Routing and account numbers are important in managing your money. People can identify your bank with the assistance of a routing number, and they can identify your account using an account number.

You’ll need a routing number for interbank transactions, including wire transfers and direct deposits. However, an account number is required for internal bank activities, such as withdrawals and deposits. Understanding the differences between the two is crucial for safeguarding and managing your money effectively.

Routing Number vs. Account Number

You get a unique account number and the bank’s routing number when you open a bank account. Both are available online or at the bottom of a cheque leaf. You need your bank’s routing and account numbers for online banking and payment processing activities.

Each account user has a unique account number, similar to a customer ID or fingerprint. These numbers show exactly where the money in a transaction came from (debited) or where it is going (credited).

Routing numbers indicate which bank is associated with the transaction. Account numbers typically range from nine to twelve digits, although some may be longer. However, routing numbers have nine digits.

- Importance of Routing Number and Account Number

Account numbers are like fingerprints; they are unique and protect your money. You must protect these details at all costs. Routing number and account number are significant as they allow you to make many different kinds of transactions.

These numbers show you exactly where your money is. There is a record of where the money is going and where it is coming from. These two numbers are crucial for ensuring the money reaches the right place at the right time. Therefore, any mistake in providing exact numbers can cause delays and result in difficult-to-pay fees.

Also, you should keep this information to yourself. Thus, these numbers are crucial and must be reserved for transactions.

Routing Number

Routing numbers are nine-digit numbers that show which bank or credit union holds an account. People also call these numbers ABA routing numbers, which come from the name of the organization that issues them, the American Bankers Association.

Only the United States utilizes routing numbers. A bank informs you that it has an account with the Federal Reserve and is regulated at either the federal or state level.

Banks and credit unions often have a single routing number. However, some large national and international banks may have different routing numbers depending on your location or the location of your account.

- Routing Number of a Check

Previously, ACH transactions used routing numbers linked to electronic account withdrawals and transfers, whereas ABA transactions relied on routing numbers for physical checks. Nowadays, most banks use a single routing number for all transactions.

A routing sign is also on the top corner of a check, typically right below the check number. This number typically consists of three or four digits and indicates the specific bank it belongs to. But it is no longer widely used.

- Routing Numbers for International Transfers

International and domestic wire transfers utilize different routing numbers. In other words, the routing number that appears at the bottom of your checks is not valid. For a list of authorized routing numbers for international transactions, contact your financial institution or visit their website.

- How to Make Use of Routing Numbers?

Large multinational banks may have many routing numbers. Unlike local banks, which typically have a single routing number, this can change depending on the state where the account is maintained. The following things may need routing numbers:

1. Reordering checks

2. Paying consumer bills electronically

3. Linking a mobile payment app to your bank account

4. Setting up direct payment for things like your paycheck or Social Security funds

5. Tax payments made to your local tax office or the Internal Revenue Service (IRS)

Read More: Mastering the golden rules of accounting: A fundamental guide

Account Number

Your bank account is assigned a unique account number consisting of digits. It is required for banks to perform account-specific transactions such as depositing, withdrawing funds, and making direct transfers. When you open a bank account, either checking or savings, the bank provides you with an account number to track all your activity inside that account. Think of your account number as a distinct figure from your debit card number, which you can usually find on your bank statements or in your online portal.

Also, be careful not to share your account number, as doing so could make your money vulnerable. However, unlike a routing number, an account number points to your specific account at the bank. You’ll often be asked for both numbers to make electronic payments, have your salary deposited into your account, or schedule online bill payments. Before you share your account number, always make sure it is correct.

How to Find Your Routing and Account Numbers?

