- Products

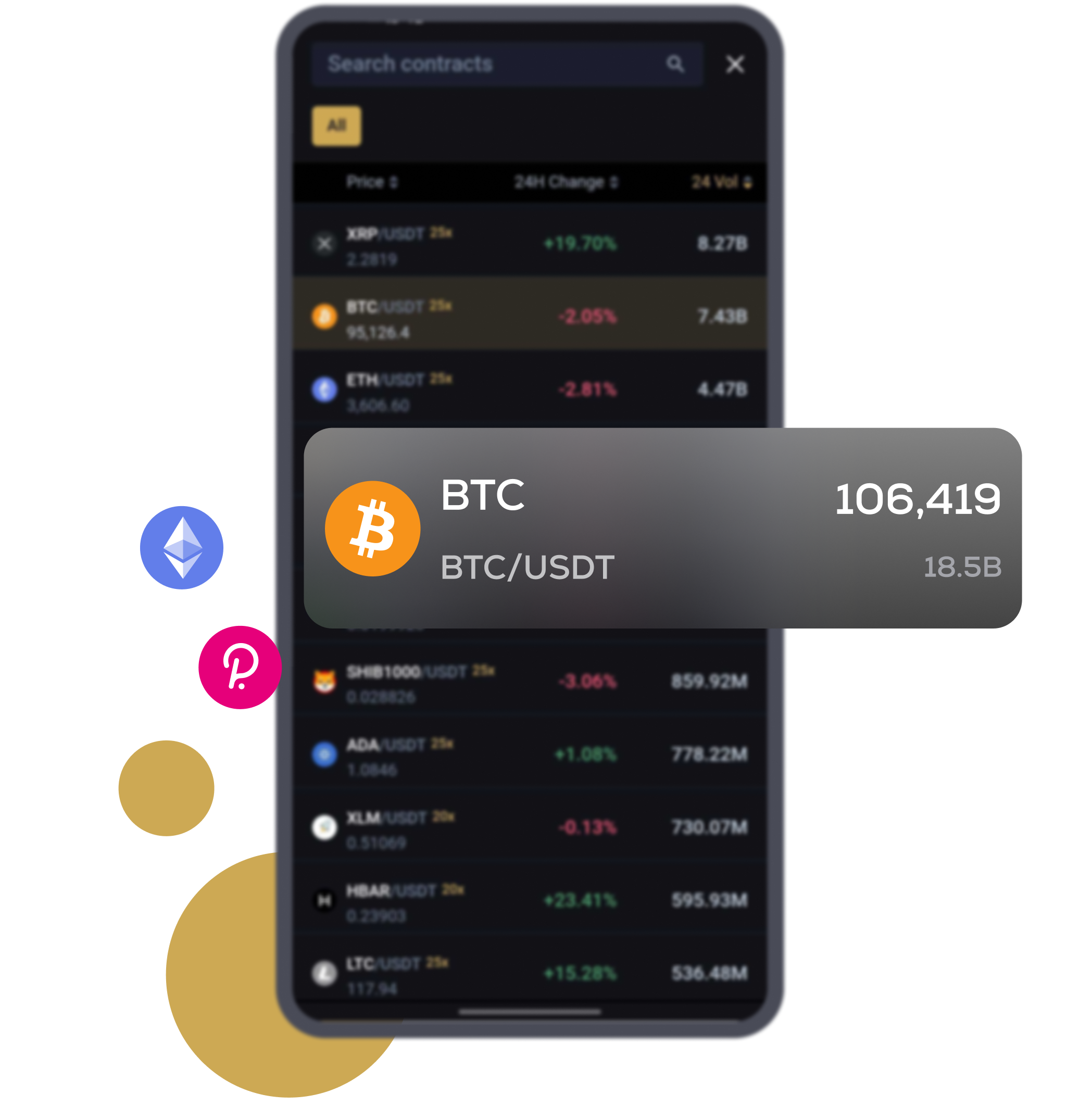

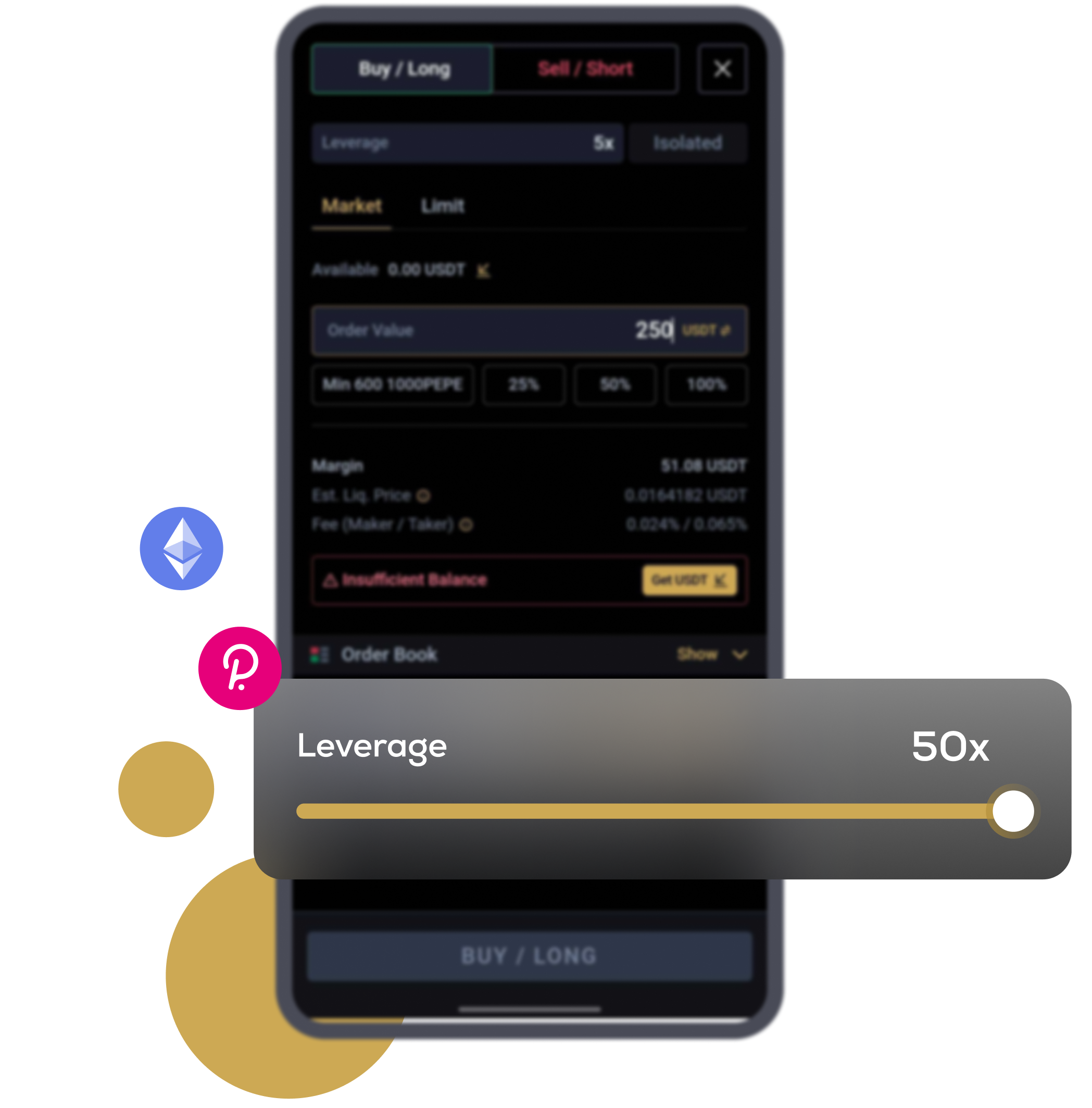

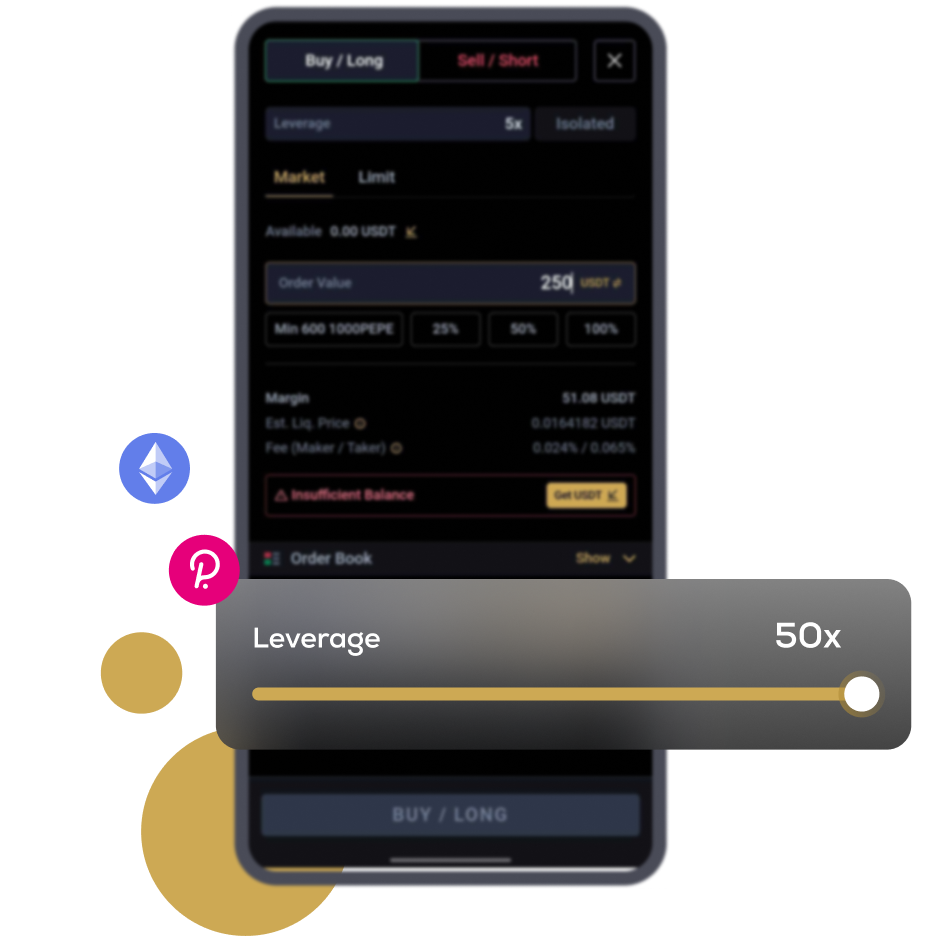

- Futures Trading

