of two conditions: a stop price that activates your order and a limit price that defines the range where it executes.

Think of it as an automated safety switch. Let’s say you bought Bitcoin at ₹1,03,00,000 and want to cap potential losses. You could set a stop price at ₹1,02,00,000 and a limit at ₹1,01,50,000. If Bitcoin falls to ₹1,02,00,000, your order activates but only sells above ₹1,01,50,000. If the market crashes past ₹1,01,50,000 instantly, it won’t execute below that.

This feature prevents panic selling during sudden dips while still protecting your downside. It’s ideal for traders who want automation with control.

Stop-limit orders are also used to catch breakouts. Suppose Ethereum trades at ₹3,55,800, and you expect a rally once it crosses ₹3,60,000. You set a buy stop at ₹3,60,000 and a limit at ₹3,61,000. The moment the price breaches ₹3,60,000, your order activates and buys within that range, ensuring you ride the breakout without overpaying.

Read More: Crypto Borrowing: How to Get Liquidity Without Selling Your Crypto

Bracket Orders

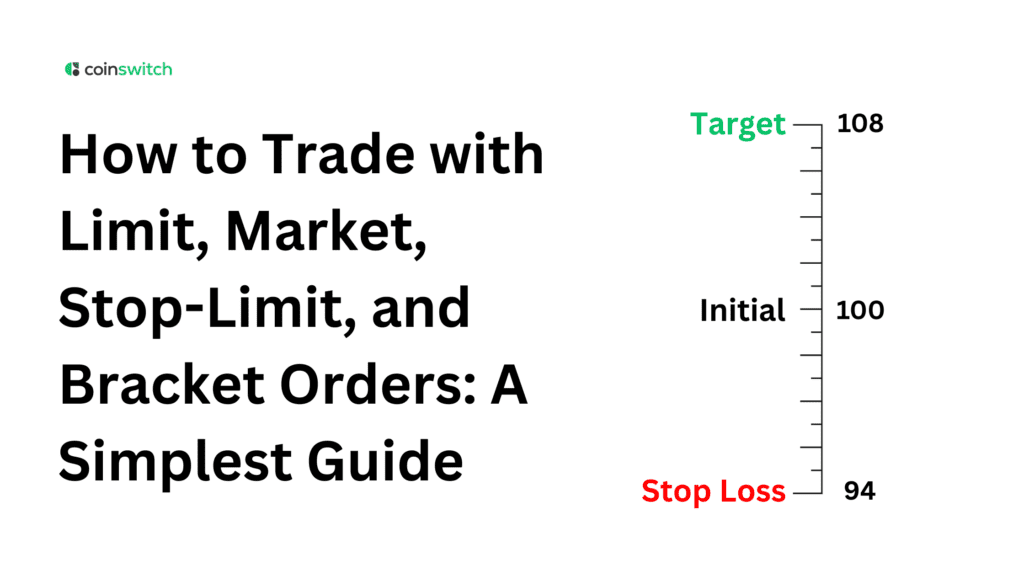

A bracket order wraps three actions into one: your entry, your take-profit, and your stop-loss. It’s the professional’s way of saying, “I’ve planned my trade from start to finish.”

Here’s how it works. Suppose you buy Bitcoin at ₹1,03,36,000. You set a target at ₹1,05,00,000 to book profit and a stop-loss at ₹1,02,00,000 to limit risk. The system automatically cancels one when the other triggers. If Bitcoin hits ₹1,05,00,000, your profit locks in; if it dips to ₹1,02,00,000, your losses stay capped.

This automation keeps emotions out of the game. No second-guessing, no “should I sell now?” panic. You define your best- and worst-case scenarios before the trade even starts.

Bracket orders shine in crypto trading because volatility works both ways. When markets swing, traders without stops can lose discipline fast. A pre-set bracket ensures your strategy survives those emotional moments.

How These Orders Work Together

Each order type has its moment, but they often work best when used together. A trader might use a limit order to enter at a specific level, a stop-limit order to guard against volatility, and a bracket order to automate profit-taking.

Imagine a scenario: you expect Bitcoin to dip slightly before climbing. You place a buy limit at ₹1,03,00,000. Once filled, you set a bracket order, stop at ₹1,02,00,000, and target at ₹1,05,00,000. Now, your trade has structure: controlled entry, defined risk, and automated exit.

Conclusion

Trading isn’t about catching every swing; it’s about mastering control. Market, limit, stop-limit, and bracket orders are tools built for that purpose. Market orders offer instant action, limit orders bring precision, stop-limits add protection, and brackets automate everything.

In crypto’s 24/7 world, these tools become your go-to tools. They help you manage trades when volatility spikes or sentiment shifts in seconds.

FAQs

1. What is the 90% rule in forex?

The 90% rule says 90% of new traders lose 90% of their capital within 90 days. It’s not about fear, it’s about awareness. The takeaway applies to crypto too: risk control matters more than speed. Using limit, stop, and bracket orders helps protect your capital while learning market behavior.

2. What is the difference between a bracket and a stop-limit?

A stop-limit order activates once a price threshold is reached, then executes only within a range you set. A bracket order includes both stop-loss and take-profit levels along with the main entry. Essentially, a stop-limit is one-sided protection, while a bracket order manages both sides of the trade automatically.

3. What is the 80% rule in futures trading?

The 80% rule in futures trading suggests that if the price re-enters the previous day’s Value Area and holds there for two consecutive 30-minute periods, there is an 80% chance it will move across the entire Value Area.

4. Can I use both a stop and a limit order at the same time?

Yes. You can place both together using a bracket order or advanced stop-limit setups. This way, if your profit target hits, your stop cancels, and vice versa. It’s the cleanest method for managing risk while keeping profits systematic. Most crypto platforms support it natively.