The following are the different ways you can find your routing and account numbers:

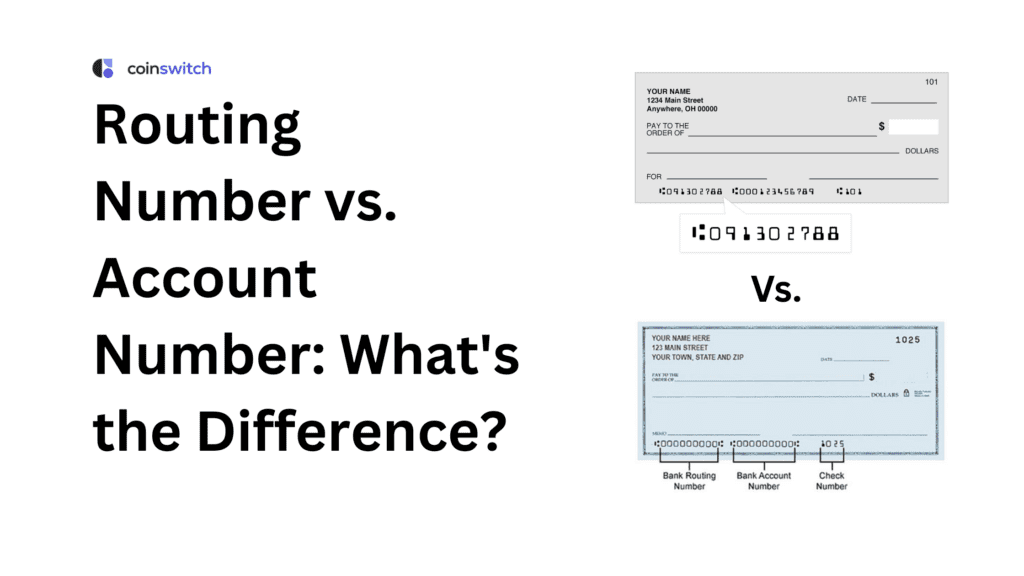

With a Cheque

Your account and routing numbers are printed on the bottom of your cheque. There will be three sets of numbers, with blanks and/or characters between them. The first number, typically nine digits long, is the routing number. The next group of numbers, which is generally nine to twelve digits long, is the account number. The third number is the check number itself.

Without a Cheque

The following are some of the various methods that you may use to locate your routing and account number if you do not have a chequebook or a paper cheque:

- Access Your Online Banking Account

Routinely, banks allow you to check your routing and account numbers through the Internet. After you’ve signed in, click on your account details or dashboard. The account number and routing number will be clearly displayed in that location. This is considered the safest and most correct method for getting information.

- Check the Transactions on Your Bank Account

Your account number is typically shown on your monthly bank statement, whether on paper or digital. Examine the area at the top or the bottom of page one. You can often find a bank’s routing number in the payment information section of its statements. This is convenient if you do not have cheques or can bank online.

- Visit Your Bank in Person or Over the Phone

If you can’t easily obtain your numbers, simply visit your bank branch and speak with one of the executives.

Read More: Universal Account Number (UAN) passbook and other services

Example

There are three sets of numbers at the bottom of a check. The account number usually comes first, followed by the cheque number, and the 9-digit routing number. But those numbers may appear in a different order on a cashier’s cheque.

Magnetic ink character recognition (MICR) is used to write the numbers at the bottom of each check in magnetic ink. The magnetic ink, pronounced “micker,” allows the processing tools at each bank to read and process the account information. Thanks to the MICR line, credit unions and banks can process cheques quickly.

The Bottom Line

To handle your money wisely, you need to know the difference between a routing number and an account number. While account numbers guarantee that funds are deposited into the correct account, routing numbers facilitate transactions between institutions. Knowing these differences is essential when setting up payments or transfers.

If you know how routing and account numbers work, you can feel safe and sure with your money. However, remember to use the correct numbers for every transaction to avoid mistakes and delays in your banking.

FAQs

1. What is the difference between a routing number and an account number?

An account number tells you whose account it is, while a routing number tells the bank or financial institution for which it is intended. Each is essential for successfully managing operations such as direct transfers.

2. Are the routing number and IFSC code the same?

No. IFSC code and routing number are not the same thing. In the US, a routing number is used to find banks. In India, an IFSC code is used to facilitate electronic fund transfers between banks.

3. Is the sequence number the same as the account number?

No, an account number and a sequence number are not the same. While account numbers are used to identify a customer’s bank account for transactions, sequence numbers are often used for internal tracking or numbering cheques.

4. What is the routing number of SBI?

Since routing numbers are unique to the financial system in the United States, the State Bank of India (SBI) does not utilize them. Instead, SBI uses the IFSC code to identify branches and facilitate electronic money transfers for people in India.