Trade Futures Contracts and Settled in USDT & INR

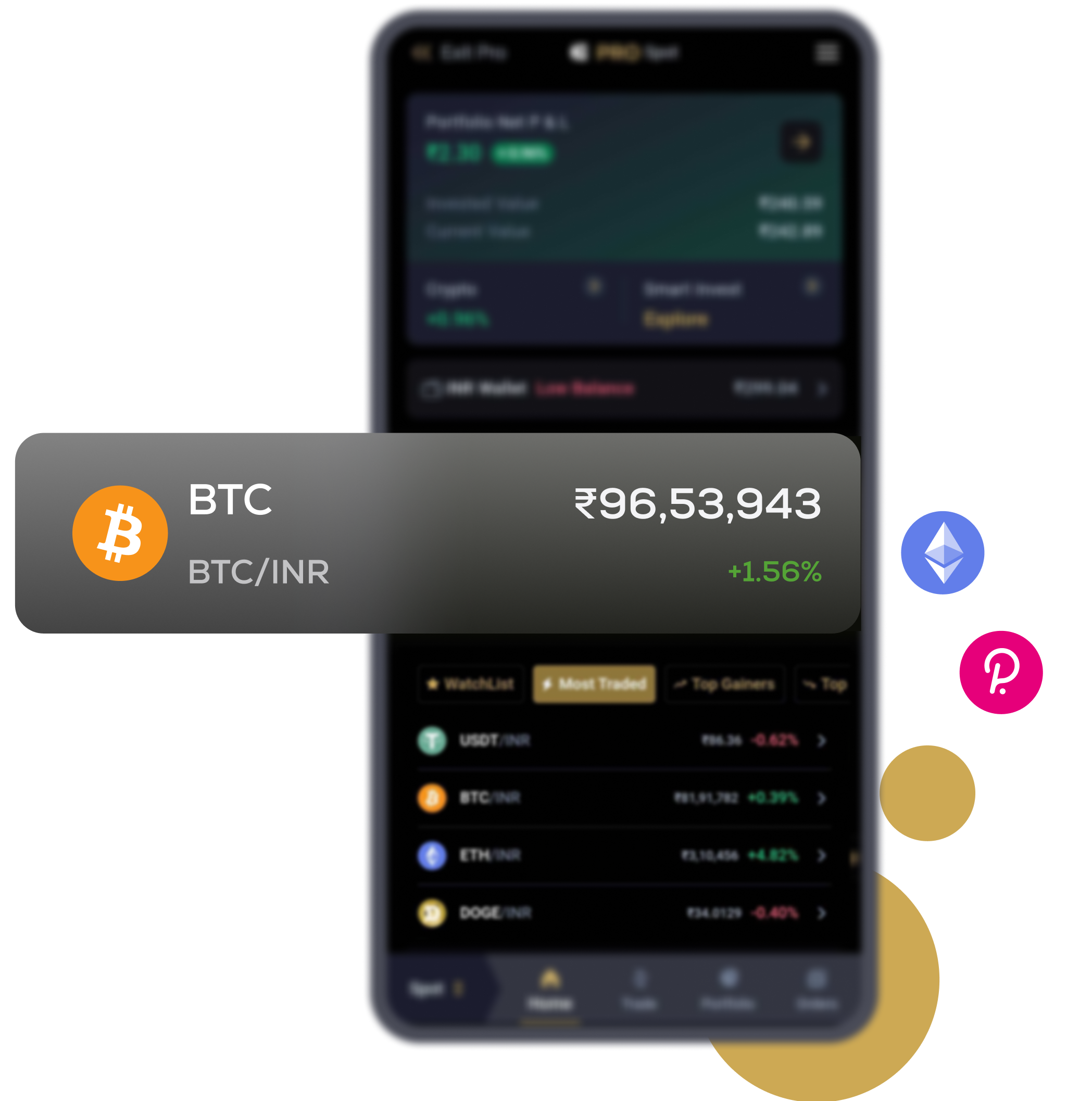

- Spot Trading

Advanced Crypto Spot Trading in INR

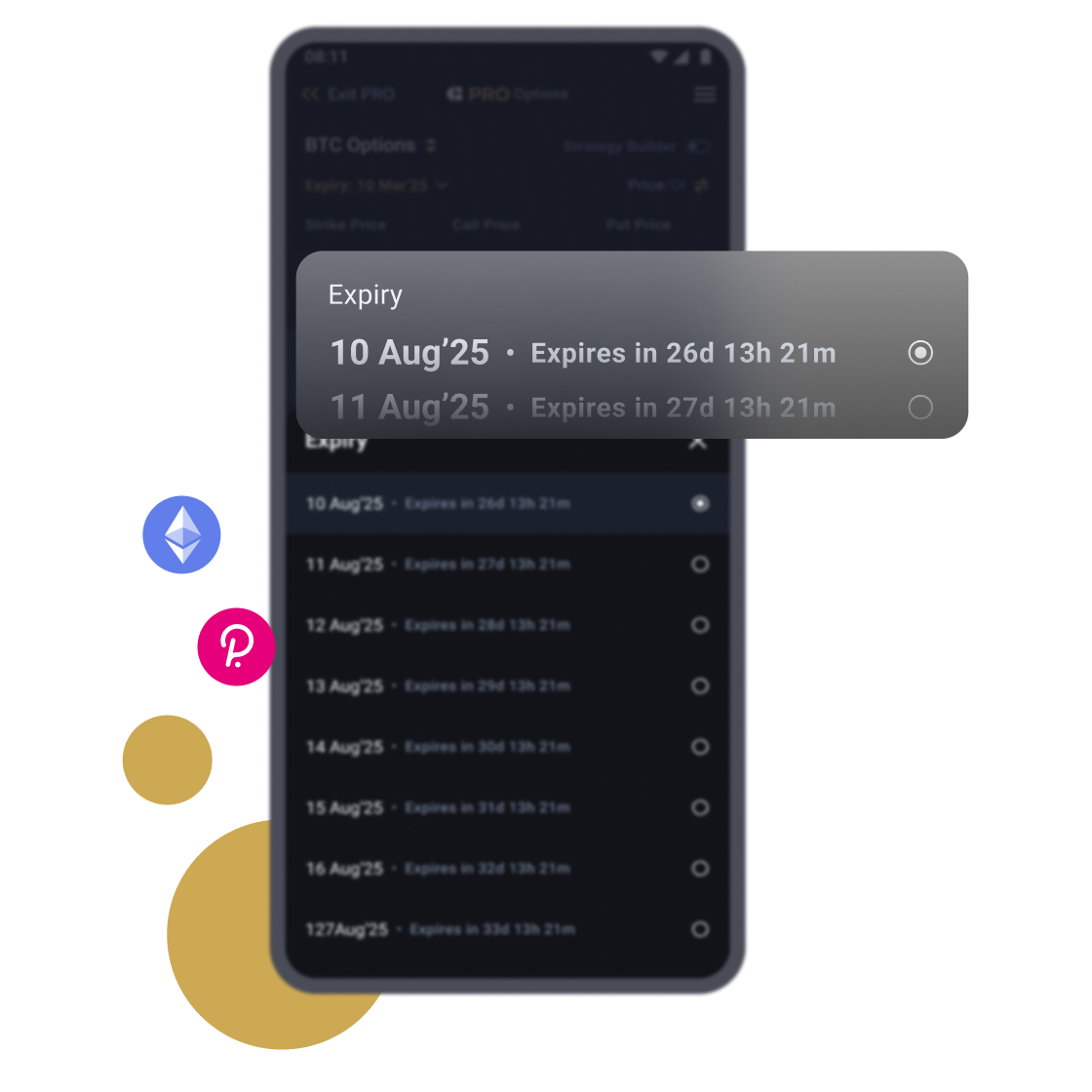

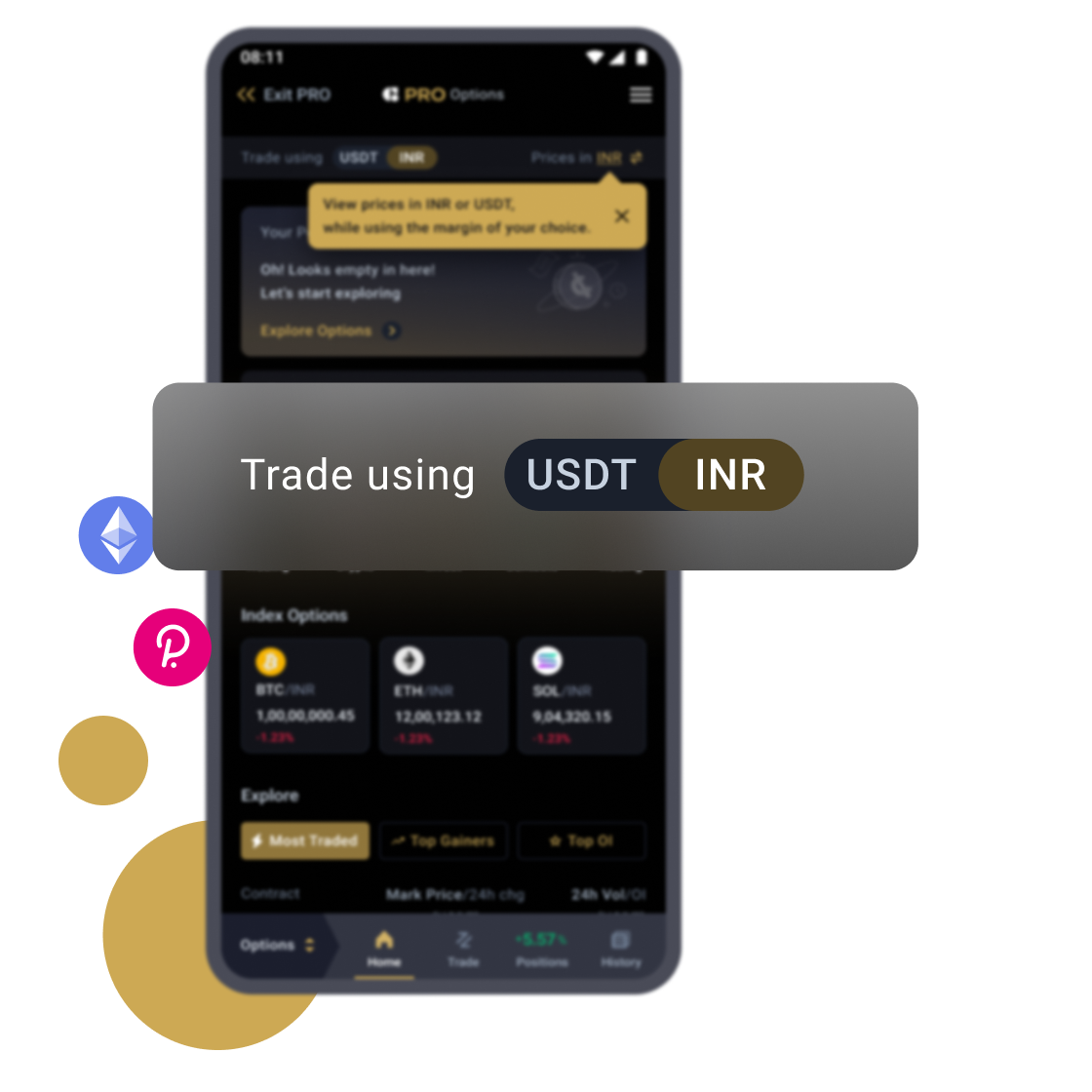

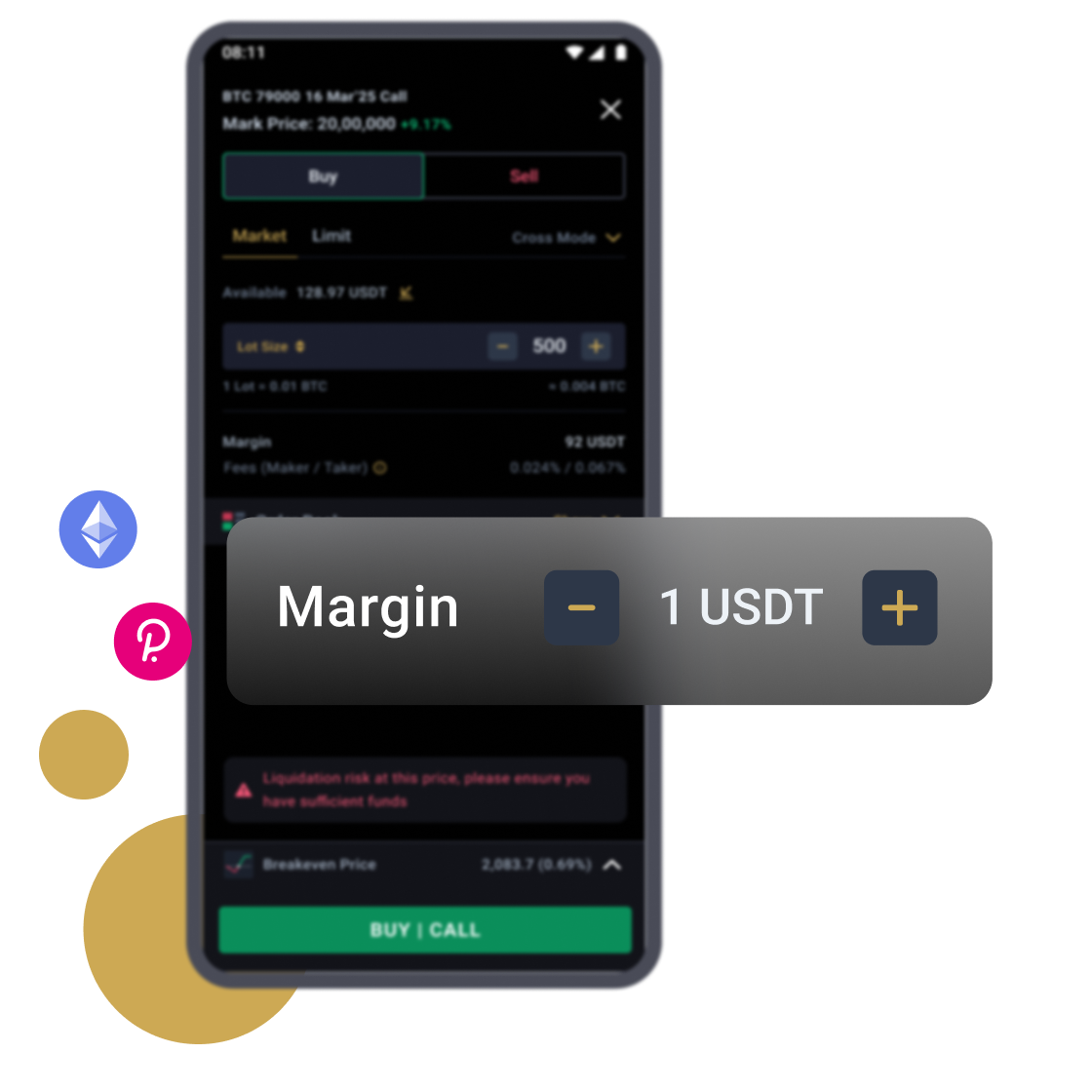

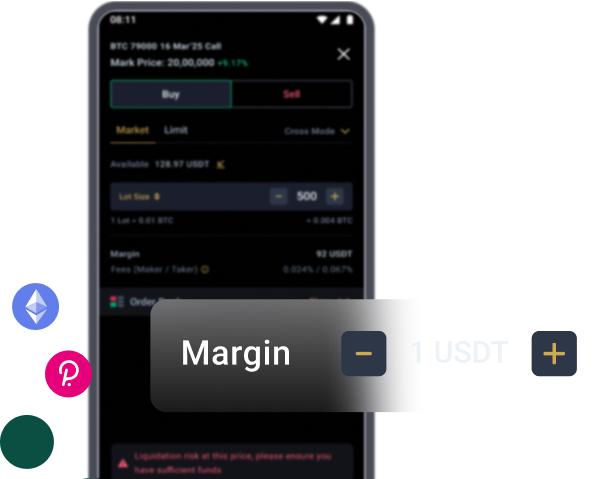

- Options Trading

Trade Options Chain and Settle in USDT & INR

- Web3 Coins

Trade Tokenized Stocks in INR

- API Trading

Automated Crypto Trading With APIs

- HNIs & Institutional Investors

Experience Personalized Crypto Services

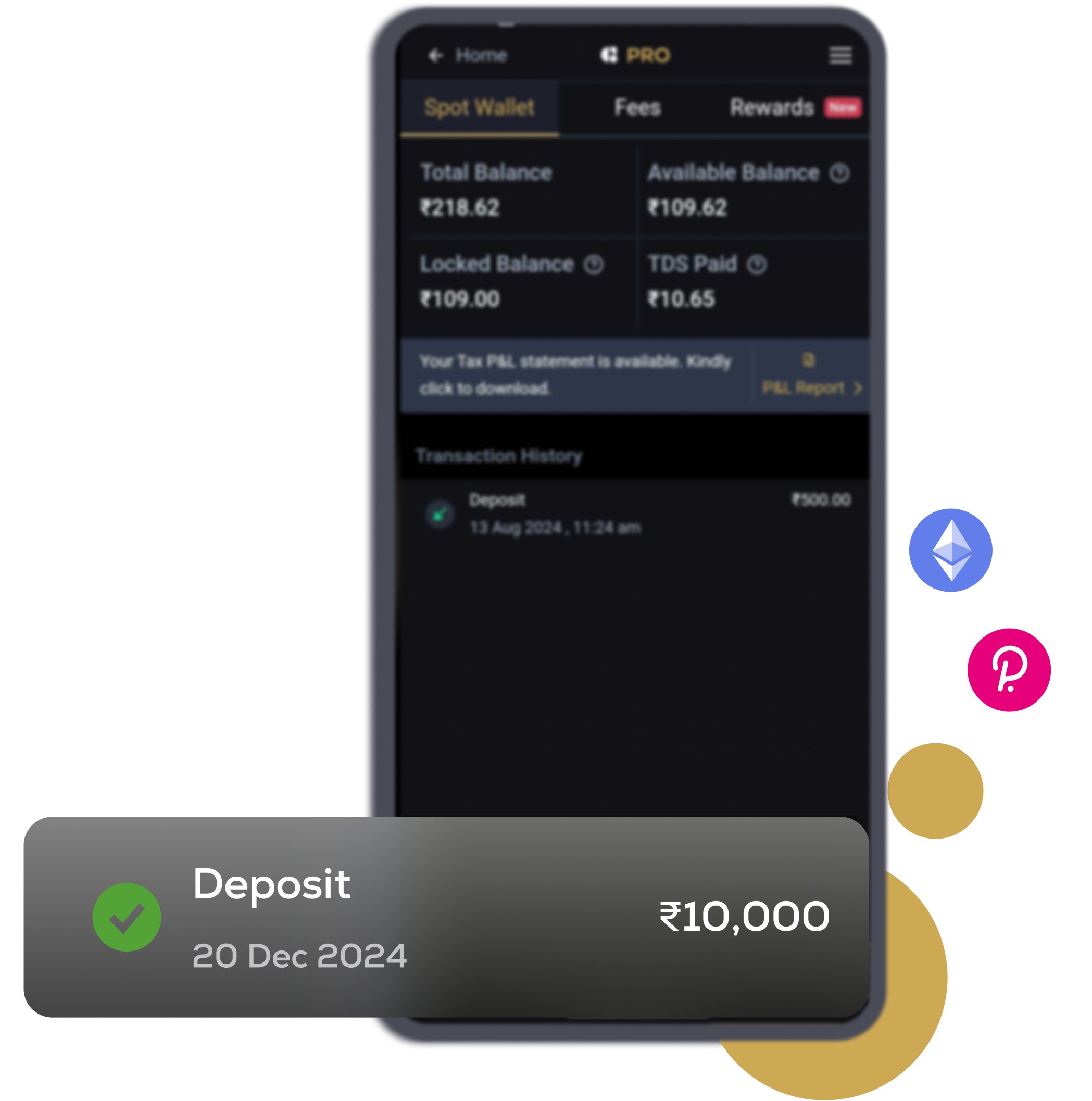

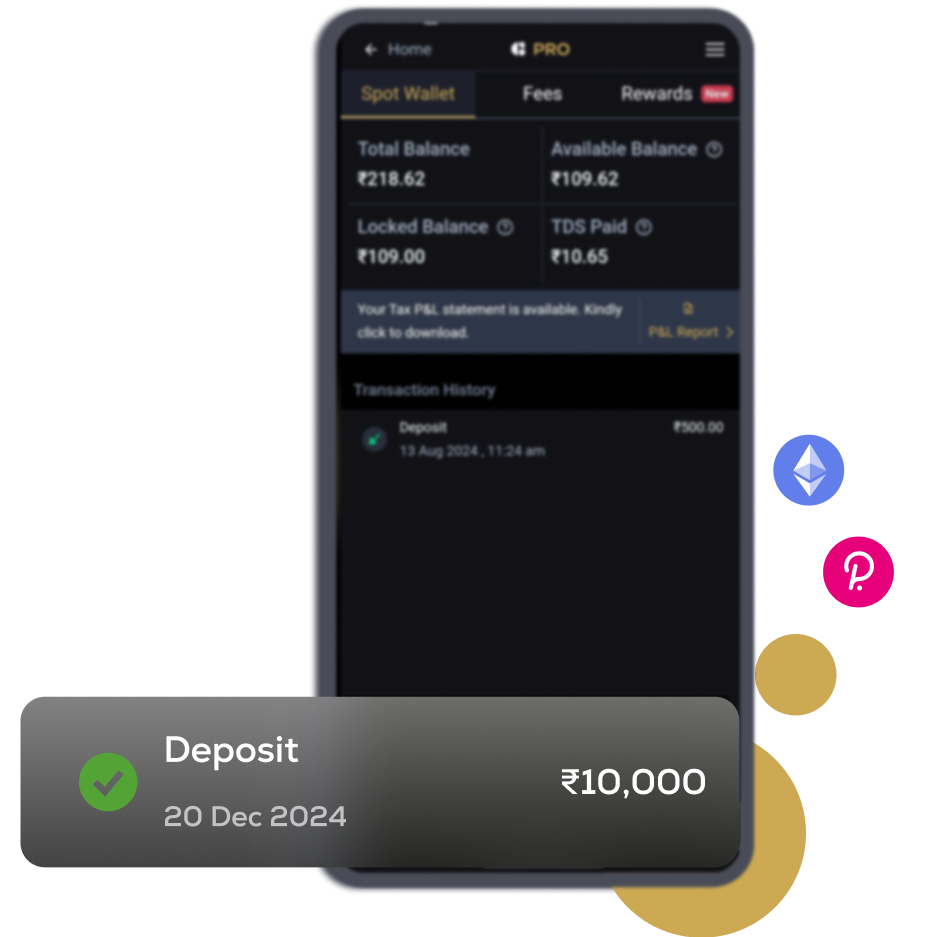

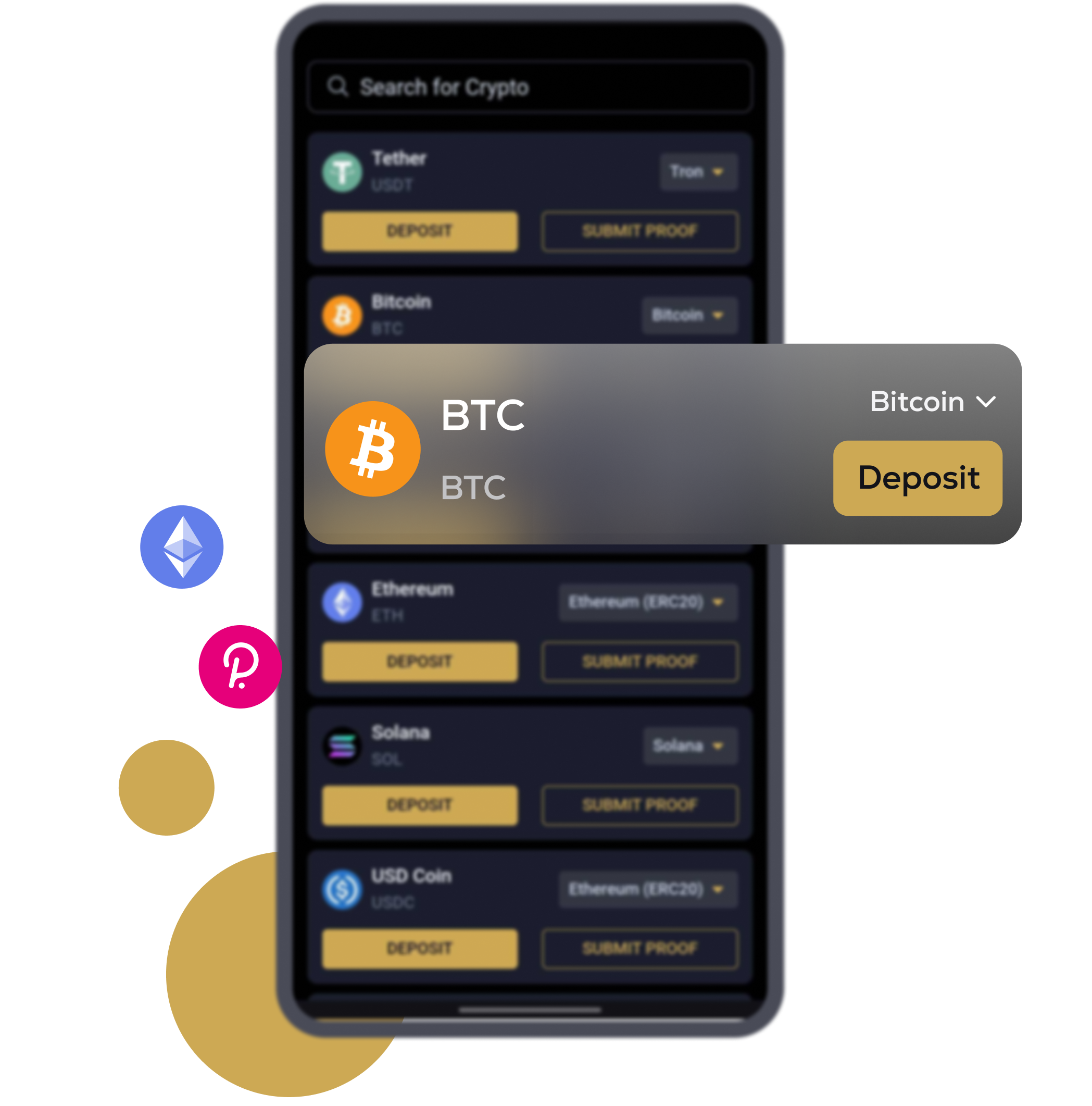

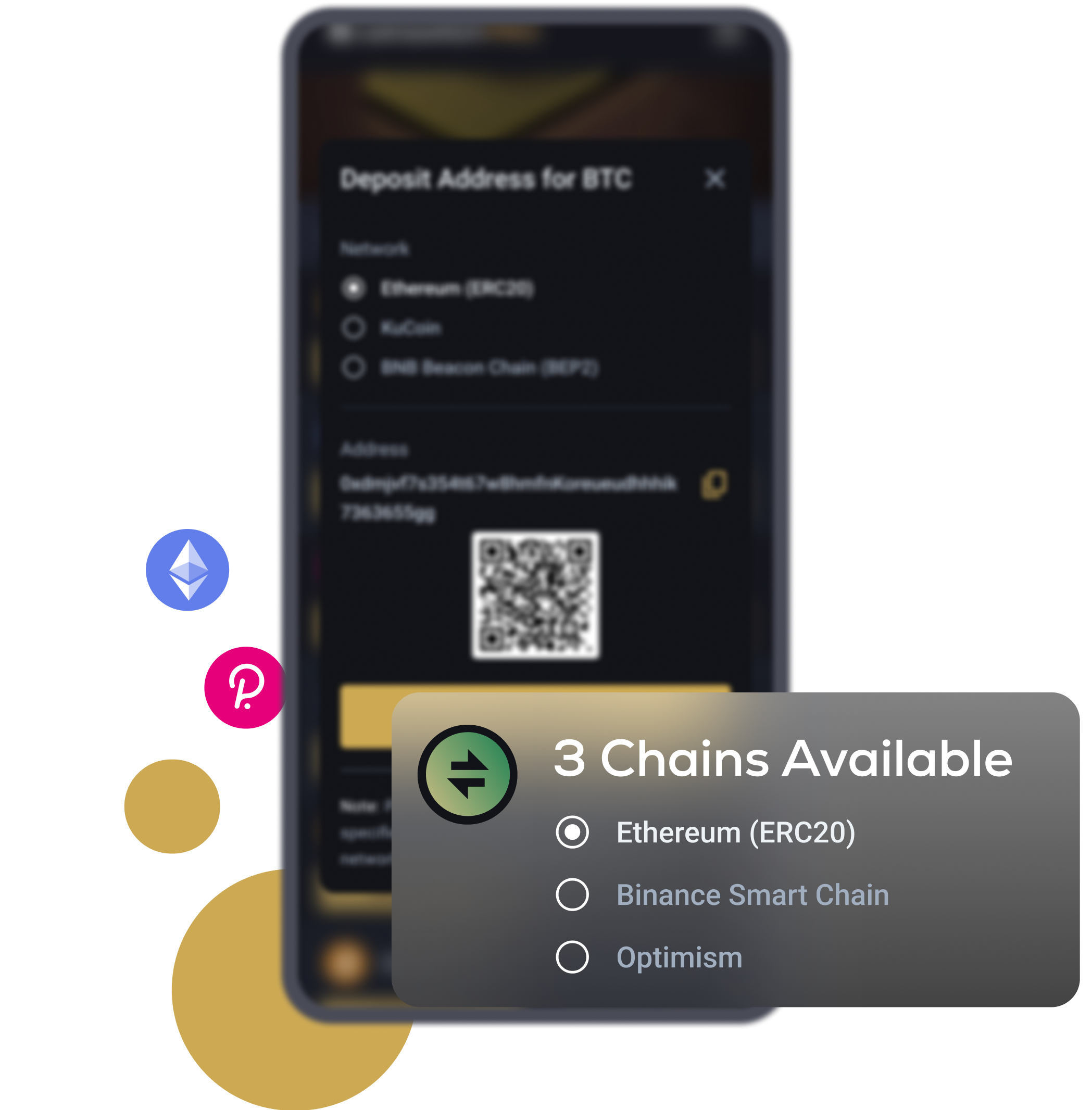

- Crypto Deposit

Quick Crypto Deposits to Your Account

- Systematic Investment Plan

Buy Crypto Monthly Using SIP

- CoinSwitch Cares

Recovery Program for WazirX Users

- SmartInvest

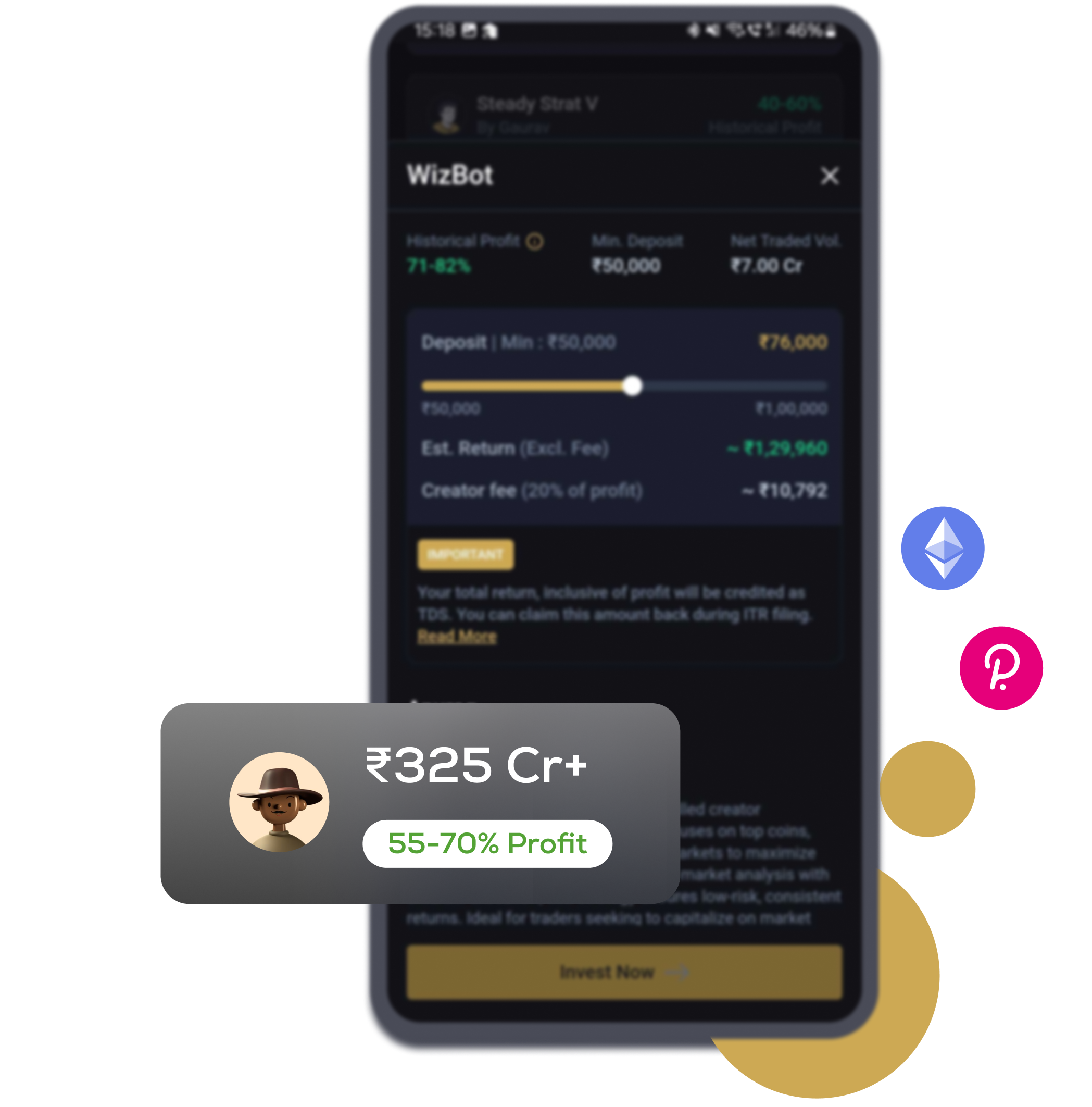

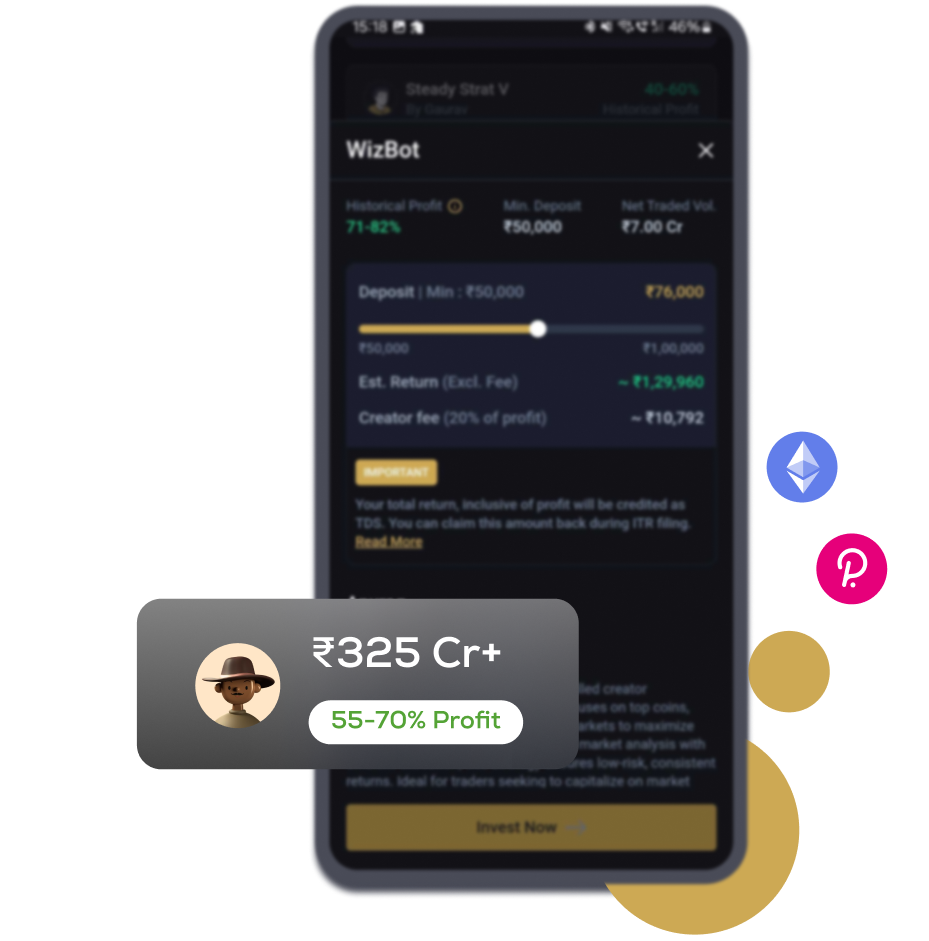

Multiply Crypto Profits in The Smart Way

- OTC Trading

Trade Large Crypto Orders with Deep Liquidity

- Futures Trading

- Markets

- Ventures

- Blog

- Company